AE Wealth Management: Weekly Market Insights | 11/26/23 – 12/2/23

Weekly Market Commentary

THE WEEK IN REVIEW: Nov. 26 – Dec. 2, 2023

November was a good month for markets

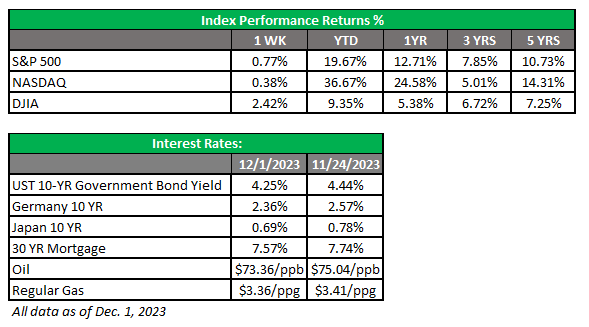

Christmas came early this year for investors. Colloquially known as a “Santa Claus rally,” the market experienced an upward bounce in the latter half of November. On the equities side, the S&P 500 and Nasdaq saw their best monthly gains (8.9% and 10.7%) since July 2020. Over on the bonds side, U.S. Treasury yields continued to drop and the bond market had its best monthly gain in nearly 40 years.

Markets continued to rise last week, bolstered by the good news that inflation is slowing. The personal consumption expenditures (PCE) index rose a mere 0.2% in October, for a year-over-year increase of 3.5%. Sure, it’s still above the Fed’s 2% target — but it’s the lowest the PCE has gotten in 2½ years. And the latest data showed core PCE was even lower, running at 2.5% over the past six months.

The PCE numbers mean Americans aren’t spending as much as they previously were. (Except on Black Friday. We were shopping in full force, shelling out billions of dollars between Black Friday and Cyber Monday.) The combo of waning income growth, high interest rates, increasing prices and resumption of student loan payments has eaten into folks’ savings, and people are having to cut back. It’s a departure from earlier in the year; third-quarter gross domestic product (GDP) was revised upward to 5.2% after a second reading last week.

Is a soft landing still possible?

All signs are pointing to the Federal Reserve keeping interest rates where they are at their last meeting of 2023 next week. Comments from several Fed officials last week seemed to confirm they’re done raising rates. Board member Christopher Waller said, “I’m increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.”

Waller even opened the door just a crack to possible rate hikes in early 2024. He said that if inflation continued to moderate over the next three to five months, “we could start lowering the policy rate just because inflation is lower.” And in his comments, Fed Chair Jerome Powell said that interest rates were now “well into restrictive territory.” But just to hedge his bets, Powell also said the Fed would raise rates again if dictated by data. His comments helped push the 10-year U.S. Treasury note yield down to 4.21% in intraday trading on Friday, nearly a three-month low.

Is the Fed actually going to be able to pull off a soft landing with the economy? It’s looking more and more promising. Personal spending rose 0.2% in September, and personal incomes kept pace. Housing permits came in above expectations for the month of October. Weekly jobless claims ticked down; however, continuing claims jumped to 1.93 million, their highest level in two years.

Coming this week

- It’s a fairly busy week for economic data, especially related to employment. The latest job openings number will be released on Tuesday and is forecasted to drop from 9.6 million to 9.4 million. The ADP employment report will come out Wednesday and the Bureau of Labor Statistics (BLS) employment situation will be released Friday. We’ll also see the latest unemployment rate, which is expected to remain steady at 3.9%.

- Other data this week includes factory orders (Monday), producer manufacturing index for the services industry (Tuesday), U.S. trade deficit (Wednesday), wholesale inventories and consumer credit (Thursday), and consumer sentiment and hourly wages (Friday).

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

12/23-2091642