AE Wealth Management: Weekly Market Insights | 1/7/24 – 1/13/24

Weekly Market Commentary

THE WEEK IN REVIEW: January 7-13, 2024

Stocks improve while inflation numbers are mixed

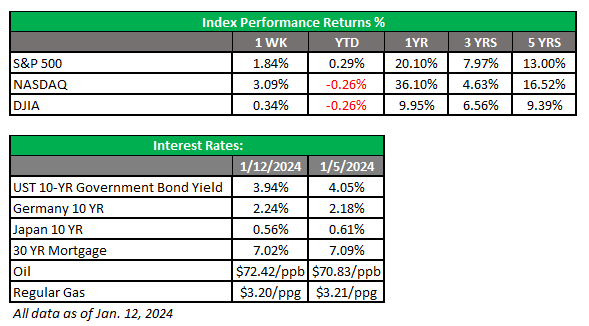

Stocks moved up in the first full week of trading in 2024. Several tech giants — including Facebook parent Meta and chipmaker NVIDIA — posted solid gains, even as the tech industry experienced layoffs at companies such as Discord, Audible, Google and Twitch.

The big data release last week was the latest Consumer Price Index (CPI) number, which showed inflation rose to 3.4% in December, up 0.3% from November. In total, core prices rose 3.9% in 2023. The slight increase caused stocks to waver on Thursday, but they rebounded a bit following the release of Producer Price Index (PPI) data. Wholesale prices ticked down another 0.1% in December, their third consecutive monthly decline. Declining producer prices were mostly due to lower costs for gasoline and food, suggesting inflation really is continuing to subside and that the Federal Reserve will stick to its plan to cut rates later this year.

Other data included fourth-quarter 2023 earnings from several companies, notably big banks such as JPMorgan Chase, Citigroup, Bank of America and Wells Fargo. The previously mentioned layoffs haven’t hit employment numbers yet, which were steady last week. The Labor Department reported on Thursday that 202,000 workers filed for unemployment benefits in the first week of the year, well below expectations and the lowest number in almost three months. Another 1.83 million workers filed continuing claims, the lowest level since October.

Fixed-income traders continue to be perplexed by inflation data, and the yield on the benchmark 10-year Treasury fell back below 4%. Here’s an interesting tidbit: The Federal Reserve Bank of New York’s use of reverse repurchase agreements dropped to its lowest level in 12 months last week. These “reverse repos” encourage banks to place money with the Fed, taking assets (and liquidity) from the banking system and cooling growth. This may suggest that the Fed’s program of quantitative tightening is beginning to slow and could come to an end soon.

SEC allows mainstream trading of bitcoin

Last Wednesday, the SEC approved the buying and selling of spot bitcoin exchange-traded funds (ETFs), a decision that many hailed as a “game-changer” for investors.

While the ETFs are available to mainstream investors, they aren’t for everyone. Spot bitcoin ETFs are a riskier investment due to their high volatility. There’s also no guarantee that investors will be able to sell shares quickly or at their desired price. The SEC noted, referring to these exchange-traded products (ETPs): “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

Coming this week

- It’s another short week for markets with Monday’s Martin Luther King Jr. Day holiday. We’ll see most of this week’s action on Wednesday, including the release of import prices, December retail sales, business inventories and industrial production numbers.

- The latest initial jobless claims will come out Thursday, along with housing starts and building permits.

- Friday will include more housing market data, as the latest existing home sales numbers are released. We’ll also see the latest consumer sentiment data, which is expected to remain unchanged from last month at 69.7.

- Several Fed committee members will be on the speaking circuit this week. Traders will be listening closely for signals of what the Fed plans to do with rates in the next few months.

At this time, AE Wealth Management does not allow the sale of bitcoin.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

01/24-3320609-3