AE Wealth Management: Weekly Market Insights | 5/29/22 – 6/4/22

View PDF Version

Strong jobs report leaves Fed with no reason to pause its plans

When strong jobs growth is bad for markets

There are plenty of open jobs — but job growth is slowing. Last Friday’s Bureau of Labor Statistics (BLS) situation showed that job growth is still there. We added 390,000 new jobs in May, much higher than the 325,000 consensus estimate. The unemployment rate remained at 3.6%, the lowest since February 2020.

Service and hospitality jobs saw a significant increase (up 46,000 jobs and 84,000 jobs, respectively) — which is understandable as consumers seem to be opting to travel and eat out over buying goods. However, it’s a bit worrisome as many of these jobs are on the low side of the pay spectrum.

The ADP report on Thursday confirmed the BLS numbers, coming in at +128,000 jobs when expectations were closer to +300,000. Small businesses lost jobs, while the education and health sectors were the highest source of new jobs. Leisure and hospitality came in third. Education and health typically hold up well during economic downturns, since we still send kids to school and go to the doctor. But when things go badly, we often stop eating out and traveling.

The number of job openings dipped slightly in May, dropping from 11.8 million to 11.4 million. But the question is: Are the openings a match for the folks available to fill them? We may enter a rare place where we have higher unemployment because of an economic slowdown, yet there are abundant openings for those with the skills to fill them. We could also continue to experience wage inflation for the workers with the most-needed skills.

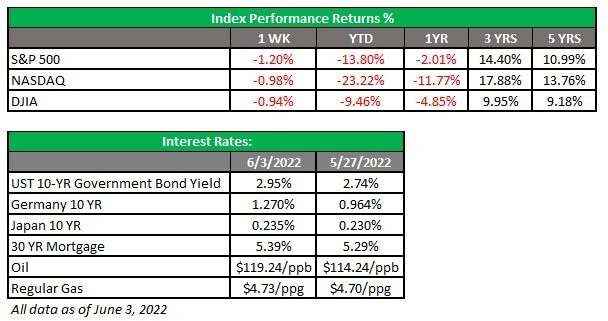

Markets had an up-and-down week; first, there were fears that the economy is slowing, followed by optimism that the Federal Reserve might slow down its rate increases. Fed Vice Chair Lael Brainard laid those hopes to rest by saying the Fed will continue aggressively fighting inflation, and the Friday jobs number reinforced that notion. With almost 400,000 new jobs, there is little reason for the Fed to ease up when the unemployment rate is at this level, so it needs to focus on its other mission: taming inflation.

While a strong jobs report is normally an indicator of a strong economy and a tonic for the markets, right now it seems bad because the Fed appears to have no excuse to stop raising rates. With the Consumer Price Index (CPI) running at 8.3% year-over-year and the national average for regular unleaded gas over $4.80 per gallon, it doesn’t seem likely the Fed will blink this time.

From storm clouds to a hurricane and a “super bad” feeling

Jamie Dimon, CEO of JPMorgan Chase, revised his view of the economy last week. He had earlier stated there were storm clouds ahead for the economy, and his weather forecast just changed for the worse. Now he’s saying we are to expect a hurricane.

Dimon specifically cited the Fed’s desire to unwind its balance sheet and its inexperience with financial tightening as the reason for his lack of confidence in their ability to pull it off. The $9 trillion on the Fed’s balance sheet, which has flooded into the economy, will need to be mopped up and the impact on interest rates will be severe.

Then there’s Tesla CEO (and future Twitter owner) Elon Musk, who stated he has a “super bad” feeling about the economy and laid out plans to lay off 10,000 workers. Yes, this is just two people with their own opinions, but they are high-profile business leaders and their lack of optimism isn’t encouraging for markets. Given Dimon’s and Musk’s access and insight into the real-time business climate is much deeper than most people’s, their outlooks bear noticing.

Coming This Week

- This will be a light week for economic data, so the market will bob along on the latest news or narrative for most of the week.

- We’ll see mortgage applications and wholesale inventories on Wednesday.

- The much watched, followed and anticipated CPI reading will be released Friday. In April, CPI dipped slightly to 8.3% from 8.5%, and consensus expectations are for a slight decline to 8.1%. If that number holds, it’s a clear sign inflation isn’t going away anytime soon.

- We will also get the consumer sentiment reading on Friday, but the market will fixate on the CPI number.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

6/22-2230390-1