AE Wealth Management: Weekly Market Insights 8/7/22 – 8/13/22

Weekly Market Commentary

THE WEEK IN REVIEW: August 7 – August 13

Inflation cools, markets take off

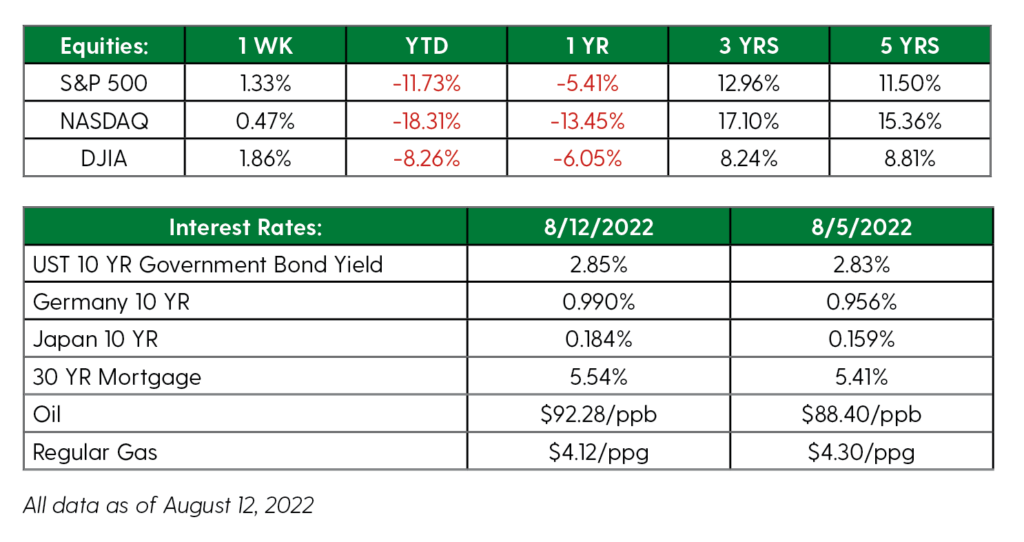

Both the consumer price index (CPI) and producer price index (PPI), which measure inflation, came in lower last week. Meanwhile, markets have been on a run after hitting recent lows in mid-June, boosted by the hopes a slowing economy and declining inflation will keep the Federal Reserve from raising interest rates again.

Despite the market’s solid recent performance, the road ahead may still be a bumpy one. The recent decreases in both CPI and PPI were primarily due to the drop in gas prices, as the average cost per gallon decreased from $5 to $4 in July. However, food and housing prices are still going up, and the Fed’s preferred measure of inflation (the core number, which excludes volatile gas and food prices) is also rising. Food prices are showing no signs of coming down soon; the food category, which tracks the cost of groceries, is up 13.1% over last year, the biggest jump since 1979.

The summer driving season is winding down, and gas demand is dropping while supply is increasing. People can change their driving habits, but they cannot eat or use their houses less. As we head into hurricane season, we could be one major storm from a refinery going offline and gas prices going right back. Or we could also have another geopolitical crisis, which can spike oil prices. Plus, all the strategic petroleum reserve sales may stop this fall.

The problem for the markets right now: They are trying to call the Fed’s rate-hike bluff. But is the Fed bluffing? We don’t doubt the Fed would love not to raise rates since tightening isn’t fun. But the current economic data to support a rate pause doesn’t appear to be there. At least, not yet.

Expecting the Fed to call off raising rates based on the rise and fall of gasoline prices won’t likely happen unless — and until — we see lower costs in everything else as well. Minnesota Fed Governor Neel Kashkari, a noted Fed dove, has even said the Fed needs to stay aggressive. Our advice: This is a golden opportunity to get your portfolio aligned with your risk profile and goals. If you have been stressed out by the markets this year, it’s probably time to review and reassess your allocations.

What this fall is beginning to look like

The case for a bullish end to the year has faded from strong belief to wishful thinking. Here’s where we are: The two-year Treasury, which is inverted relative to the 10-year, is a persistent recessionary signal. Gross domestic product (GDP) has been contracting the entire year so far, and some have argued that despite two consecutive quarters of negative GDP growth, we’re not in a recession. The Fed only started raising rates in March, and it usually takes six months to see the effects of rate hikes (which would be September). And the Fed still has to unwind its balance sheet, which is nearly $9 trillion.

Meanwhile, the government continues to spend money, which will only add to inflationary pressures. The consumer appears cranky, and inflation is still high, even though it’s come down a smidge. The market has yet to readjust to lower earnings multiples resulting from higher borrowing costs and a discouraged consumer.

How do any of these things align with a bull rally? Sure, the Nasdaq has moved into a new bull market (defined as a 20% or more lift from recent lows), and the S&P 500 has moved out of bear market territory. But technology stocks, which dominate the Nasdaq, are susceptible to a rise in rates; therefore, higher rates will likely hurt the Nasdaq. The S&P 500 could struggle to maintain earnings due to higher rates and profits softening due to cranky consumers.

All of this will likely lead to the jobs market — which has been one of the only positive spots lately — eventually contracting. If you look at the most recent figures, more than half of the 500,000+ jobs added in July were part-time positions, which may mean people are taking a second job to help with higher expenses. These are some of the things we are looking at as we head into the last few months of the year and that have us reconsidering our initial case for a strong end to 2022.

Coming this week

- This week will be pretty quiet after some high-level reports the past two weeks.

- The data start this week will be the Fed’s minutes from its last meeting, which will be released on Wednesday. The market will look for any dovish signals to continue fueling this most recent rally.

- A fresh look at mortgage applications and retail sales will give us a glimpse into the state of the housing market and if consumer demand is weakening in the face of elevated and persistent inflation.

- A few Fed officials will be speaking this week, which can always provide something that may move markets.

- Finally, unemployment claims, existing home sales and leading indicators will round things out on Thursday.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR), who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

8/22-2330610-3