AEWM Wealth Report – Not Your Parents’ Retirement

Download PDF Version

Fewer companies are offering pensions. The future of Social Security is unclear. As a result, Americans who are approaching retirement seem to be seeking alternative options for creating guaranteed retirement income and managing risk in their portfolios.

Overview

Retirement is having a heyday. Baby boomers (born between 1946 and 1964 and almost 72 million strong) are retiring in waves.1 Meanwhile, the oldest members of Generation X (born between 1965 and 1980) are beginning to contemplate their own post-work future — and their expectations for retirement are much different from generations before.

A new study from the Insured Retirement Institute (IRI) reveals how retirement expectations are changing from generation to generation. The study examined those who are already receiving Social Security retirement benefits — a mix of members of the Silent Generation (born between 1925 and 1945) and baby boomers — and Gen Xers who will start to become eligible for benefits in 2027.2

Read on to discover how retirement expectations are changing and how these expectations are impacting how pre-retirees invest for retirement.

Study Findings

Finding #1: Pre-retirees are less confident that guaranteed retirement income will be available throughout their later years.

Working boomers and Gen Xers can’t count on retirement income from guaranteed sources (such as pensions and Social Security) like earlier generations did. While 61% of current retirees said a private or public pension will provide income in retirement, only 37% of Gen Xers said the same.

Pre-retirees also expressed a lack of confidence that Social Security benefits will be available when they retire. While 93% of current retirees said Social Security will serve as a primary source of income in their later years, the number dipped to 88% among working baby boomers. And it dropped significantly for Gen Xers, with only 68% expressing confidence that Social Security will still be available when they retire.

Source : Insured Retirement Institute. “Evolving Retirement Expectations Among American Workers and Retirees.”

Finding #2: Pre-retirees have a gap between expected income and expenses in retirement.

Gen X fully expects they’ll need more money in retirement, especially as prices rise and people live longer. But there’s a gap between how much pre-retirees have saved and how much income they expect to need, especially with the prospect of reduced Social Security benefits and declining pensions.

The study found that working boomers average $652,780 in retirement savings, while Gen Xers have saved around $400,000.

Source: Insured Retirement Institute. “Evolving Retirement Expectations Among American Workers and Retirees.”

Finding #3: Pre-retirees have lower expectations that retirement savings will last as long as they need.

The gap in savings has decreased pre-retirees’ confidence that they’ll have enough money to last until age 85 or beyond. While 45% of working baby boomers said they think their retirement income will last, only 32% of Gen Xers said the same.

Source: Insured Retirement Institute. “Evolving Retirement Expectations Among American Workers and Retirees.”

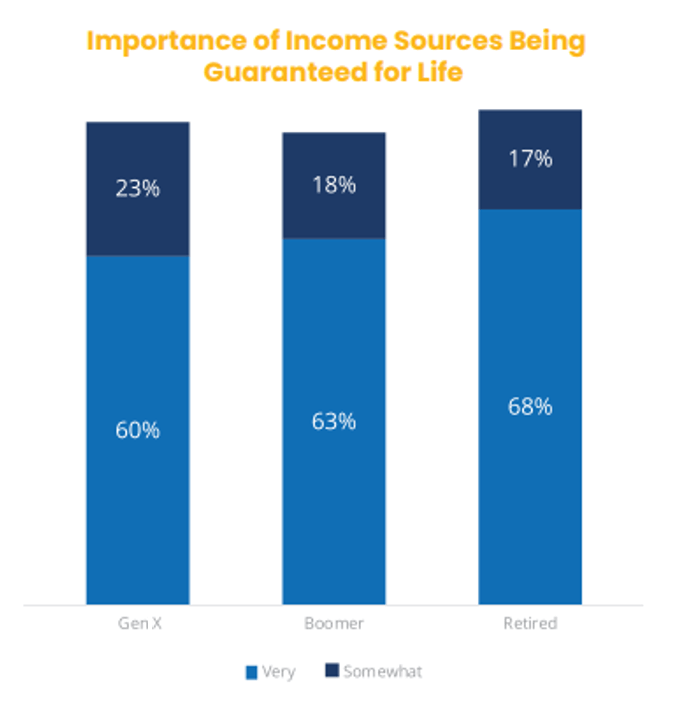

Finding #4: Gen Xers, working baby boomers and current retirees are all interested in investment options that offer downside protection and lifetime income.

What does all this mean? Both pre-retirees and retirees alike are interested in finding and implementing investment options that can help provide guaranteed income throughout their later years. This was very or somewhat important to 83% of Gen Xers, especially given their reduced access to pensions and lack of faith in the future of Social Security.

Source: Insured Retirement Institute. “Evolving Retirement Expectations Among American Workers and Retirees.”

Options for Creating Guaranteed Income in Retirement

So how can current workers of all generations build guaranteed retirement income? The study looked at how pre-retirees are increasingly turning to a defined contribution plan — such as a 401(k) or IRA — as their primary retirement savings vehicle. And more of them are looking for expanded investing options within their defined contribution plans to help manage risk and generate retirement income. These options include:

- Target date funds

- Registered index-linked annuities (RILAs)

- Fixed indexed annuities (FIAs)

- Fixed annuities (FAs)

- Variable annuities (VA) with guaranteed lifetime withdrawal benefit (GLWB)

In addition, Gen Xers were much more likely than working baby boomers or current retirees to look for environmental, social and governance (ESG) investing options in their defined contribution plan. The study revealed that 57% of Gen Xers said they preferred ESG funds to be included in their plan, compared to only 36% of individuals who have already retired.3

Final Thoughts

Of course, not every defined contribution plan includes these options for participants. And not every pre-retiree has access to a plan. Fortunately, individuals have access to and can take advantage of these investment types outside of a defined contribution plan. For example, an individual can add a standalone fixed annuity or variable annuity to their portfolio and use it to generate guaranteed income in retirement.

But how do you know which options might be a fit for your portfolio? It all depends on your future goals and income needs. If you’re concerned about outliving your savings, we recommend scheduling a consultation with your financial advisor to review potential strategies, even if you’ve already entered retirement. They can help you explore your range of options and get you back on the path toward a confident retirement.

Sources

1 Investopedia. July 25, 2023. “Baby Boomer: Definition, Age Range, Characteristics, and Impact.” https://www.investopedia.com/terms/b/baby_boomer.asp. Accessed Aug. 9, 2023.

2,3 Insured Retirement Institute. July 7, 2023. “Evolving Retirement Expectations Among American Workers and Retirees.” https://www.irionline.org/research/article/evolving-retirement-expectations-among-american-workers-and-retirees/. Accessed Aug. 9, 2023.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

8/23-3052652