AE Wealth Management: Weekly Market Insights | 10/29/23 – 11/4/23

Weekly Market Commentary

THE WEEK IN REVIEW: Oct. 29 – Nov. 4, 2023

Fed pauses and markets bounce back

The Federal Reserve paused again last week, holding rates steady at 5.25% to 5.50%. At his post-meeting press conference, Chair Jerome Powell didn’t really provide any direction other than the Fed will continue to depend on the data. He also left the potential of another rate increase in the future and didn’t hint at when the Fed might actually lower rates.

In some ways, the comments put markets on par with the Fed. Markets can react to data as soon as it’s available, but if the Fed is sitting back and reacting to the same data, it has lost the initiative. Long story short: The Fed seems to be done raising rates. We will likely have to deal with the current level of inflation and hope an economic downturn will bring inflation down the rest of the way.

If we have a recession during next year’s election cycle, pretty much every official up for reelection will put immense pressure on the Fed to lower rates and stimulate the economy. The other factor that works against the Fed raising rates (or keeping them higher for longer) is our immense national debt and budget deficits. Paying more money for interest on borrowed money isn’t a winning strategy.

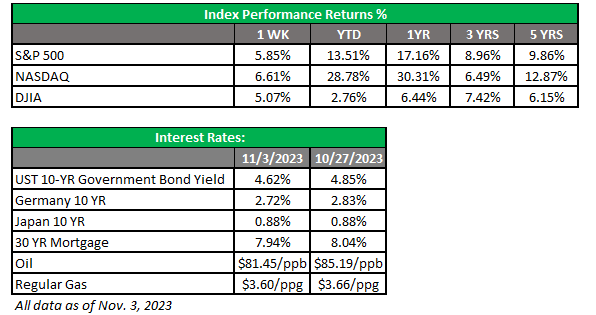

All that aside, markets enjoyed their best week of the year. Yields fell, Powell didn’t sound overly bullish, and the Israeli-Hamas conflict remained contained so far (more below). On the jobs front, the ADP employment number came in at +113,000, short of the consensus calling for +145,000. The actual reading has missed the consensus estimate to the downside since August.

Interestingly, the ADP and the Bureau of Labor Statistics (BLS), which have been polar opposites to one another the past few months, were both below estimates this time around. The BLS non-farms payroll came in at +150,000 versus a consensus of +179,000. The prior month was also revised downward from +336,000 to +297,000, a clear signal of a softening jobs market and exactly what markets wanted to see.

After giving up a fair bit of our annual gains, the S&P 500 fell to nearly 4,100 in October; last week we regained nearly 250 points, which put the index up 13.5% year-to-date. Rising yields, which had been beating equity markets steadily downward since August, have retreated significantly as bond markets fret over a weakening economy.

Middle East conflict not overly upsetting markets (so far)

A month after Hamas launched its terrorist attacks on Israel, U.S. markets continue to not expect a widening of the conflict and are moving forward after the Fed’s decision on rates. Despite belligerent talk from Iran and its proxies (Hezbollah, Islamic Jihad, Houthis, etc.), there hasn’t really been any escalation.

Israel held back initially from going into Gaza, but last week it started the slow process of finding and destroying Hamas. Iran predictably has done nothing but continue to make threats, which are followed up by attacks from their puppets in the region. The U.S. wisely so far has refused to escalate the conflict but has expressed a desire to strike back at anyone who attacks our forces in the region. Iran doesn’t want to confront the U.S. directly, because it wouldn’t go well for them, and we would probably destroy both their military and their oil production infrastructure.

Interestingly, the price of oil is currently below pre-conflict levels in early October. Iran (and Russia) would love to see higher prices for crude, but for that to happen, Iran would have to get involved directly. However, this wouldn’t actually benefit Iran because its oil facilities would be gone in no time, leaving it with no oil to export.

The markets have seemed to settle into the scenario that World War III is not imminent, the conflict will be contained regionally and world oil supplies will not be disrupted. The situation remains tense — but for now, the markets appear to be more focused on the Fed, earnings and the state of the economy.

Coming this week

- Now that the Fed has left rates alone and the jobs data has confirmed the economy is slowing and the smoking-hot gross domestic product (GDP) print from the prior week isn’t looking like the scary impetus for more rate hikes, it’s time to hear from regional Fed presidents. Jeffrey Schmid (Kansas City), John Williams (New York) and Lorie Logan (Dallas) will speak on Tuesday. On Wednesday, we’ll hear from Williams again. Then Raphael Bostic (Atlanta), Thomas Barkin (Richmond) and Kathleen O’Neill Paese (St. Louis) will provide comments on Thursday. Finally, Logan and Bostic will speak again on Friday.

- Why all the attention on the Fed speakers? With Powell basically telling us we’ll see how things go, it’s really important to listen to these Fed officials’ views on the direction of interest rates. Markets will be paying attention.

- Other areas of interest will include the consumer credit readout late Tuesday, especially as people are struggling with high credit balances and rates. We’ll also see MBA mortgage applications and wholesale inventories (Wednesday), the Fed balance sheet (Thursday) and consumer sentiment (Friday).

- Earnings will continue this week. Nearly half of the companies had reported by Oct. 27, with the majority reporting positive earnings per share.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

11/23-3214123