AE Wealth Management: Weekly Market Insights | 11/13/22 – 11/19/22

Weekly Market Commentary

THE WEEK IN REVIEW: Nov. 13 – 19

The back-and-forth dance continues for markets

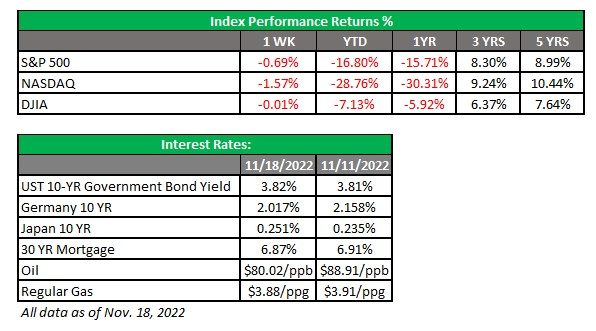

After a strong showing the previous week, the major domestic equities gave back most of the prior week’s gains and closed slightly lower last week. Markets opened weaker following comments from Federal Reserve Governor Christopher Waller, who said the Fed has “a ways to go” before ending rate hikes. On Tuesday, we had a bit more encouraging news on that front: The year-over-year producer price index (PPI) decelerated from 8.5% to 8.0% in October. The lower number means manufacturers are paying less for the things they need to produce what they sell — and hopefully those savings get passed on to the consumer. The report seemed to change Waller’s stance slightly, and on Wednesday, he said the latest data had led him to favor a hike of 50 basis points (0.50%) at the Fed’s December meeting. Other Fed members may share that sentiment; Fed Vice Chair Lael Brainard signaled last week that the Fed may increase rates by 50 basis points next month, instead of the 75-basis-point hikes we’ve seen after the last four meetings.

Last week’s dip came despite better-than-expected earnings reports from retailers such as Walmart, Ross Stores and Foot Locker. And on Wednesday, the Commerce Department reported that retail sales — excluding the auto industry — rose 1.3% in October, the biggest gain since May. One blemish on the surprisingly positive retail picture was Target, whose shares fell sharply after the company reported slowing discretionary spending over the last few weeks.

Last week also brought another round of prominent layoff announcements. Amazon, for example, announced roughly 10,000 job cuts just before the holiday shopping season kicks off in earnest. Still, despite a flurry of layoffs in the past few weeks, initial jobless claims came in at 222,000, right in the range of 214,000-226,000 we’ve been in since September.

Divided we stand

It seemed like we waited a long time for the final verdict, but we finally know that Republicans succeeded in flipping the House of Representatives in the midterm elections. With Democrats controlling the Senate and the White House, a Republican majority in the House officially leaves us with a divided government for the next two years. We’ve discussed before how a divided government usually results in gridlock, which is typically a boon for markets. But we’ve still got a lot of challenges to work out, and that could spell more volatility for investors in the coming months.

Will that be cash or credit?

Here’s an interesting factoid: In the fourth quarter of 2019, Americans were sitting on about $1 trillion in cash. By the second quarter of this year — a mere 2.5 years later — that amount had ballooned to $4.7 trillion.

Sadly, that cash supply seems to have dwindled, wiped out by inflation. Americans are relying more heavily on credit cards to cover their expenses, and credit card balances increased 15% in the third quarter. It’s the largest year-over-year increase in more than 20 years — and that number could grow if Americans put more of their holiday shopping on plastic.

Coming this week

- The Thanksgiving holiday makes this week a short one. A couple of Fed officials are scheduled to speak in the first half of the week. Will they reinforce Waller and Brainard’s signals that we could see a 50-basis-point rate hike in December?

- Most of the data will come out Wednesday, including new home sales, which are expected to drop from 603,000 to 572,000 for October. We’ll also get a final reading of the consumer sentiment index for November, which is forecasted to be adjusted to 55.1 from its initial reading of 54.7.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

11/22-2578521-3