Weekly Commentaries

AE Wealth Management: Weekly Market Insights | 8/10/25 – 8/16/25

Weekly Market Commentary THE WEEK IN REVIEW: Aug. 10-16, 2025 Markets rise on rate cut expectations A lot was riding on inflation data last week, with many of the usual “experts” calling for the Consumer Price Index (CPI) to go up in response to tariffs. As usual, they were wrong, and the CPI stayed fairly…

AE Wealth Management: Weekly Market Insights | 8/3/25 – 8/9/25

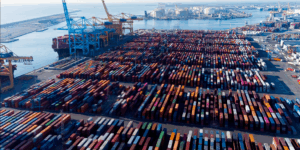

Weekly Market Commentary THE WEEK IN REVIEW: Aug. 3-9, 2025 Trump follows through With the Aug. 1 tariff deadline looming last week, some traders were banking on President Donald Trump extending the deadline once again. But he followed through for the most part, saying the deadline “will not be extended” and making the tariffs effective…

AE Wealth Management: Weekly Market Insights | 7/27/25 – 8/2/25

Weekly Market Commentary THE WEEK IN REVIEW: July 27-Aug. 2, 2025 Here we go again? There was a lot going on last week, from the Federal Reserve meeting and July jobs (more in the section below) to tariff deadlines, earnings and the initial second-quarter gross domestic product (GDP) report. The week started off well enough,…

AE Wealth Management: Weekly Market Insights | 7/20/25 – 7/26/25

Weekly Market Commentary THE WEEK IN REVIEW: July 20-26, 2025 Records keep rolling Another week, another set of records. The S&P 500 and Nasdaq kept the winning streak alive, notching fresh highs for the second consecutive week.1,2 The Dow wasn’t left behind, gaining 1.26% and sitting just under highs from earlier in the year.3 What’s…

AE Wealth Management: Weekly Market Insights | 7/13/25 – 7/19/25

Weekly Market Commentary THE WEEK IN REVIEW: July 13-19, 2025 The drama continues It feels like we’ve been writing about this every week for the last six months, but once again, President Donald Trump says he wants to fire Federal Reserve Chair Jerome Powell because interest rates are “artificially high.”1 Last week opened another chapter…

AE Wealth Management: Weekly Market Insights | 7/6/25 – 7/12/25

Weekly Market Commentary THE WEEK IN REVIEW: July 6-12, 2025 It’s like déjà vu all over again The third quarter of 2025 is starting out with some eerie parallels to the way the second quarter opened. But so far, markets are a little more chill than they were in April. Back then, markets were jarred…

AE Wealth Management: Weekly Market Insights | 6/29/25 – 7/5/25

Weekly Market Commentary THE WEEK IN REVIEW: June 29-July 5, 2025 “Big Beautiful Bill” signed into law Now that President Donald Trump has signed the sweeping reconciliation bill into law, the markets can take that potential unknown off the table and adapt to a new landscape.1 This does not mean the bill is perfect, that…

AE Wealth Management: Weekly Market Insights | 6/22/25 – 6/28/25

Weekly Market Commentary THE WEEK IN REVIEW: June 22-28, 2025 U.S. bombs Iran’s nuclear facilities If someone said we would see oil prices drop $10 per barrel and the S&P 500 hit a new high in the week after the U.S. bombed Iran’s nuclear production facilities, what would you say?1,2 Well, it did happen. Almost…

AE Wealth Management: Weekly Market Insights | 6/15/25 – 6/21/25

Weekly Market Commentary THE WEEK IN REVIEW: June 15-21, 2025 All eyes on the Middle East Markets were focused on the conflict between Israel and Iran all last week, with the China trade deal, the Federal Reserve meeting and the G7 gathering all taking a backseat. Last week’s Israeli strikes against Iran were surgical, with…

AE Wealth Management: Weekly Market Insights | 8/17/25 – 8/23/25

Weekly Market Commentary THE WEEK IN REVIEW: Aug. 17-23, 2025 Powell speaks and markets like what they hear Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium late last week was just what the U.S. market wanted to hear.1 The days leading up to his speech were somewhat depressing, as the…