AE Wealth Management: Weekly Market Insights | 1/29/23 – 2/4/23

Weekly Market Commentary

THE WEEK IN REVIEW: Jan. 29 – Feb. 4

Fed — and the economy — may be slowing, but jobs are still strong

The Federal Reserve met last week and raised rates by 25 basis points (0.25%), bringing the fed funds rate to 4.5-4.75%. In less than a year, we’ve gone from 0% to current levels. Now the Fed has slowed a bit, going from a 0.75% increase three meetings ago to 0.50% in December and 0.25% last week. It’s clear that inflation and wage pressures are declining, but Fed Chair Jerome Powell declared the job is still unfinished. He went on to say the disinflationary process has started, and if conditions deteriorate too much, the Fed will act.

Is it all talk? Smaller rate increases are closer to a pause than an acceleration of rate increases. In my view, tough talk costs you nothing — and with inflation coming down and real wages falling, continued job growth is the only fly in the ointment right now. The Fed’s next move is pretty obvious amid a constant drumbeat of layoffs, a slowing economy and ubiquitous talk of recession. We’re just now beginning to feel the impact of the Fed’s tightening from last year. The fed funds rate will likely get close to — but not over — 5%, but all the current negativity means we will probably see another 0.25% increase at the next meeting plus a clear signal of a pause.

How long we stay at these levels is another matter. If gas prices continue to rise, inflation will remain elevated and force the Fed to remain at these levels longer. The latest increase should be the next or next-to-last, barring any significant, unforeseen development. Chairman Powell’s recent comments were less hawkish than others he’s made recently, and the handwriting is on the wall: We’re pretty close to a new normal, but how long we remain there is anyone’s guess.

As mentioned, employment continues to be a thorn in the Fed’s side. The ADP report came in at +106,000 for January, which was less than half the 235,000 we saw in December (a welcomed signal). But the latest Bureau of Labor Statistics (BLS) employment situation report blew the doors off the consensus estimates of +187,000, coming in at +517,000, with unemployment staying low at 3.4%.

The Job Openings and Labor Turnover Survey (JOLTS) number for December came in at 11 million and has been over 10 million for nearly a year, despite all the high-profile layoffs. Just as in the jobs report, the largest increase in job openings on the JOLTS report was in hospitality and food services. I’m wondering if a recession will impact higher-paid workers more while lower-paying leisure, retail and food sectors will have jobs available for anyone who wants one. Will we see unemployment rise while openings remain elevated as higher-compensated workers collect unemployment benefits and lower-paying service jobs remain unfilled? This scenario can occur, and if the Fed is looking for job growth to weaken, it might be waiting for a while.

Markets keep chugging

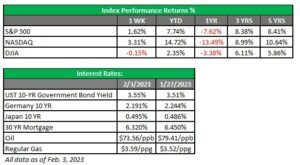

Markets had their best January since 2019, and the upward momentum has spilled into a strong start to February thanks to the dovish Fed last week. Earnings haven’t been as awful as expected, and there have even been some significant surprises to the upside. Overall, 29% of the companies in the S&P 500 had reported their fourth-quarter results as of the end of last week. Of these companies, 69% have reported actual earnings per share (EPS) above estimates, which is still below the five-year average of 77% and the 10-year average of 73%. In aggregate, companies are reporting earnings that are 1.5% above estimates.

We are back to the market trying to outthink and outmaneuver the Fed. Remember last August when Chairman Powell stopped the markets by stating that the Fed was nowhere near pausing? Last week he signaled we were closer to the end with rate hikes, and thanks to the resiliency of U.S. companies, we are at levels where we can actually have a strong year, barring any significant events.

But just as I say that, we should all keep in mind that something unforeseen can pop up at any time. For now, the S&P 500 is over 4,100 and headed up and should handle a significant event better than at a wobbly 3,100. This market and U.S. companies have scratched and clawed to stay in the game for a moment like this, and even though earnings are weaker than expected, they aren’t completely awful.

Coming this week

- This will be a pretty light week for data — a good thing following a week filled with the Fed decision, jobs data and high-profile earnings.

- We’ll hear from two Fed speakers this week: John Williams on Wednesday and Patrick Harker on Friday. Will their comments echo Powell’s?

- Other data this week includes consumer credit (Tuesday), wholesale inventories (Wednesday), unemployment claims (Thursday) and consumer sentiment (Friday).

- Additional fourth-quarter earnings reports will continue to come in this week.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

2/23 – 2722061-1