AE Wealth Management: Weekly Market Insights 9/4/22 – 9/10/22

Weekly Market Commentary

THE WEEK IN REVIEW: Sept. 4 – Sept. 10

Markets finish positive and Fed stays the course

Fed stays the course as the ECB joins the rate-hiking party

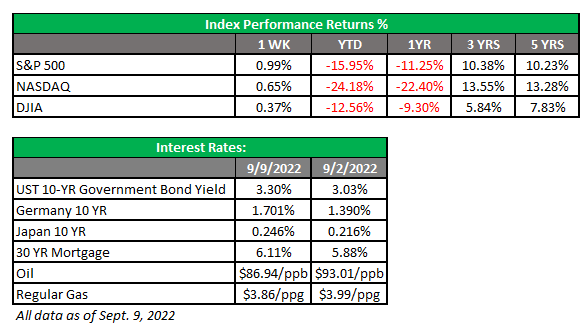

Last week was up and down as the markets focused on a shred of positive comments from Federal Reserve Vice Chair Lael Brainard on Wednesday. Although she affirmed the Fed’s commitment to lowering inflation, she said at some point the risks between raising rates and damaging the economy would balance out.

The markets took Brainard’s comments to mean the Fed may waver as the economy shows signs of weakening. Markets shot up on Wednesday and continued rising over the next two days, finishing in a positive position for the first time in three weeks.

For his part, Federal Reserve Chairman Jerome Powell continued to pound the table and affirm the message he delivered in his speech from Jackson Hole, Wyoming, in late August. He reiterated that the Fed remains narrowly focused on inflation and achieving the price stability portion of its dual mandate, repeating his message that “the Fed has and accepts responsibility for price stability.”

Powell further noted that one of the lessons learned from the period of inflation former Chairman Paul Volcker inherited is that failing to bring inflation down only entrenches inflation expectations, making it harder to get under control. The prior record of failed attempts to control inflation resulted in higher costs in bringing it down again. Powell said the Fed must keep inflation expectations anchored for the medium term, and that appears to be the case so far. He also said the Federal Open Market Committee will keep raising rates and won’t back down until it is sure inflation is sustainably moving toward the Fed’s 2% target.

While this could risk a recession, the cost of failure in controlling inflation is higher over the longer term. The markets still seem to believe the Fed will blink if we start seeing the economy slow even more and that they won’t follow through on stated rate increases. This thinking could not have been any more apparent than it was after Brainard’s comments led to misconstrued hope and Powell’s hawkish comments were ignored the next day. This game of chicken could end badly for the market, especially if earnings begin to suffer before we see broader weakness in the economy. The next Fed meeting is on Sept. 20 and 21, with fed funds futures predicting a 90% chance of a 75-basis-point (0.75%) hike.

Speaking of 75 basis points: The European Central Bank (ECB) raised its deposit rate from 0% to 0.75% Thursday. The move was unprecedented and followed a July hike of the refinancing rate from 0% to 0.50%. The main refinancing rate stands at 1.25%, the highest since 2011. The rate hike may have been too little, too late for Europe, especially when you consider the double squeeze of a habitually weak economy sliding into a deep recession and the specter of an acute energy shortage thanks to the embracing of alternative energy production and an over-reliance on Russian oil and gas imports.

The long cold winter ahead for Europe: a cautionary tale

Do you know why people watch soap operas or reality TV shows? Because we like to see other people’s outrageous behavior and misery and feel good about ourselves. No matter how badly we behave or how bad our lives are, someone else is always in a tougher spot or acting worse.

There is a lesson here. Or maybe it’s a cautionary tale. As we start thinking about winter, the sad reality is that we will be paying more for electricity, heating oil and natural gas this year. Think about how quickly we have come to this point, then think about Europe, which has been on this path for decades. We will pay more to stay warm this winter, but at least we will have the option to pay more.

Europe, in contrast, doesn’t have that option. Decades of green policies and demonization of the oil, gas and nuclear energy industries have led Europe into a potentially disastrous situation. Russia’s invasion of Ukraine more than six months ago has put Europe in a bind because they need Russia’s oil and gas but condemn the attack. They sanctioned Russian oil and gas and will not buy energy from Russia, nor will Russia be inclined to export any to western Europe.

Now Europe is in a quandary: Stand up for Ukraine and freeze, or let Russia have its way and access cheap energy. Europe made itself dependent on cheap Russian power, and people could die in Europe this winter because of that choice. Having to choose between supporting a sovereign neighbor’s independence and having your population suffer in winter is not a great place to be.

This all happened because Europeans chose to outsource their energy needs to Russia, and a geopolitical crisis has left them scrambling to find new sources. Britain is resuming offshore drilling and fracking, Germany is firing up old coal plants and France is doubling down on nuclear power. It could be a rough winter in Europe, and hopefully we will learn a lesson to avoid the same fate.

Coming this week

- The newest reading of the Consumer Price Index (CPI) will be out Tuesday. Last month, the CPI (the core marker for inflation) was at 8.5%. Gas prices have continued to drop, albeit not at the same rate as in July, so hopefully we will also see a decline in the CPI. Movement in either direction could be a major market mover.

- The Producer Price Index (PPI) will provide another inflation mile marker on Wednesday.

- On Thursday, jobless claims, retail sales, industrial production and business inventories will give a peek into whether the economy is slowing further.

- Finally, on Friday we’ll get a consumer sentiment reading, which has remained fairly strong so far.

- Friday will be a quadruple witching day. (Quadruple witching is when stock index futures, stock index options, stock options and single stock futures all expire on the same day.) Market movements tend to be severely magnified on these days, so anything goes as we end the week.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

9/22-2410942-2