AE Wealth Management: Weekly Market Insights | 8/4/24-8/10/24

Weekly Market Commentary

THE WEEK IN REVIEW: Aug. 4-10, 2024

Market turbulence continues as recession worries persist

It was hard to avoid seeing what happened last week as the recent decline in equity markets continued. Markets took a huge hit on Monday, with the volatility index (VIX) spiking before settling in the mid-20s. That’s a stunning number, considering the VIX was hovering around 12 less than a month ago.

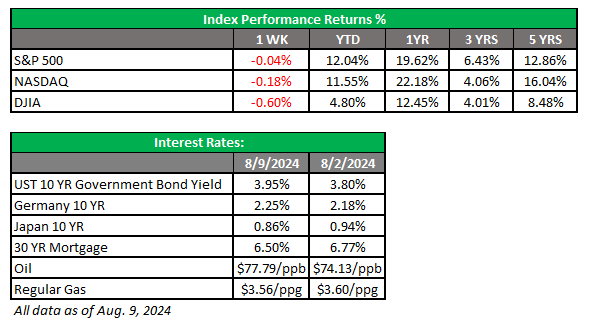

Monday was an outright panic and a classic example of a rout after losing nearly 900 points in the first two days of August headed into the weekend prior. The Dow dropped over 1,000 points (-2.6%) after being down more than 1,200 at one point in the day, while the S&P 500 lost 3% and the Nasdaq was down 3.43%.

What drove the mayhem? Primarily, it seemed to be concerns that the economy was sliding into recession. Surprisingly weaker-than-expected jobs numbers and manufacturing reports the week prior triggered recessionary concerns overseas as well, especially in Japan. The Nikkei 225 fell 12.4%, its worst one-day loss since Black Monday in October 1987.

The pall of an escalating conflict in the Middle East added to the tension. A Hezbollah rocket attack killed Israeli children at a soccer match, which prompted Israel to assassinate several high-level Hamas and Hezbollah officials, one of which was killed in Iran. Potential retaliation from Iran plus concerns about Israel’s response and potential impact on world energy markets and economies weighed heavy on markets.

Closer to home, the recent shake-up in the U.S. presidential race has also affected markets. When it appeared that former President Donald Trump would win against current President Joe Biden, markets focused on what some call the “Trump trade,” which included sectors like energy and defense. The other major beneficiaries of the Trump trade would be smaller companies that would fare better from less regulation and lower taxes. This phenomenon was fueling a rotation trade where profits from high-flying tech stocks were plowed back into smaller companies, with the rest of the market finally beginning to participate after being asleep for the first half of the year. But uncertainty crept back in last week when polls showed Vice President Kamala Harris had wiped out Trump’s lead.

When you sit and contemplate all the negative factors weighing on markets, it’s somewhat surprising that last Monday wasn’t worse. Markets rebounded slightly on Tuesday, but after a promising start on Wednesday, we couldn’t maintain the momentum and gave up all gains to end around where we were on Monday. Thursday was odd (in a good way), as it only took weekly unemployment claims to come in slightly under expectations to send markets roaring upward. It’s extremely unusual to see a weekly unemployment claims report have that kind of effect on markets. It just shows how hypersensitive the markets were last week and how fragile the most recent three-month run-up has been.

We are back to where we were in early June, and unless we have a sustained uptick of bad news, the market will resume moving forward, albeit in a more volatile fashion.

Late to the game — the Fed’s current dilemma

Much has been said about whether the Federal Reserve should have cut rates at its July meeting. Some argued that a cut of 25 basis points (0.25%) would have been a symbolic gesture to show rate cuts were finally here. A cut from 5.25% to 5.00% would not have been economy-altering, but it would have shown the Fed was selecting a path and pre-positioning itself for things to come.

A July rate cut also would have reassured markets. After all, with all the combined brainpower and intellect, we would expect the Fed to be ahead of the curve and forward-thinking. Yet like in so many other parts of our economy, government and society, the term “expert” seemed to ring hollow these days. But keep in mind that this was the same Fed that said inflation was “transitory,” the same Fed that seemingly waited too long to begin raising rates to combat the transitory inflation that turned out not to be transitory, the same Fed that raised rates at the quickest pace in history and the same Fed that has kept rates higher for an extended period. Why did the markets all of a sudden expect that pattern to be altered?

The consumer price index (CPI) hit 3.0% in June of 2023 and has been floating between 3.0% and 3.7% since then. The Fed last raised rates in July 2023, and we were told that it takes six months to a year for Fed actions to be felt. A 5.25% fed funds rate for a year seems to have done nothing to inflation but has done a number on the economy to the point where the markets were spooked that we were on the verge of recession.

We have frequently said the final 1% decline in the rate of inflation to the 2% the Fed would like to see would either require another bout of rate hikes or keeping rates where they are for too long, and both options could result in a nasty recession. Hopefully, we see CPI below 3% this week, and that might finally be the signal for the Fed to cut. The market rebound late last week gave the Fed a breather for now by not forcing them into making an emergency cut and probably adding to the panic. I expect further volatility in the months ahead, but I can also see the market fully recovering and posting new highs by year-end. However, the Fed needs to finally act and act soon.

Coming this week

- Last week was hard on the nerves but pretty light in the way of data. This week promises to be more eventful.

- We’ll be looking at July inflation data this week. On Tuesday, we’ll get the producer price index (PPI) and core PPI. If we see a decline, markets will likely rally because it will make a rate cut in September even more certain.

- We’ll get the second half of the July inflation story on Wednesday. CPI is arguably more widely followed, so CPI and core CPI will set the table for market performance, but it would be nice if PPI behaves the day prior. If we break below 3.0%, it may be just the ticket to get the Fed to declare some sort of victory over inflation and move in September.

- Other data released this week will probably be overshadowed by inflation readings but can magnify the market’s reaction in either direction. We’ll see MBA mortgage applications, weekly unemployment claims, retail sales, and the New York and Philly Fed manufacturing survey. We’ll close out the week with consumer confidence on Friday.

- Earnings will continue all week. With 75% of the S&P 500 reporting results as of August 2, 78% of companies reported positive earnings per share (EPS) and 59% reported positive revenue. Earnings growth for the second quarter for the S&P 500 is 11.5%, the highest since the fourth quarter of 2021.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

8/24 – 3757920-2