Financial Advice for Your Recent College Graduate

Download PDF Version

It isn’t an easy time to be a young adult. Economic uncertainty, a softening job market and rising prices create challenges for college graduates who are just setting out on their own journeys toward independence.

Overview

Graduating from college should be an exciting time, but today’s graduates are launching into a particularly challenging environment. From the conflicts overseas having their impact in the U.S. to a softening job market and high prices, your recent college graduate may need support and advice as they define the road ahead.

Many of these graduates are also carrying a financial load as they embark on their careers. Public university students borrow nearly $33,000 on average for their bachelor’s degree, and those costs can double or triple for private schools.1

It’s challenging to start life “underwater” in terms of their debt-to-income ratio, and most graduates are focused more on becoming debt-free than building wealth. Still, it can be important for college grads — especially those in their early 20s — to develop successful money management habits now. The following are ways you can help your recent college graduate find their financial footing.

“It takes courage to grow up and become who you really are.” — E. E. Cummings

Establishing Solid Financial Habits

One of the first life lessons we all learn is that building a strong foundation can increase our chances of success. Building a financial foundation starts with developing good practices in four categories: spending, saving, investing and protecting.

Spending

While some of us are naturally inclined to spend while others save, financial responsibility can be learned. One of the keys is to create a budget that accounts for both practical purchases and indulgences. Splurging on the occasional big purchase can be balanced out by incorporating money-saving habits. Even a graduate making a good entry-level salary can still make coffee at home or pack a lunch for work most days. Grabbing a coffee from Starbucks or dining out in a restaurant can be an infrequent indulgence. The advice is simple: “Live like you’re still a college student.”

Saving

Setting aside each month — even if it’s only a small amount — can help graduates establish a saving habit. The initial goal could be to create an emergency savings fund with enough money to cover three to six months of expenses. This is especially helpful to have early in your career when you may be more likely to be caught up in a layoff.

This is also the time money graduates will start chipping away at debt, especially student loans. One way to do this is by increasing payments toward the loan with the highest interest with the goal of paying it off first. Once that loan is dispatched, add the monthly payment to the loan with the second-highest interest rate and repeat until all the debt is paid off.

Investing

Some earlier — and even older — adults mistakenly believe investing is for people who are further along in their careers or making more money. But anyone can benefit from investing, even if it’s small amounts. Right out of college is a great time to start investing.

The younger your grad starts investing, the more money they can earn over the long term, thanks to the power of compound interest. Here’s an example of how it works:

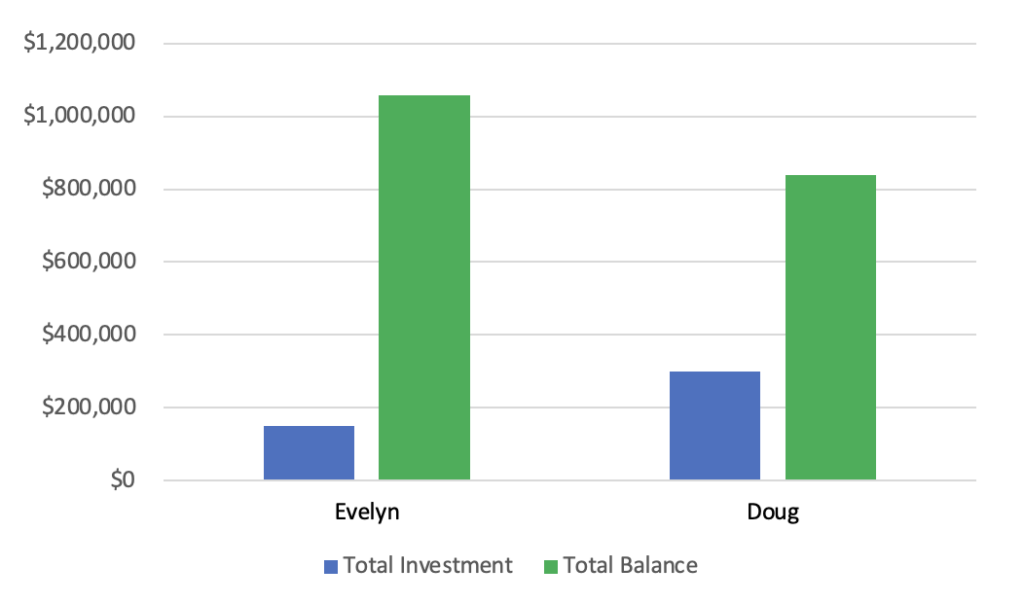

Evelyn starts investing at age 25, putting $10,000 a year in her investment account every year for 15 years for a total of $150,000. At age 40, she stops investing and reallocates the money for her child’s college fund.

Doug, on the other hand, decides to spend his money on other things. He doesn’t start investing until age 35, a full decade after Evelyn. At that point, he invests $10,000 per year for the next 30 years – twice as long as Evelyn. In all, Doug contributes $300,000 to his investment account.

Check out how they fared in the chart below:2

*This hypothetical illustration assumes an average annual return of 6%. The illustration does not represent any particular investment, nor does it account for inflation.

Despite investing half as much money as Doug, Evelyn earned over $220,000 more by age 65. That is the power of compound interest at work, especially for someone who is early in their career and starts investing as soon as possible.

College graduates entering the workforce might find it easiest to start investing through their workplace retirement plan, where they can potentially take advantage of matching contributions from their employer. You might also consider introducing them to your financial advisor, who can help them get set up with investing options outside their workplace.

Protecting

Compound interest works both ways, which is why it’s important for everyone to make loan payments on time. Missing payment dates can end up costing more through late penalties and even higher interest rates. It can also negatively impact your credit rating, making it much more difficult to purchase large-ticket items such as a car or house later.

Final Thoughts

may be in charge of managing their finances for the first time. You can help by offering a lot of patience, a little understanding and your own personal insights.

Some of the real-life lessons you’ve learned over the years may be brand new for the young college grads in your life. Perhaps the biggest — and best — lesson you can share with them is to develop good financial habits early. If they do, they will reap the rewards for years and even decades to come.

SOURCES

1 Melanie Hanson. Education Data Initiative. March 3, 2024. “Student Loan Debt Statistics.” https://educationdata.org/student-loan-debt-statistics. Accessed May 6, 2024.

2 Vanguard. “When should you start saving for retirement?” https://investor.vanguard.com/investor-resources-education/retirement/savings-when-to-start. Accessed May 6, 2024.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

6/24-3573738