AE Wealth Management: Weekly Market Insights | 6/12/22 – 6/18/22

View PDF Version

THE WEEK IN REVIEW: June 12 – June 18

The Fed disappoints – again

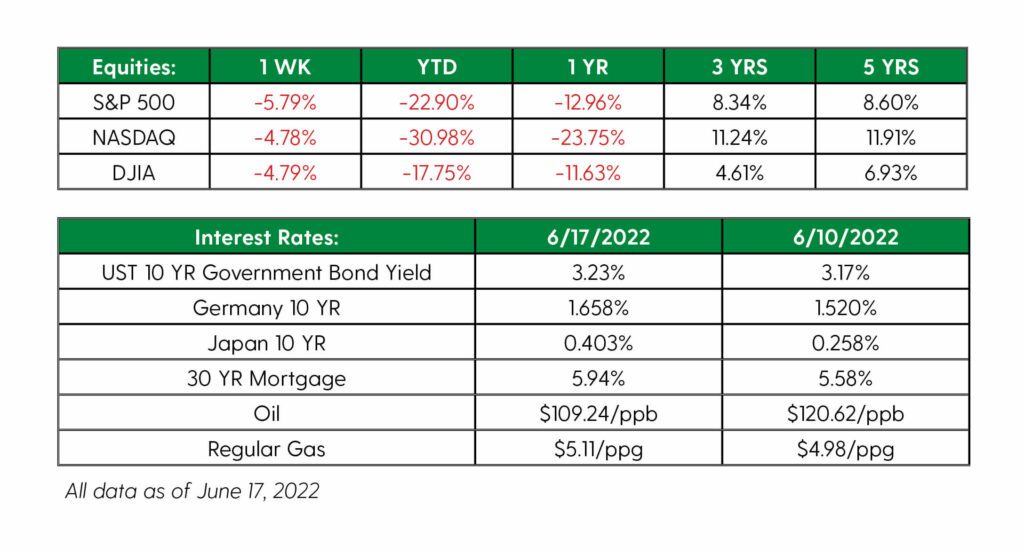

The markets had another rough week, but the news last week was all about the Federal Reserve meeting. After the red-hot Consumer Price Index (CPI) and Producer Price Index (PPI) readings, it was leaked the Fed would move interest rates up by 75 basis points (.75%). Sure enough, they did, for the first time since 1994.

Markets initially erased daily gains, then rallied furiously on Wednesday on the back of comments from Fed Chair Jerome Powell. The Dow rose over 600 points, then gave back half of those points in the last minutes before the close. Remember on May 4 when Chairman Powell told us that 75 basis points wasn’t a consideration and he couldn’t guarantee a soft landing? On that day, the Dow rallied nearly 1,000 points in the last hour and a half of trading, only to lose it all and then some the next day. Those comments turned out to be the catalyst that took us to a new yearly low on May 20.

The same scenario played out following last week’s Fed meeting — only this time, we didn’t have to wait two weeks to hit fresh lows, since we were already there. The new wrinkle was that five other central banks (Hungary, Switzerland, Brazil, the UK and Taiwan) also raised rates after the Fed did. As people began sifting through Powell’s comments, they realized how close to a recession we really are. Short-term rates are now expected to be around 3.5% by year end, and the Fed says they are expecting Gross Domestic Product (GDP) growth to be 1.7% for each of the next two years. In comparison, GDP grew by 6.9% in the fourth quarter of 2021, and 2022 projections were 3%-4% only a year ago.

First-quarter GDP was -1.5%, and the Atlanta Fed is projecting second-quarter GDP to be 0.00% — meaning the Fed thinks we will grow 3.4% in the second half of the year. Seriously? It doesn’t seem possible — although only last month they told us there was no way we would see a hike of 75 basis points.

Furthermore, the Fed raised its year-end inflation projection from 4.3% to 5.2%. If we want to get to a 2%-3% inflation rate, we need to raise rates another 2%-3% in addition to the 3.5% we expect to have by year end, equaling a total of 6% in rate hikes. How was the Fed going to get inflation to 4% before this most recent meeting with only 2%-2.5% in increases? And are they now accepting a 5.2% inflation rate with a total of 3.5% in rate hikes this year? Right now, the Fed just doesn’t seem credible.

The Fed is also projecting unemployment to rise to 4.1% over the next two years. The administration continues to promote the narrative the economy is strong, that there’s nothing they can do about sky-high energy prices and they’re looking to spend more. No one appears to have a logical plan to help make things better in the short term, and the market sniffed that out as we closed out the week.

The economy has become a two-man lift

Some things are too heavy for one person to lift. That’s where we are with respect to the economy and, by extension, the markets. The Fed right now is being expected to do all the heavy lifting needed to slow inflation, calm the markets, keep the economy growing and provide a soft landing. But they are only willing to go so far. Right now, their limit is 3.5% on the Fed Funds rate and 5.2% inflation by the end of the year. With the very real possibility of negative to flat (at best) GDP growth in the first half of the year, as mentioned above, the economy would need to grow 3.4% in the last six months of 2022.

It’s hard to believe that can happen without some serious help from somewhere else. If the Fed deals with all things monetary and the federal government deals with all things fiscal, then how can the government help with the lift? The Fed claims it cannot help with energy and food, but there’s likely something policy-driven that this administration can do to help carry the load. And while they are at it, they could stop promoting the narrative that the economy is strong. C’mon, man, 1-2-3, lift!

Coming This Week

- Markets are closed on Monday in observance of Juneteenth, the federal holiday signed into law last year.

- The only major event this week will be Fed Chair Jerome Powell’s testimony before the Senate Banking Committee.

- Real estate and mortgages have been slowing dramatically over the past few months. Existing home sales (Tuesday), mortgage applications (Wednesday) and new home sales (Friday) will likely show a continuing decline in the housing markets. Rates on conventional mortgages have more than doubled since this time last year.

- Consumer sentiment, which has been cratering, will close us out on Friday.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

6/22 – 2230390