AE Wealth Management: Weekly Market Insights | 7/7/24-7/13/24

Weekly Market Commentary

THE WEEK IN REVIEW: July 7-13, 2024

July surprise?

Last week, this section was titled “September surprise,” as the chatter in the market was all around the Federal Reserve possibly making a rate cut in September. With unemployment over 4%, all we needed was an improving inflation picture to make markets’ expectations of a rate cut in September a reality.

On Thursday, year-over-year Consumer Price Index (CPI) numbers came down from 3.3% in May to 3% in June, which fueled actual talk of a possible cut in July and sent markets upward. However, the latest Producer Price Index (PPI) number brought markets back to earth on Friday. Input producer prices were higher than expected, and PPI rose from 2.2% in May to 2.6% in June year-over-year. While the July rate-cut talk evaporated, the odds of a September rate cut stayed high, so it doesn’t look like markets’ confidence was shaken following the PPI report.

It seems likely that we’ll see a rate cut in September. Right now, the market is betting on two rate cuts this year: one in September and another in November or December. With the deceleration of the economy, we may even see three rate cuts — July, November and December.

The Fed has painted itself into a corner, hanging on with higher rates to force stubborn inflation back to 2%. Pushing for that last 1% decline would most likely do major damage to the economy and drive us into a recession. The Fed’s other option is to back off and lower rates in an attempt to change the economy’s trajectory. The peril of that move is the very real potential of reigniting inflation. In all, it’s not a great place to be however you slice it.

The big concern is that we already may be at the point of no return. While the Fed is hesitating to cut rates until we get closer to 2% inflation, by the time they recognize the problem it may be too late for the economy. In that scenario, we could end up with the worst of both outcomes: low growth and stagflation.

Markets might have started their shift in the second half of 2024

Markets have been hanging on expectations for rate cuts for most of this year, but indices have risen mostly on the wings of a few high-flying tech stocks while the rest have mostly treaded water. That may be changing.

The Nasdaq came off a record high last Wednesday and was joined on its way down by large-cap growth, leading to a miserable Thursday since both are dominated by big tech names. The silver lining? At the same time this was happening, large-value, midcap and small-cap equities all had a great day as profits were taken and positions were reallocated and rotated.

The Nasdaq and large-cap growth were back on Friday, despite the PPI disappointment. This is a theme to watch in the second half of 2024: After a strong first half dominated by a handful of tech stocks (think Nvidia), we’re likely to see a broadening of the rally with the rest of the market catching up as interest rates come down and tech names get their wings clipped and fall back into mediocrity.

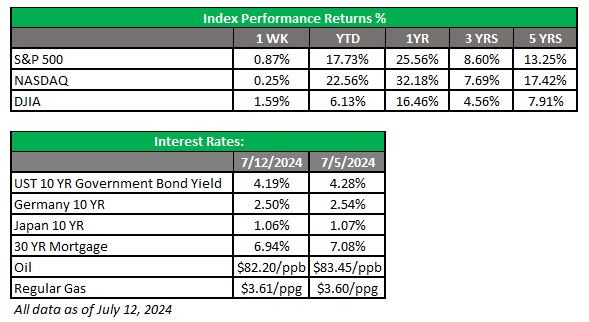

As this happens, we’ll experience increased volatility. Last week was a classic example of this process. The S&P 500 and Nasdaq set new records last week, while the Dow hit its first new high since May. If the thesis holds and second-quarter earnings behave, we should have a strong end to the year, barring something extraordinary. The next six months might be a good time to channel your inner George Washington as patience, discipline and perseverance would be really good qualities to embrace right now.

Coming This Week

- Markets will have plenty to digest this week. There are still the latest CPI and PPI reports to mull over, plus we’ll get data like the New York manufacturing survey (Monday), U.S. retail sales and business inventories (Tuesday), the Fed Beige Book and MBA mortgage applications (Wednesday) and Philly Fed manufacturing, unemployment claims and leading economic indicators (Thursday).

- While the data is important, the big deal this week will be Fed speakers and what they say about rate cuts. We’ll hear directly from Fed Chair Jerome Powell on Monday, then several additional Fed members throughout the week.

- Second-quarter earnings started last week with JP Morgan, Wells Fargo and Citigroup. Some well-known names reporting this week include Goldman Sachs, BlackRock, Bank of America, Johnson & Johnson, US Bancorp, United Airlines, Alcoa, Netflix and American Express.

AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

7/24 – 3674748-3