AE Wealth Management: Weekly Market Insights | 7/9/23 – 7/15/23

Weekly Market Commentary

THE WEEK IN REVIEW: July 9 – 15, 2023

Rally continues as inflation drops

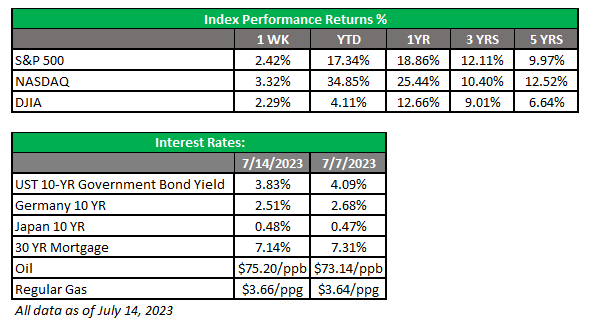

Markets had a strong week, posting year-to-date highs as we topped 4,500 on the S&P 500. The primary driver for the continued rally? Anticipation (and then affirmation) of declining inflation readings. Remember last year? The Consumer Price Index (CPI) was over 9% and the Producer Price Index (PPI) was up more than 11%. Last week, we got a little more relief as CPI declined to 3.0% and core PPI dipped to 2.6% year over year.

Both readings came in below expectations and showed significant progress. That’s great news — and even though these levels are still higher than desired, markets were happy to see the lower inflation readings. We had a pretty solid rally going into the announcements, and it continued through most of the week before we gave up some gains.

The Federal Reserve is one of the key drivers for markets right now. Although another 25-basis-point (.25%) hike is largely expected for the upcoming Fed meeting, the anticipated second hike later this year is not as certain as it was. The probability of a 25-basis-point hike at the July 25-26 meeting rose from 60% to 97% over the past month, but the probability of rates remaining the same in September improved to 84%, in November to 69% and in December to 62%. In fact, the chances of a rate cut back to where we are right now (before the expected July increase) is 23%. The market clearly doesn’t expect a second increase and is still holding on to hopes of at least one cut by year-end.

Whatever the outcome last week, the market loved the inflation news and seems to think the Fed will be done with rate raises after the July meeting. However, as poet Robert Burns famously said, “The best-laid schemes o’ mice an’ men / Gang aft agley.” (Or, more plainly, “The best-laid schemes of mice and men / Go oft awry.”) Who knows what may befall the markets and the economy over the next six months? We could usher in a recession, but we could also see new record highs. Markets like the situation for now, but we could see some excitement in the months ahead (more on that below). In the meantime, it’s a good idea to take your investment pulse, check up on your goals and adjust your portfolios or allocation if needed.

Will the smooth ride last?

We seem to be in a good place at the moment, but the markets are always looking for something to worry about. If it isn’t the Fed, it will be the consumer or potential recession. If that doesn’t stir things up, maybe it will be concerns over earnings. If all else fails, it will be who wins the Musk/Zuckerberg cage match.

The point? Markets need news to react to — and if there’s nothing, then they will create drama. It’s the slowest part of the year for trading, and everything is smooth now, but that could change quickly as more data is released. The nearest data will be second-quarter earnings, and we’ve already seen some major banks report very strong results. The markets will surge on anything positive because we’re expected to be at the low point for earnings in this cycle. Strong earnings will signal that companies have weathered the Fed’s rate hikes and will likely do well as rates decline. But weak earnings could trigger volatility and angst over weak consumer demand and potentially cloud the outlook.

Then there’s the Fed meeting, where we will likely get another 25-basis-point hike. Any hawkish post-meeting talk from the Fed could worry markets as they mull the possibility of another hike. Finally, we will get the initial reading of the second-quarter gross domestic product (GDP) in late July. Concerns will probably swirl that the Fed has done too much and we are headed toward recession or that the economy is still strong and the Fed may need to do more. Enjoy the calm now because markets seem to be always looking for the next cause for concern.

Coming This Week

- Retail sales, industrial production and business inventories on Tuesday will give us a pulse on consumers and how much the economy is slowing (if at all).

- Mortgage applications and housing starts on Wednesday should show a stabilizing housing market as that segment gets used to the new rate levels.

- Existing home sales and leading indicators will close out the week’s economic data.

- Second-quarter earnings will be reported all week. There have been several significant surprises to the upside already, and if that persists, expectations will be for the markets to keep climbing.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

7/23-2982871-3