AEWM Wealth Report: How the Fed Funds Rate Impacts U.S. Consumers

Download PDF Version

Overview

After cutting interest rates three times in the last half of 2024, the Federal Reserve paused cuts in the first six months of 2025. Their reason for the pause: potentially inflationary tariffs and solid economic data.1

Throughout the pause, markets continued to keep a close eye on signs the Fed might be changing its stance and implementing cuts soon. Why is the market paying such close attention? Let’s look at what the federal funds rate is and how shifting the rate can directly impact markets and individual consumers.

Understanding the Federal Funds Rate

The Federal Reserve’s primary mandates are setting monetary policy and promoting stability of the financial system in the U.S.2 One of the ways it does this is by setting the federal funds rate — the target rate established by the Federal Open Market Committee (FOMC).

The Fed shifts the federal funds rate to help promote (or discourage) economic growth. Keeping rates low encourages borrowing, which spurs individual consumers and companies to spend more and results in an expanding economy. The inverse is also true; raising rates means fewer loans and less spending, eventually leading to a contracting economy.3

Where Rates Have Been — and Where They’re Going

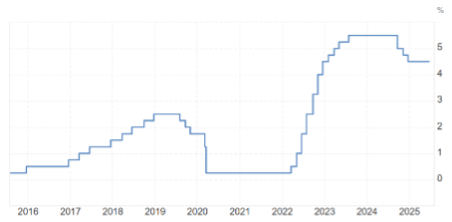

Although rates have stayed relatively low over the past decade, the rate was as high as 20% in the early 1980s.4 The Fed dropped rates to zero in March 2020, as the COVID-19 pandemic brought the U.S. economy to a halt. Rates hovered near zero for the better part of two years until the Fed increased them at its March 2022 meeting and continued to increase them over the next year and a half, eventually landing at 5.25-5.50%.

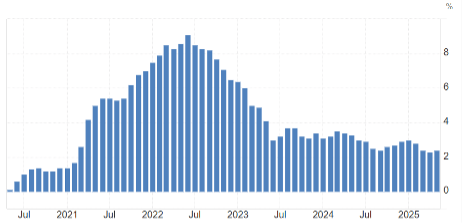

The Fed kept rates at that level until September 2024, when it embarked on a series of three cuts to lower the federal funds rate to 4.25-4.50%. The reason for the cuts? By that time, the year-over-year inflation rate — which had been as high as 9.1% in mid-2022 — had dropped significantly closer to the Fed’s target of 2%.5

Federal Funds Rate5

January 2016-June 2025

What does the federal funds rate have to do with inflation? Remember that low rates spur the economy — and higher rates slow it down. If the Fed raises rates, it will discourage more borrowing and consumers and companies will buy less, resulting in less liquidity and (hopefully) decreasing inflation.

One of the big challenges for the Fed is deciding when to move rates and by how much. If they wait too long to cut rates, the economy can lag. But cut too quickly, and inflation can rise once again. It’s a delicate balance, and the Fed weighs various factors when deciding whether to increase, decrease or keep rates the same during its eight annual meetings.

U.S. Inflation Rate6

January 2016-June 2025

The Impact of Interest Rates

Investors are directly impacted by interest rates in a number of ways:

- Stock market valuations: When rates rise, borrowing costs for businesses increase, which can reduce corporate profits and slow expansion plans. And as profits decline, stock prices often follow. But lower rates make it cheaper for companies to borrow, fueling growth and often supporting higher stock valuations.

- Bond prices and yields: Interest rates and bond prices move in opposite directions. When rates go up, newly issued bonds offer higher yields, which makes existing bonds with lower yields less attractive and pushes prices down. This dynamic is especially important for investors holding longer-term bonds, as they’re more sensitive to rate changes.

- Fixed income returns: Rising rates can mean better yields on cash, CDs and money market accounts, making them more attractive to conservative investors seeking income and capital preservation. But fixed income returns generally shrink when rates are low, often prompting investors to look elsewhere for higher yields.

- Real estate investments: Higher interest rates lead to more expense mortgages and financing costs, which can cool housing demand and put pressure on real estate values. In low-rate environments, cheaper financing can boost real estate activity and support higher property valuations.

- Consumer spending and economic growth: Just like corporations, individual borrowers also pay more when rates are high. This can cool consumer spending and have a ripple effect on businesses dependent on demand. On the flip side, lower rates encourage spending and investment, often spurring economic growth and lower unemployment rates.

Final Thoughts

From the returns you earn on your savings to the cost of your next car or home, understanding how rates work can help you make smarter financial decisions. Here are three key takeaways to keep in mind:

- Timing large purchases and loans can save (or cost) you money. Big financial decisions — like buying a house, financing a business expansion or taking out a personal loan — are closely tied to interest rates. Understanding the rate environment can help you decide when to lock in financing, potentially saving substantial amounts over time.

- Interest rates ripple through every part of your financial life. Rates impact how much a large purchase will actually cost, how much you’re charged for credit card purchases, and even how much you have to live on in retirement.

- Your investment strategy should adapt, not overreact. Markets can swing sharply with rate changes, but the most effective investors keep a long-term perspective. Rather than making drastic shifts when rates change, adjust your asset allocation thoughtfully. Staying diversified and disciplined helps you ride out short-term volatility while staying aligned with your goals.

SOURCES

1 Steve Kopack. NBC News. July 1, 2025. “Trump’s tariffs kept Fed from cutting rates, Jerome Powell says.” https://www.nbcnews.com/business/economy/trumps-tariffs-kept-fed-cutting-rates-jerome-powell-says-rcna216220. Accessed July 1, 2025.

2 Federal Reserve Bank of St. Louis. “The Fed and the Dual Mandate.” https://www.stlouisfed.org/in-plain-english/the-fed-and-the-dual-mandate. Accessed July 1, 2025.

3 James Chen. Investopedia. Jan. 27, 2025. “Federal Funds Rate: What It Is, How It’s Determined, and Why It’s Important.” https://www.investopedia.com/terms/f/federalfundsrate.asp. Accessed July 1, 2025.

4 Sarah Foster. Bankrate. May 7, 2025. “Fed’s interest rate history: The federal funds rate from 1981 to the present.” https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/. Accessed July 1, 2025.

5 Trading Economics. “United States Fed Funds Interest Rate.” https://tradingeconomics.com/united-states/interest-rate. Accessed July 1, 2025.

6 Trading Economics. “United States Inflation Rate.” https://tradingeconomics.com/united-states/inflation-cpi. Accessed July 1, 2025.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

8/25-4636446