AE Wealth Management: True Asset Diversification | Blog

ARE YOU SURE YOUR ASSETS ARE DIVERSIFIED?

Download PDF Version Here

Evaluate your diversification strategy across all of your investment accounts to ensure that many of your holdings do not overlap — which may negate the benefits of diversifying.

Overview

The theory of diversification is that by spreading out invested assets among a wide variety of holdings, an investor can help reduce the chances of losing money when some of those investments drop in value. Not only can diversifying help manage risk, but it offers the opportunity for growth even when other portions of the portfolio decline.

However, someone who invests in mutual funds or exchange traded funds (ETFs) may not be as diversified as he or she thinks. For example, the top five companies held by the SPDR S&P 500 ETF Trust fund account for more than one-fifth (21%) of that portfolio.1 Those individual holdings are:

• Apple

• Microsoft

• Amazon

• Facebook

• Alphabet (Google’s parent organization)

Furthermore, let’s say that same investor diversified even further by investing in a Nasdaq-100 Index-based fund, which includes high allocations to the technology, consumer services and health care industries.2 The investor may be surprised to find that the top five holdings in that fund compose 41% of the portfolio, and 11% is represented by Apple alone.3

Diversification helps manage risk by reducing exposure to a single company, asset class or industry. It’s important to invest in an appropriate balance among stocks, bonds and short-term investments to create a diversified portfolio. In addition to various asset classes, also consider diversifying across securities by:

• Market capitalization (e.g., small, mid, large cap)

• Sectors and industries

• Regions

• Investment styles (e.g., growth, value)

• Credit qualities

• Types of issuers (e.g., U.S., international, government, corporate)

Diversification is a strategy designed to help maximize opportunities through wider exposure while minimizing the risk of losing money. However, be aware that it cannot assure a profit or protect against losses in a declining market.

Unintended Overlap

You may not only have substantial overlap among stock and bond mutual funds, but also consider how much of your net worth is invested in your employer. For example, say you work for Google and part of your compensation is paid through company stock options. Then consider how much of Google stock may be included in your 401(k) investments and any other types of investments you hold — such as a mutual fund, ETF or index annuity aligned with the S&P 500. Then imagine the overlap that may exist if both you and your spouse work for Google.

A general rule of thumb is to hold no more than 10% of your portfolio in any particular industry or company. There are tools available that enable investors to analyze their portfolios for overexposure to a variety of investment components, such as a specific company, sector, region, investment style or asset category (e.g., large or small cap stocks, domestic stocks, international securities and Treasury bonds).4

Asset Allocation and Risk Tolerance

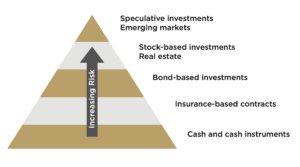

Asset allocation is the strategic decision to invest a specific percentage of your money in various asset categories, such as stocks, bonds and cash instruments. The percentages allocated should take into account your financial goals, your timeline for needing the money and your tolerance for risk. Among the risks involved, consider not only the risk of market loss but also the risk of rising long-term inflation, the risk of retiring during a market decline and the risk of running out of money late in retirement. Remember, failing to meet long-term goals could be due to investing too conservatively.

“Exposure to different areas of the economy can help increase your portfolio’s level of diversification.”5

Household Portfolio

Diversification is important across all investments, including employer-sponsored plans, IRAs and stock portfolios. But also remember the issues related to unintended overlap. With that in mind, be sure to consider potential overlap among separate investments held by spouses. After all, if you are planning a future together, the sum of all those various parts will culminate in your retirement portfolio. If there is significant overlap, then you may not be appropriately diversified. If those overlapping securities decline close to retirement, it could affect your long-term retirement income.

Together, a couple should not only identify their shared, long-term financial goals but also how they will be best achieved — right down to the individual holdings in all of their investments. It is also important to consider the timeline for reaching your goals because a diversified portfolio should also take into account when you need the money. When it comes to lifelong planning, it may be better to tap some types of investments first and other ones later. This plan should include strategies to help make the most of your Social Security and pension benefits as a couple.

Investment Timelines

Among the average couple who reaches age 65, there is a 50% chance that at least one spouse will live to age 92.6 Therefore, planning for retirement means making sure your money lasts as long as the longest living spouse. There are various strategies to consider, such as whether to tap taxable (e.g., brokerage portfolio), tax-deferred (e.g., traditional IRA, employer-sponsored retirement plans) or tax-free (e.g., Roth IRA) accounts first. These are decisions best made in consultation among both spouses and a trusted financial advisor as they relate to specific goals and planned retirement timelines.

Tax Diversification

Many retirement investment accounts provide tax-deferred earnings to help investors accumulate wealth without the burden of annual taxes on interest, dividends or realized capital gains. They also can offer a tax break on current income. Because of these tax advantages, it may be tempting to maximize contributions to an employer’s retirement plan and contribute extra savings to a traditional IRA. However, this strategy will likely increase tax liabilities during retirement.

While taking advantage of qualified plans is a good idea, there are benefits to spreading out your savings among tax-deferred and taxable accounts. This strategy provides withdrawal flexibility during retirement and can help manage your tax liability. For example, in addition to maxing out an employer plan, consider placing additional assets in a Roth IRA instead of a traditional IRA. A Roth does not offer an immediate income tax deduction, but earnings grow tax- free and can be withdrawn tax-free once the account is at least five years old. Plus, you have the option to withdraw contributions at any time, which means the Roth can serve double duty as an emergency savings account as well.7

Asset Location

A key factor of tax diversification is to invest in well-matched holdings for each type of account. For example, securities that generate significant ordinary income or pay out qualified dividends may be better suited for tax-deferred accounts. This includes high- yielding taxable bonds, bond funds and real estate investment trusts.

Equities that have high growth potential over the long-term may be good candidates for a Roth IRA, since earnings grow tax-free. A Roth is also a good vehicle for short-term trades, as they typically avoid short-term capital gains taxes.

In contrast, investments that are tax-efficient or inherently tax- advantaged, such as municipal bonds, can be a good option for a taxable account. Stocks held longer than a year currently receive a lower capital gains tax rate compared to short-term gains or ordinary income, so they also may be appropriate for taxable accounts.8

Final Thoughts

While spreading out investments across a wide selection of securities offers the benefits of diversification, recognize that this is not a one- time event. You should monitor the progress of all of your investments to ensure they stay on track to meet your goals. Note that prolonged outperformance (or underperformance) can throw a strategic asset allocation plan out of whack. Ensure that your mix of asset class percentages stays aligned with your tolerance for risk and any changes in your future needs.

Plan to meet with your financial professional to periodically review and rebalance your asset allocation. Remember, don’t just monitor each account individually, but view all accounts in your household as a single portfolio — including your employer-sponsored retirement plans. This can help ensure you maintain appropriate diversification for your overall household portfolio without unintended overlap.

1 Philip van Doorn. MSN. April 3, 2021. “How investors can tap into ‘industrial revolutions’ in countries including China and India.” https://www.msn.com/en-us/money/savingandinvesting/how-investors-can-tap-into-industrial-revolutions-in-countries-including-china-and-india/ar-BB1feLZN. Accessed Aug. 2, 2021.

2 Nasdaq. June 4, 2021. “When Performance Matters: Nasdaq-100 vs. S&P 500, First Quarter ’21. https://www.nasdaq.com/articles/when-performance-matters%3A-nasdaq-100-vs.-sp-500-first-quarter-21-2021-06-04. Accessed Aug. 2, 2021.

3 Philip van Doorn. MSN. April 3, 2021. “How investors can tap into ‘industrial revolutions’ in countries including China and India.” https://www.msn.com/en-us/money/savingandinvesting/how-investors-can-tap-into-industrial-revolutions-in-countries-including-china-and-india/ar-BB1feLZN. Accessed Aug. 2, 2021.

4 T. Rowe Price. June 15, 2021. “How to Make Your Household Financially Diversified.” https://www.troweprice.com/personal-investing/resources/insights/how-to-make-household-financially-diversified.html. Accessed Aug. 2, 2021.

5 Ibid.

6 Ibid.

7 T. Rowe Price. June 7, 2021. “How to Make the Most of Your Savings Using a Tax-Efficient Approach.” https://www.troweprice.com/personal-investing/resources/insights/how-to-make-most-of-your-savings-using-tax-effficient-approach.html. Accessed Aug. 2, 2021.

8 Ibid.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/. 8/21 – 1747939 For financial professional use only.