AE Wealth Management: Stereotypical Investor Mistakes | Blog

Beware of Stereotypical Investor Mistakes

The Wealth Report by AE Wealth Management

Download PDF Version Here

Learn to recognize common investor blunders to avoid them in the future.

Overview

The first quarter of 2022 has brought more turbulence to the financial markets. On the heels of the omicron outbreak, inflation continued to surge and Russia invaded Ukraine. Within this landscape, stock prices plunged across many sectors while aggregate commodity indices (e.g., energy, metals, agriculture) increased. Moreover, volatility may continue as the Federal Reserve contemplates interest rate hikes throughout the rest of this year.1

Even experienced investors cannot predict which way markets will turn under these conditions. But imagine if you’re a new investor, of which there are many. The pandemic introduced a whole new demographic of investors, which currently represent 15% of all U.S. stock market participants. Charles Schwab has dubbed this the “Investor Generation,” composed of consumers who began to dabble in investing after the stock market crash in 2020. They took advantage of the market dip while under lockdown, followed by months of gainful employment working from home. From then on, performance was mainly up.2

That is, until February of this year. For many investors, both new and seasoned, market downturns can give way to irrational thinking and fear-driven mistakes that could negatively impact long-term goals. Learn the typical mistakes investors make during a market decline.

Panic Sellers

The desperate feeling of seeing long-term gains freefall in your portfolio can lead to panic selling. Instead of buying low and selling high, these investors sell when prices are dropping in order to cut their losses. Unfortunately, selling at the wrong time can lock in losses, and the inability to buy back into the market at the right time means investors can lose out on gains while they sit on the sidelines.

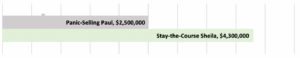

Take, for example, the case of Sheila and Paul, each of whom invested $5,000 a year from 1980 until the end of February 2022. By staying fully invested, Sheila achieved a 12% annual return and accumulated $4.3 million. Paul, on the other hand, sold after each market downturn and ended up missing out on two consecutive years of positive returns. He still earned an average 10% annual return but accumulated only $2.5 million.3

Sideliners

The worst part of panic selling is when an investor goes to cash and then stays there. Many times when the market rebounds, it does so quickly, with the most robust advances early on in the recovery. The investor who waits, worried about whether another decline will follow, may miss out on those early gains. In fact, some investors may want to jump back into a rising market but keep waiting for another dip to do so. Meanwhile, they lose out on potential gains.

Let’s say you panic sell but worry about the damage to your portfolio by staying on the sidelines. One tactic you can deploy is to dollar cost average the money you took out back into your portfolio. In other words, invest a certain percentage of that pot of money at regular intervals, like each month. The market may still be declining, but this way you can take advantage of those lower prices. You don’t risk a large portion of assets all at once, but you can work your way back into your previous position so that when the market recovers, you enjoy those gains.4

Note that dollar cost averaging doesn’t ensure you’ll make a profit nor can it protect your portfolio against losses in declining markets. To be effective, it requires continuous investing regardless of fluctuating prices, so you should consider your ability to keep investing even when the market is volatile.

“Individual investors who ‘sell high’ and go to cash waiting for a market downturn to come and go often lose patience as stocks continue to go up. This results in their missing out on gains rather than preventing losses.”5

Anchors

Anchors buy stocks based on a preconceived notion of their value. For example, if all you know about a stock is its price today, you might assume how much it will grow over the next year. What you may not know is how much or why it grew, or declined, over the past year — along with a plethora of other factors that can help determine future performance. In other words, you become biased by a certain piece of information, and you “anchor” your investment decisions based on that original assumption.

Here’s an example for clarity. Let’s say you go shopping and see a pair of shoes you like for $200. Then you see a pair you like for $100. An anchoring bias means you may view the second pair as being of lesser quality. However, if you’d seen the $100 shoes first, you might view them as a good value and the subsequent $200 pair as overpriced.

It’s important to understand the anchoring bias because we often adopt it without even knowing it. As an investor, you should work with an advisor who will help you vet many underlying fundamentals to gauge both future performance of holdings and whether they are well suited for your investment strategy and goals.6

Clingers

Some investors cling to stocks that are losing ground when, in fact, selling in a declining market could be a prudent tactic for them. The two key factors to consider are the long-term prospects of that stock or sector and the potential upside of harvesting a loss to improve long-term tax efficiency.

For example, if holdings in a taxable investment account are declining and not well positioned for longer-term gains (e.g., coal stocks), you may want to harvest those losses in order to offset future gains from stocks that are rising — and are better positioned for the current environment.7

Timers

Trying to time when to sell and when to buy based on daily market fluctuations is generally ill-advised. Moreover, doing so in a taxable portfolio could generate substantial transaction costs and capital gains taxes that make the effort more expensive than just staying on course. In fact, before you open any type of investment account, be sure you understand how trading, broker, management, advisory and commission fees will affect your portfolio’s total return.

Lookie-Loos

Sometimes traffic gets backed up on the highway in the opposite lanes from where a wreck occurred. It is human nature to stare in horror at something bad that has just happened. Unfortunately, this occurs among investors as well. Watching the stock portion of a portfolio sink during a market decline may leave you feeling helpless and stuck. However, long-term price shifts — whether upward or downward — can impact your portfolio’s asset allocation.

Lookie-Loos may decide to forgo their periodic portfolio rebalance because they can’t stand the idea of turning paper losses into actual losses. But the market doesn’t usually move in tandem. When stocks drop, bonds may rally — and vice versa. By rebalancing on a regular basis, you can redeploy your investment dollars to take advantage of current market opportunities. It also takes the emotion out of investing. Rebalancing losses can restore your asset allocation strategy and tends to improve risk-adjusted returns over time.8

Final Thoughts

If you don’t have an immediate need for the money you’ve invested, it is generally a good idea to give the market time to recover. After all, most people don’t get divorced after their first argument. You learn to adapt to the market’s natural ups and downs, develop your personal tolerance level for volatility and stay focused on the long-term rewards.

Taking the long view, historical performance has shown over and over again that the stock market will recover — and grow. If you find the volatility is more than you can stomach, speak with a financial professional about ways to diversify your holdings for a more balanced approach to long-term growth. You also may want to consider incorporating annuities and other insurance vehicles that offer insurer-backed guarantees for income during retirement.

Investing can be stressful at times, but it is one of the best ways to achieve wealth over the long term. Learning what investment behaviors are common — but detrimental — is a good way to avoid them in the future.

1 Lisa Shalett. Morgan Stanley. March 8, 2022. “Why the US Economy May Fare Better Than the Market.” https://www.morganstanley.com/ideas/ukraine-fed-tightening-economic-growth-2022. Accessed March 14, 2022.

2 Elizabeth Gravier. CNBC. June 22, 2021. “Here are the 7 biggest investing mistakes you want to avoid, according to financial experts.” https://www.cnbc.com/select/biggest-investing-mistakes/. Accessed March 14, 2022.

3,4 Dan Hunt. Morgan Stanley. March 14, 2022. “Top 5 Mistakes Investors Make in a Market Sell-Off.” https://www.morganstanley.com/articles/top-5-investor-mistakes. Accessed March 14, 2022.

5 Dan Hunt. Morgan Stanley. Dec. 2, 2021. “How To Handle Volatility.” https://www.morganstanley.com/articles/how-to-handle-volatility. Accessed March 14, 2022.

6,7,8 Dan Hunt. Morgan Stanley. March 14, 2022. “Top 5 Mistakes Investors Make in a Market Sell-Off.” https://www.morganstanley.com/articles/top-5-investor-mistakes. Accessed March 14, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

03/22-2074656