AE Wealth Management: Weekly Market Insights | 7/21/24-7/27/24

Weekly Market Commentary

THE WEEK IN REVIEW: July 21-27, 2024

Up, down and all around

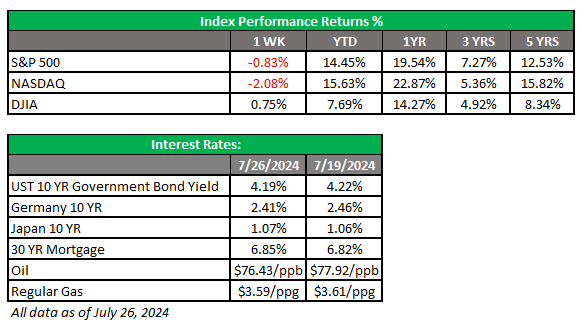

Mid-week market mayhem was unleashed last week, as the major indexes dropped significantly off their record highs after disappointing earnings reports from some of the tech giants. The S&P sold off more than 2% on Wednesday, its largest one-day drop in more than a year, while the Nasdaq saw its worst loss since October 2022.

Tech has been a major upward driver this year, so it’s no surprise it was also the catalyst for last week’s dip. But markets might want to look at the bigger picture; analysts are predicting overall earnings for the S&P 500 have risen 9.8% over the past year. If that number holds, it will be the largest year-over-year earnings growth since the fourth quarter of 2021.

Other positive data led to a slight rebound on Thursday: Non-defense durable goods orders rose 1% in June, while weekly jobless claims fell more than expected. Plus, the first reading of second-quarter gross domestic product (GDP) showed the economy grew by 2.8%, well above expectations and higher than the 1.5% gain in the first quarter.

The other good news was that personal consumption expenditures (PCE) stayed steady at an annual rate of 2.5%. The Federal Reserve prefers this number to measure inflation, and the fact that the last reading wasn’t too far off the Fed’s 2% target will play into their discussion about rate cuts during their meeting this week. Indeed, futures markets are pricing in zero chance of the federal funds rate staying at its current level by the September meeting.

Coming This Week

- The big market-mover this week will be the Fed meeting on Tuesday and Wednesday. Markets will be listening closely to Fed Chair Jerome Powell’s post-meeting comments on Wednesday to see what he has to say about potential rate cuts in September.

- It won’t come out in time to make a difference in the Fed’s rate decision, but we’ll see the latest employment data this week. The ADP employment report for July will come out on Wednesday, followed by non-farm payrolls on Friday.

- Other significant data this week includes consumer confidence (Tuesday), pending home sales (Wednesday), manufacturing costs and construction spending (Thursday), and wages and factory orders (Friday).

- We’ll also continue to see second-quarter earnings throughout the week.

AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

7/24 – 3674748-5