AE Wealth Management: Weekly Market Insights | 6/2/24 – 6/8/24

Weekly Market Commentary

THE WEEK IN REVIEW: June 2-8, 2024

Cool Summer?

With school out and families gearing up for slower times this summer, it looks like they are going to have some company. The economy may be looking to get some time off and is cooling pretty quickly as well. And consumers are finally beginning to buckle under the weight of interest rates and inflation. After the summer is done and the bills come due, the party may start coming to an end.

Last week featured new record highs for the S&P 500 and Nasdaq (see next section), but signs of a softer economy were also apparent. Remember the other week when first-quarter gross domestic product (GDP) was revised downward from +1.6% to +1.3%? Last week, the Atlanta Fed — usually one of the more optimistic forecasters of GDP growth — revised its estimate of second-quarter GDP downward from +2.7% to +1.8%.

Additionally, the Job Openings and Labor Turnover Survey (JOLTS) report, which shows how many job openings are available, dropped to about 8 million for the lowest level of job openings in three years. Please remember that the JOLTS is a delayed report; last week’s reading was for April and marked the second monthly decline in that number. Openings are declining, but we have not yet seen layoffs, which for now is keeping the hope going that we may be able to thread the needle by slowing the economy enough to tame inflation and avoid recession.

The ADP employment report, which tracks corporate jobs, came in below expectations at +152,000 on Wednesday in yet another signal of slowing job growth. Plus jobless claims on Thursday were higher than consensus again. But on Friday, the Bureau of Labor Statistics (BLS) bucked the recent trend and reported that 272,000 jobs were created last month, well above the expected consensus reading of +188,000. However, the unemployment rate climbed to 4.0%, which is a psychological red line. Both March and April jobs numbers were revised downward, and this most recent jobs number may also follow the trend of being revised downward.

Speaking of trends, the unemployment rate has been trending upward from its last low of 3.4% in April 2023 to the current 4.0% level. One-half of 1% may not seem like much, but when we start rubbing up against psychological barriers, it starts to wear on the psyche and markets. Finally, 250,000 workers left the labor force, showing the labor participation rate is declining.

Let’s bring this full circle: We have higher interest rates, inflation is still far above the Federal Reserve’s stated target and now we see multiple signs of job growth slowing. The current danger now is the Fed potentially misreading the slowdown in jobs and economic activity and not acting soon enough. There is still time to pull out of this downward dive in an orderly manner, but if the Fed waits too long, they may course-correct too aggressively and create turbulence. This would panic the markets and probably drive us into a recessionary environment. Consumers are getting tapped out, and the longer rates remain where they are, the more pressure it will put on them. That last mile to tame inflation may end up being the killer. Just like the Fed waited too long to address inflation, it may wait too long to cut to avoid a recession. Maybe the rate cuts from the European Central Bank and Canada are a clue as to where things are headed. But then again, the Europeans and Canadians have always been a little more accepting of inflation.

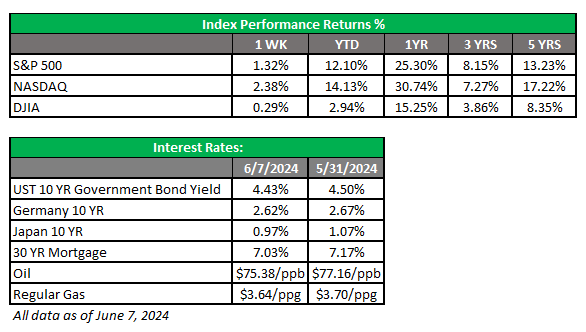

Markets plow ahead on hopes of rate cuts and a soft landing

Yields declined prior to Friday’s jobs report, then rose again late in the week. Meanwhile, the S&P 500 and Nasdaq set more new records last week, driven by the rate-cut chatter that’s picked up again. With the European Central Bank, Canada, Sweden and Switzerland all beating the Fed to the punch, and this week’s mostly weaker jobs data coupled with lower first-quarter GDP in the U.S., the market began to buzz about the possibility of a rate cut in July. We saw records for the S&P 500 last Wednesday as the index surged well above 5,300 and for the Nasdaq, which pierced the psychological 17,000 barrier (17,187.90). The Dow lagged last week after it crested above 40,000 on May 17.

Tech led the way, as usual. Nvidia surpassed Apple in market capitalization (stock outstanding x market price) and is only behind Microsoft for the No. 1 spot in the U.S. However, the idea of lower rates also helped drive the rest of the market. We eased back as the market started to get fidgety; after begging for rate cuts, the specter of those actually happening has sent a pang of worry through the market. Is the economy just slowing or is it slowly falling off a cliff? The debate will rage, and the data will be examined six ways from Sunday.

Fed Chair Jerome Powell will have to walk a very fine line. If he signals the Fed will need to move unexpectedly to shore up the economy, the markets will panic. But if he ignores the recent data and says all is OK, it could be reminiscent of his “inflation is transitory” position before the Fed started raising rates. At the onset of rate cuts, the markets will likely be happy and then panic if the cuts start to look like the Fed is trying to goose a flagging economy.

If Powell can engineer a “just right scenario,” the markets will likely be ecstatic, but the chance of that outcome isn’t looking great. We’re left with two more likely scenarios: 1) the Fed moves too soon or 2) the Fed waits too long to cut rates. Both would result in volatility and market turmoil.

We’ve been saying for the past few months that you should make any adjustments in the first half of 2024. For those who listened, kudos. For those who did not: THE TIME IS NOW to readjust your portfolios and asset allocations to make sure they are aligned with your plans and goals and that your allocations have not been distorted in the recent run-up. The time to address a leaky roof is on a sunny day, and right now, the sun seems to be shining brightly for stocks.

Coming this week

- No new data on Monday or Tuesday, so the markets will be ruminating on last week’s jobs data and what it means for potential rate cuts from the Fed at its meeting on Tuesday and Wednesday.

- The current probability the Fed will leave rates alone this week is 99.4%. And the chances of a July rate cut are still small. The probability of rate cuts rises in September, which seems really far away right now.

- We will get the latest consumer price index (CPI) and core CPI on Wednesday, too late to impact the Fed’s decision. Markets will be watching to see which direction inflation is moving. With Powell speaking after the Fed meeting, markets may be volatile in the last half of the week.

- Other data this week will include MBA mortgage applications (Wednesday), producer price index (PPI) and core PPI (Thursday), and import prices and consumer sentiment (Friday).

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

6/24-3619288-2