AE Wealth Management: Weekly Market Insights | 12/4/22 – 12/10/22

Weekly Market Commentary

THE WEEK IN REVIEW: Dec. 4 – 10

Markets wait for the Fed

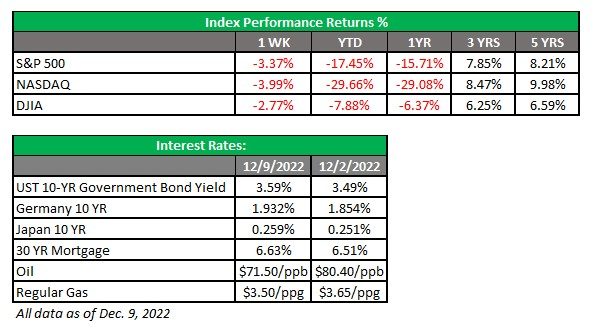

Markets blew off some steam early last week as they tried to settle into a happy place in advance of the Federal Reserve meeting this week. The week prior, markets ripped upward on Federal Reserve Chairman Jerome Powell’s comments suggesting a moderation in the pace of rate increases. Markets sold off pretty hard on Monday and Tuesday as jobs data came in stronger than expected, renewing fears the Fed would have to continue raising rates and could drive us into a recession.

Stocks drifted mostly lower Wednesday; not something investors love to see but still a break from the sharp declines registered during the first two trading days of the week. It might be an indication markets were shifting into wait-and-see mode — waiting, in this case, to see what the Fed’s rate decision will look like. A bump of 50 basis points (0.50%) seems nearly a sure thing, but the bigger concern now is that the central bank will signal its intent to raise rates well into 2023, even as worries mount that the economy is heading for a recession.

Markets ticked upward Thursday in anticipation of the latest producer price index (PPI) number. PPI readings were hotter than expected Friday and markets closed the week down. It’s the same story we’ve seen for the past six months: The Fed raises rates to fight inflation, markets keep looking for data that suggests inflation is declining and expect the Fed to pivot, and they rally. After the economic data or employment numbers prove resilient or miss expectations (as was the case with PPI), the Fed reinforces its stance to fight inflation. Then markets get jittery because they believe the Fed will go too far and run the economy into a deep recession. That was the story last week, and it will continue to be the story until we get fresh data via the consumer price index (CPI) on Tuesday and guidance from the Fed on Wednesday.

As for the final Fed meeting of the year coming this week: It’s looking likely we will see a 50-basis-point increase in the federal funds rate to the range between 4.25% and 4.5%. This would mark the seventh and final rate increase this year — a stunning number when you consider that this time last year, the broad consensus was calling for two 25-basis-point (0.25%) increases for all of 2022.

Is inflation really slowing, or is something else afoot?

PPI came in at 7.4% year-over-year for November, higher than the consensus expectation of 7.2% but still down from 8.1% in October. The PPI reading is the last and most recent inflation data point for the Fed to consider ahead of this week’s meeting. Sure, the reading was a decline from the prior month but not as much as the markets wanted to see.

Why is PPI important? Both the producer price index (PPI) and consumer price index (CPI) are measured by the Bureau of Labor Statistics (BLS) and are a family of indexes measuring the average change over time in prices. (PPI measures the change in price for what producers pay for the goods and services they sell to consumers.) Although gas prices have declined and brought inflation down slightly, the price of everything else remains elevated.

The reduction in inflation rates appears to be “transitory.” If we do not address the supply side of our energy needs by producing more petroleum products here at home, we will likely be subject to price spikes that will impact our inflation readings. If energy costs are not dependable, producers will be hesitant to lower prices, and we will continue to experience elevated levels of inflation, which will fluctuate directly with the price of oil. In other words, gas prices will be “transitory” rather than durable.

We could be only one major storm, negative event in the Middle East or super-busy driving season away from gas prices rocketing back to where they were last July 4 — or even higher. And if the price of oil goes back up, by extension, inflation will also go back up. Finally, a self-induced wound could come in the form of the government stepping in to replenish the Strategic Petroleum Reserve (SPR), which would drive the price up and shrink supplies — kind of like quantitative tightening except with oil. Until we address energy independence, inflation will most likely be here to stay in some form or another.

Coming this week

- We will get the November reading of CPI on Tuesday, and expectations are to trend lower from the October reading of 7.7%. The CPI reading will come out as the Fed meeting begins and may (or may not) be factored into the Fed’s rate decision.

- The Fed’s final meeting of 2022 is scheduled for Tuesday and Wednesday. As mentioned earlier, it’s expected the Fed will increase the federal funds rate by 50 basis points. However, the rate increase won’t be the main story. Instead, the main story will be the guidance going forward, which could dictate market performance for the final two weeks of 2022 and the first week of 2023.

- Mortgage applications on Wednesday will give us a sense of how the housing market is doing. Friday is a quadruple witching day, when stock index futures, stock index options, stock options and single stock futures derivatives contracts all expire simultaneously.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

12/22-2622992-3