AE Wealth Management: Weekly Market Insights | 8/22-8/28/21

Big spending plans rammed through as Afghanistan unravels and gets deadly

The past few weeks have been rough on the public, specifically veterans, as we watched a deadly withdrawal from Afghanistan. As the country was transfixed by events overseas, House Speaker Nancy Pelosi recalled members of Congress from the summer break to vote on the infrastructure bill and $3.5 trillion spending package. Then Congress recessed until September.

The parallels of the infrastructure bill with the Afghanistan situation are apparent to me. Everyone agreed we needed to leave Afghanistan after 20 years of war, but the “how we get out” part was important. Likewise, everyone agrees we need to address infrastructure, but the what and how are important, too.

The massive $3.5 trillion spending bill also moved forward with the infrastructure bill. Although the bill hasn’t even been written yet, it continues down the path of the “let’s just do something now while we can and worry about the fallout later” mentality.

While it may be possible to simultaneously deal with issues on both the domestic and international fronts, here’s my take: We should really focus on resolving the Afghanistan mess before spending. How will all of these events impact markets in the future? It’s open to debate. In the interim, low interest rates and waves of cash will keep pouring into the markets as we see record close after record close. It’s going to be a challenge to forecast beyond the next three to six months, which I think will be pretty strong albeit with much more volatility. The scary part is all the unintended fallout from unprecedented borrowing and spending – not to mention a Taliban-controlled Afghanistan.

Experts miss on GDP estimates … again

The second reading of second-quarter GDP missed again. The initial reading was expected to be close to +9% and came in at +6.5%. Then the second reading was expected to climb as high as 7.3% – but only ticked up to +6.6%. Don’t get me wrong: 6.6% GDP growth is phenomenal and nothing to be ashamed of. But both the Q1 and Q2 numbers have been consistently lower than experts predicted. Given the amount of money being thrown around, their expectations continue to be higher than the actual experience.

Markets continue to drive upward despite mounting negative news

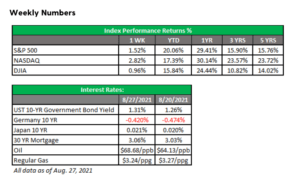

There seems to be no shortage of negative news out there, from 12 Marines and one Navy corpsman dead in a suicide bomb attack at Kabul airport and the ongoing mess in Afghanistan to the resignation of New York Governor Andrew Cuomo, higher gas prices, surging inflation and rising COVID cases due to the Delta variant. Despite the bad news, markets keep grinding higher. Last week the S&P 500 notched its 50th record close of 2021. Federal Reserve Chair Jerome Powell hinted that tapering would begin toward the end of this year, and markets still rallied into the weekend. There appears to be no end in sight to this rally, as long as Washington keeps spending and interest rates show no hint of moving up.

That said, September and October historically tend to be unkind to the equity markets. As we move deeper into hurricane season, there appears to be no shortage of financial storms that can potentially upset the current rosy market environment.

Coming this week

- The coming week will be slow with little data, but we may have some lingering hangover from the Fed’s meeting last week.

- Consumer confidence has been slipping. We’ll get a glimpse of just how bad it might be on Tuesday.

- It’s hard to believe that Friday is the start of the Labor Day weekend. Hopefully, Wall Street will be full-strength and back on the job after the holiday.

- With the upcoming month end, we’ll get the ADP employment report plus the Bureau of Labor Statistics (BLS) employment situation report, i.e., non-farm payrolls for August. The last two jobs reports have been really strong, and we need to see that continue to make sure the economy is on the right track.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The personal opinions expressed by Tom are his alone and may not be those of AE Wealth Management or the firm providing this report to you. The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product. 1744797-5