AEWM Wealth Report – Stagflation Nation

Download PDF Version

Stagflation Nation

Ongoing elevated inflation plus slow economic growth could lead to prolonged “stagflation” in the U.S.

Overview

Stagflation. It’s a funny word, but there’s really nothing funny about it. The mashup of “stagnant and inflation” is used to denote a period of slow economic growth combined with elevated inflation — a scenario that could be used to describe the current situation in the U.S.

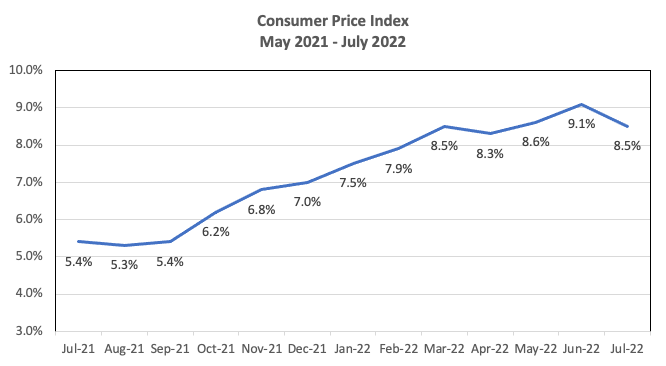

The Consumer Price Index (CPI), a core metric for measuring inflation, began rising in earnest in May 2021, as the U.S. regained its footing more than one year into the coronavirus pandemic. The Federal Reserve initially shrugged off rising inflation as “transitory,” holding to the position that it would naturally correct itself as the economy got back on track.1

Unfortunately, that never happened. Instead, CPI has remained stuck at high levels over the past year, up 9.1% over the 12 months ended June 2022 before dipping slightly to 8.5% in July.2,3 In the same period, economic growth slowed dramatically, with the U.S. Gross Domestic Product (GDP) contracting by 1.6% in the first quarter of 2022 and 0.6% in the second quarter.4

Source: U.S. Bureau of Labor Statistics. “12-month percentage change, Consumer Price Index, selected categories.” https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm. Accessed Sept. 7, 2022.

After watching inflation climb and economic growth shrink, the Fed finally changed its position and began raising interest rates in an effort to bring inflation back down. They embarked upon a series of increases, taking the fed funds rate from 0% to 2.25%-2.5% by July 2022.5 So far, however, rising interest rates have had seemingly little effect on inflation, which remains stubbornly high.

Compounding Factors

While the Fed’s reluctance to raise rates fueled the current stagflationary environment, other factors also contributed to the current situation. The Russia-Ukraine war and ongoing lockdowns in China have created additional bottlenecks in an already snarled supply chain. The resulting supply shortage and increased demand, plus rising labor wages, have pushed the cost of goods upward for both consumers and producers alike.

Still, the Fed is tasked with curbing inflation and spurring economic growth — a task it has not accomplished in 2022. And the U.S. government isn’t helping: New legislative spending bills and executive orders continue to dump fuel on the inflationary fire.

What Lies Ahead

The Fed remains committed to its course of raising interest rates until inflation starts to come back down. Markets are bracing themselves for another potential hike of 75 basis points (.75%) at the Fed’s next meeting on Sept. 20.6 But will it be enough to break the U.S. out of the current cycle of stagflation?

In our view, the answer is no. Until the government stops its excessive spending, reduces regulatory barriers and lowers the burden on businesses, growth could be slow to nonexistent. For its part, we believe the Fed needs to aggressively raise rates to stem inflation as quickly as possible. Unfortunately, a swift interest rate increase could push the U.S. into a recession — but it could beat the alternative of entering into a state of chronic stagflation for years to come.

Final Thoughts

What does a prolonged period of stagflation mean for investors? Uncertainty about how much the Fed will increase interest rates leaves markets skittish, creating uncertainty and volatility. Investors would be well served to reconsider their appetite for risk, rebalancing portfolios as needed to guard against potential market drops.

Some investors might also consider adding investment options that tend to perform well in periods of stagflation. For example, real estate, value stocks and commodities historically have fared better than other assets.7 But not every asset type is right for every investor — and how much risk you’re willing and able to take is personal to you. We recommend meeting with your financial advisor to review your portfolio and make sure you’re well positioned to ride out the effects of stagflation over the next few months.

SOURCES

1 Howard Schneider and Ann Saphir. Reuters. Aug. 27, 2021. “Fed’s Powell holds fast to ‘this year’ timeline for bond-buying taper.” https://www.reuters.com/business/feds-powell-weighs-delta-risk-gives-no-signal-start-bond-buying-taper-2021-08-27/. Accessed Sept. 7, 2022.

2 Bureau of Labor Statistics. July 18, 2022. “Consumer prices up 9.1 percent over the year ended June 2022, largest increase in 40 years.” https://www.bls.gov/opub/ted/2022/consumer-prices-up-9-1-percent-over-the-year-ended-june-2022-largest-increase-in-40-years.htm#:~:text=Consumer%20prices%20up%209.1%20percent,U.S.%20Bureau%20of%20Labor%20Statistics&text=The%20.,government%20websites%20often%20end%20in%20. Accessed Sept. 7, 2022.

3 Bureau of Labor Statistics. Aug. 15, 2022. “Consumer Price Index unchanged over the month, up 8.5 percent over the year, in July 2022.” https://www.bls.gov/opub/ted/2022/consumer-price-index-unchanged-over-the-month-up-8-5-percent-over-the-year-in-july-2022.htm. Accessed Sept. 7, 2022.

4 Bureau of Economic Analysis. Aug. 25, 2022. “Gross Domestic Product.” https://www.bea.gov/data/gdp/gross-domestic-product#:~:text=Gross%20Domestic%20Product%20(Second%20Estimate,(Preliminary)%2C%20Second%20Quarter%202022&text=Real%20gross%20domestic%20product%20(GDP,percent%20in%20the%20first%20quarter. Accessed Sept. 7, 2022.

5 Jeff Cox. CNBC. July 27, 2022. “Fed hikes interest rates by 0.75 percentage point for second consecutive time to fight inflation.” https://www.cnbc.com/2022/07/27/fed-decision-july-2022-.html. Accessed Sept. 7, 2022.

6 Jeff Cox. CNBC. Sept. 7, 2022. “Market bracing for another three-quarter point hike from the Fed this month.” https://www.cnbc.com/2022/09/07/market-bracing-for-another-three-quarter-point-hike-from-the-fed-this-month.html. Accessed Sept. 7, 2022.

7 Rebecca Lake. Yahoo! Aug. 10, 2022. “Should You Invest During Stagflation?” https://www.yahoo.com/video/invest-during-stagflation-120000335.html. Accessed Sept. 7, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

9/22-2414179