AE Wealth Management: Weekly Market Insights | 10/15/23 – 10/21/23

Weekly Market Commentary

THE WEEK IN REVIEW: October 15-21, 2023

Gloomy headlines push markets down

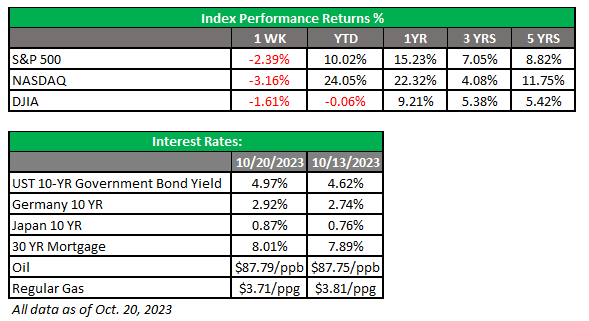

Markets slid last week amid ongoing geopolitical concerns and tough talk from Federal Reserve officials. The S&P 500 had its biggest weekly decline in a month, while the Nasdaq slid back to four-month lows.

But let’s back up. Stocks opened the week strong, with the S&P 500 marking the 15th consecutive Monday of gains. But deepening tensions in the Middle East weighed on markets by mid-week, and shares fell sharply on Thursday following reports that a U.S. Navy destroyer had shot down cruise missiles reportedly headed toward Israel. Reports of a drone attack on a U.S. base in Iraq also didn’t help matters.

Fed officials were on the speaking circuit last week and their remarks were decidedly less dovish than they had been in recent weeks. Fed Chair Jerome Powell commented that he saw no signs that the Fed’s current policy would push the economy into a recession — and markets showed their dislike by pulling back sharply.

Powell’s comment may have been spurred by some of the data released last week. The Commerce Department reported that retail sales rose 0.7% in October, double expectations. And weekly jobless claims unexpectedly fell below 200,000 for the first time since January.

But other numbers tell a different story. In the housing industry, 30-year fixed mortgage rates topped 8%, a strong reason why home sales fell in September to their lowest rate in 13 years. Residential construction has slowed as well, as building permits fell 4.4% in September. The data helped push yields on the U.S. Treasury note to nearly 5%, the highest level since 2007.

On Friday, President Joe Biden requested $105 billion in military aid, most of which is earmarked for Israel and Ukraine. The move drew criticism from Republican legislators, some of whom said the president is lumping the two together to force them into voting for the Ukraine war effort. Legislators may try to split up the bill, although if they can’t come to an agreement about who should lead them, who says they’ll be able to get any real work done?

All the global goings-on will likely keep markets off-center over the next week, especially as we draw closer to the Fed’s next-to-last meeting for the year on Oct. 31 and Nov. 1. The Fed has signaled it probably won’t raise rates again but hasn’t eliminated the option entirely. The top things that could turn markets around this week are a cease-fire in the Middle East and strong reassurance from the Fed that they won’t hike rates again next week — both of which are a long shot.

Coming this week

- Several big market-movers in terms of data are on tap this week. We’ll see more numbers from the housing industry, including the Case-Shiller home price index (Tuesday), new home sales (Wednesday) and pending home sales (Thursday).

- Thursday will include a reading of third-quarter gross domestic product and advanced retail and wholesale inventories.

- On Friday, we’ll see the latest personal income and spending numbers, plus consumer sentiment.

- No Fed officials are scheduled to speak this week, so we won’t get any additional insights into what they’re thinking as they head into next week’s meeting.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/23-3143466-4