AEWM Wealth Report – Estate and Legacy Planning Isn’t For You – It’s For Your Loved Ones

Download PDF Version

No matter their age or net worth, every adult can benefit from planning for what happens with their assets when they die. There are many components involved, and it can be a highly emotional process – but it’s worth knowing your loved ones can focus on more important things after you’re gone.

Overview

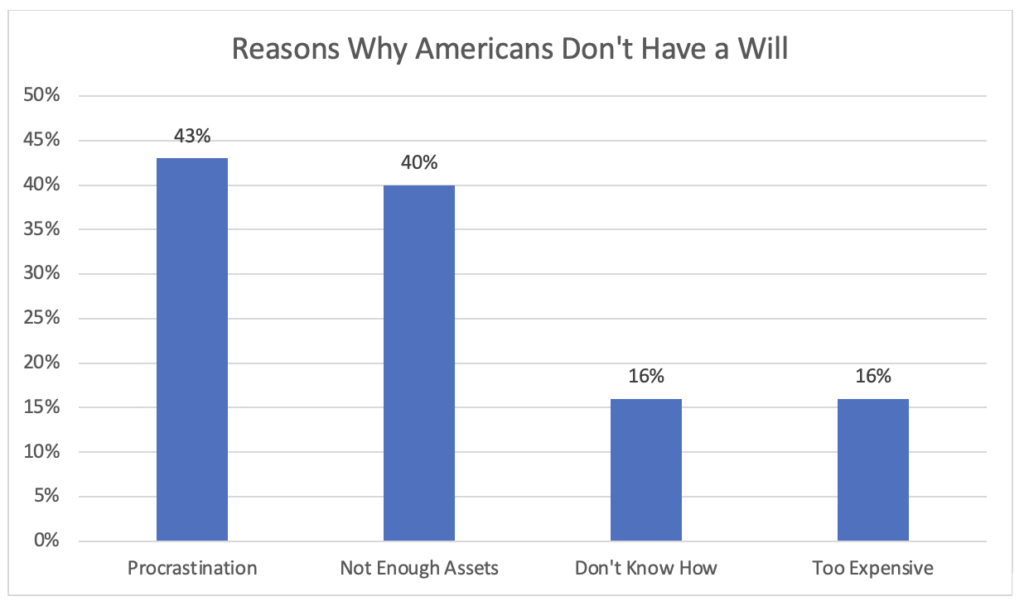

What do you want to happen to your assets after you’re gone? According to a recent study, 68% of people surveyed don’t have a will.1 While their reasons for not having one varied, 40% of those surveyed said they didn’t have enough assets to need a will. Other reasons included a lack of knowledge or funds to create a will and simply putting it off because they didn’t want to think about it.

Source: Caring.com

But here’s the thing: Even the most basic financial planning can be impactful for your loved ones in the wake of your death. When someone passes away, just paying the bills can become a chore that’s worsened by grief. The last thing you want is for the power to be cut off or for long-term-care insurance on a surviving spouse to be stopped because you weren’t there to pay the bills.

Even if you’re single with no children, it’s important to consider where your assets and possessions will end up. If you pass away without a will, the state will decide how to distribute your belongings – including any physical property, investments and even pets.

Pre-planning can also head off disagreements or arguments over who gets what. So, how can you get started with planning for what happens when you die? Let’s break it down into four simple steps.

Step #1: Gather Your Documentation

Some of the most effective pre-planning is simply letting your loved ones know where your assets are located and how to access relevant paperwork. It’s a good idea to develop a “financial fact sheet” listing your bank accounts, investments, pension, employer retirement plans, etc. It may also include details about property you own, outstanding debts and other relevant financial information.

Your financial fact sheet can be stored in a secure location, such as a safe deposit box or fireproof safe in your home. Let your loved ones know where the documents are kept, and make sure they know how to access them when necessary.

Step #2: Work With a Trusted Financial Advisor

While your financial advisor can’t help you set up a will or trust or provide tax advice, they can work with an estate planning attorney and tax consultant to make sure your accounts are set up correctly. This combination of experience can help ensure your assets are transferred to beneficiaries directly and in the most tax-efficient manner. Should you decide to put investments or other assets into a trust, your financial advisor can also help make sure they are moved correctly and provide support for distributing the assets after you’re gone.

If you don’t have an estate planning attorney or tax professional, your financial advisor can likely refer you to someone they know. They can also provide support and advice for your surviving spouse, children or other beneficiaries to manage their inheritance.

Step #3: Create Your Estate Plan

You can’t take it with you. That’s why it’s important to write a will providing instructions on how you want your possessions to be distributed when you die. While many states assign all assets to a surviving spouse, this isn’t always automatic – and may even be problematic depending on your family situation.

Here’s a look at what might be included in a comprehensive estate plan:

- Life Insurance: Depending on your age and level of assets, you may want to consider adding life insurance to your estate plan. Life insurance proceeds are distributed to your beneficiaries tax-free, and they can be used to replace income, pay off debt or even cover funeral expenses. In some cases, they can also be used to provide retirement income for a surviving spouse.

- Payable on Death Designation: Your bills will continue when you’re gone, and you’ll want to make sure your loved ones have the financial means to pay them. Consider completing a “payable on death” (POD) form to give a loved one immediate access to your bank accounts (checking, savings, money market) after you die. This is very simple paperwork that can be completed at your local bank branch (or online if your accounts are at an internet-only bank).

- Transfer on Death Deed: If you own a home or other property, you may want to establish a transfer on death (TOD) deed, directing the transfer of the property to another person at the moment of your death. (You don’t need a POD or TOD if your bank accounts or property are owned by a trust.)

- Limited Power of Attorney (POA): This legal document grants another person the power to act on your behalf for a specific purpose and for a limited period. For instance, if you’re going to be out of the country for two months, you might want to give someone limited POA to handle your affairs while you’re gone.

- General POA: This assigns another person all powers and rights to act on your behalf, including the ability to sign documents, pay bills and conduct financial transactions. This can often be a useful document to have if you’re single and want someone else to be able to help with your affairs if you begin to experience cognitive decline.

- Durable POA: A durable POA is used if you become incapacitated and can’t make decisions for yourself. It can be used for general or limited purposes.

- Living Will: Also known as an advance directive, a living will conveys if you want emergency and medical professionals to resuscitate or engage in “heroic efforts” to sustain your life.

It’s not always automatic that a spouse can make medical, legal or financial decisions on behalf of an incapacitated spouse, so it’s important to have this paperwork in order even if you’re married. It’s also important to review all of your estate planning documents regularly to make sure they’re up to date and aligned with your wishes.

Step #4: Consider Funeral Pre-Planning

When someone dies, there are a lot of decisions to make – and you can relieve some of the burden for your loved ones with funeral pre-planning. This might include details such as:

- Where you want to be buried (you might even pre-purchase a plot or headstone)

- Where to scatter your ashes if you want to be cremated

- The clothes you’d like to be buried in

- Favorite songs to play or verses/poems to be read at your services

- A preferred charity or organization to receive memorial contributions

Writing down these details may seem morbid at first, but thinking through your wishes can actually be a liberating experience. It also allows you to communicate your likes, dislikes and how you want to be remembered. Without this guidance, grieving loved ones must make these decisions on their own while navigating their own grief.

Final Thoughts

The best time to develop a plan – whether it’s retirement, long-term care or death – is well before you need it. It’s important to engage in end-of-life planning while you’re still in good health because the financial and legal complications can be onerous if you wait too long.

One of the best things you can do for your loved ones is to regularly review every plan, document, account and beneficiary designation to ensure they continue to reflect your wishes. These details tend to get lost in the wake of new marriages, blended families, the addition of new family members, divorce and death. That’s why it’s important to work with a financial advisor to help ensure your plan stays on track for the sake of your loved ones.

SOURCES

1 Rachel Lustbader. Caring.com. “2024 Wills and Estate Planning Study.” https://www.caring.com/caregivers/estate-planning/wills-survey/. Accessed July 8, 2024.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

07/24-3699681