AE Wealth Management: Weekly Market Insights | 9/15/24 – 9/21/24

Weekly Market Commentary

THE WEEK IN REVIEW: Sept. 15-21, 2024

The Fed finally cuts rates

The Federal Reserve finally delivered the long-awaited rate cut last Wednesday. The Fed began raising rates in March 2022 from zero, paused for a month in June 2023, and hit us with a final 25-basis-point (0.25%) hike at the July 2023 meeting. Then they took a pause, and we sat in this “higher for longer” purgatory with a fed funds rate of 5.25 to 5.5% for 13 months.

There were a lot of fits and starts at the beginning of the year, as the market tried to figure out exactly when the Fed would cut and by how much. First, it was six or seven cuts; then it was three, none, two, etc. And as the day finally approached, the last debate was whether we would get a cut of 25 basis points (0.25%) or 50 basis points (0.50%).

Surprise! We got the 50-basis-point cut. The volume from the 50% chorus had begun building early last week and gained momentum in the days leading up to the meeting. Now, the analysis will turn to what the Fed is seeing and why they landed where they did. Are they sensing risks of economic slowdown or recession? Are they still confident they can deliver a soft landing?

The decision was not unanimous; Fed governor Michelle Bowman voted for a 25-basis-point cut. If the economy is strong, why cut by 50 basis points? The last three times we cut by 50 was at the beginning of the pandemic, the global financial crisis and the dot-com bubble — not great times for the economy or markets.

There are a lot of mixed messages here that probably wouldn’t have been present had the Fed cut by one-quarter of 1% in July and done the same last week. We would still be in the same place, but it would have looked a lot more orderly and proactive. Now it looks like Fed Chair Jerome Powell caved to market pressures and/or pressures from some Democratic senators who were calling for a 75-basis-point cut. In any case, it either looks desperate or political — both of which could have been avoided. The good news is we got a cut, but the jury is still out on how things play out from here.

Where do we go from here?

Markets were quiet at the start of the week as we held our collective breath for the Fed to act. Once the jumbo cut was announced on Wednesday, markets didn’t really know what to do and swung from positive to negative before settling modestly down for the day.

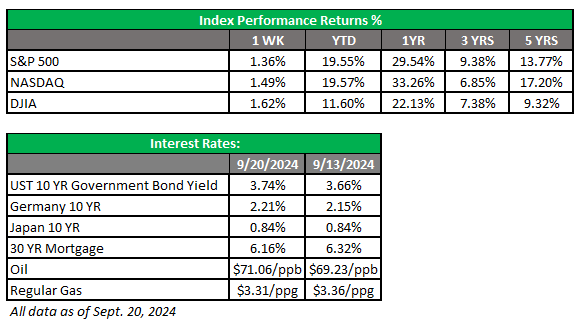

What a difference a day makes. Thursday opened with a roar, with two of the three major indices posting new all-time record highs. The Dow broke through the 42,000 level, and the S&P pierced the 5,700 level before the day was through. The Nasdaq also had a stellar day, closing above 18,000 for the first time since July. Markets cooled off a bit to end the week, but there wasn’t any major reversal.

The market looks like it is on board with the bigger cut, at least in the short term. September can be an ugly month for markets, so a stock rally is welcomed. The challenge going forward is what will the market expect for future hikes? Markets seem to think they browbeat the Fed into cutting an extra 25 basis points, but did they? Will they throw a fit if the Fed doesn’t keep delivering?

As discussed above, questions remain. Was this a political move to goose the economy less than two months before a presidential election? Will inflation go back up and prove the jumbo cut was a gimmick? The market wouldn’t like either scenario — and it could lead to some pain for investors.

Our advice is to stay disciplined and not get caught up in the hoopla. We recommend staying neutral; now is not the time to be overextended, especially with October just around the corner. A lot of people were saying that the stock market was overvalued before the cut, and last week’s action will not quiet those concerns. That overvaluation might be cured if October lives up to its reputation as a rough month for markets. Stay in touch with your advisor, and stay cautious and focused in the coming weeks.

Coming This Week

- Now that the rate cut is in the books, markets will begin to parse the data to “predict” the Fed’s future direction. Will the data be inflationary? Is it signaling recession? Politics will take on a bigger role as the election nears and one candidate or the other rises (or falls) in the polls.

- Speaking of data, on Monday we’ll see manufacturing purchasing managers’ index (PMI) data. Tuesday will feature the S&P 500 Case-Shiller home price index and consumer confidence.

- On Wednesday, we’ll get the latest on new home sales and MBA mortgage applications. It will be interesting to see if lower mortgage rates are having an impact on the housing market yet. Thursday will feature more housing data with pending home sales.

- Thursday will also bring the latest unemployment claims, which can always surprise us. Plus, we’ll get the next reading of second-quarter gross domestic product (GDP). The initial reading was 3.0%; watch out for any meaningful revisions of +/- 0.3%.

- Finally, personal consumption expenditures (PCE) and core PCE plus personal income, spending and consumer sentiment will all be reported on Friday. These all give insight into the inflation picture. The sentiment is more of a reaction to that data; if the data is bad, people generally feel bad.

- Watch out for random or stray comments from Fed officials this week, which could move markets as they stay in an “interpretative” mode.

AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

9/24 – 3827819-4