AE Wealth Management: Weekly Market Insights | 7/30/23 – 8/5/23

Weekly Market Commentary

THE WEEK IN REVIEW: July 30 – Aug. 5, 2023

Consequences

Fitch Ratings downgraded the United States’ long-term foreign-currency issuer default rating from AAA to AA+ last Tuesday, removing the “negative” rating watch and assigning a “stable outlook” label instead. (It’s like saying we were a shaky No. 1 but now a solid No. 2.) The downgrade is most likely a result of the most recent debt ceiling standoff and stopped the markets dead in their tracks.

The downgrade harkens back to 2011, which was the first time the U.S. federal government received a rating below AAA. Standard & Poor’s (S&P) had announced a “negative outlook” on the AAA rating in April 2011; then the 112th Congress voted to raise the debt ceiling through the Budget Control Act of 2011 in August. The downgrade to AA+ occurred four days later.

Not long after, the U.S. government commenced an investigation into S&P’s role in the rating of several mortgage-backed securities, which played a role in the 2008 financial crisis. In order to mend its relationship with the government, S&P asked its then-CEO to step down just 18 days after the U.S. was downgraded.

The 2011 downgrade was criticized by the U.S. Treasury Department, political figures on both sides of the aisle, many business leaders and economists. Absent any accountability, perhaps a little introspection would have been useful in avoiding a similar mistake in the future. Alas, we could only hope. It looks like August could be the official month for U.S. debt downgrades.

Fast forward to last week. Although the timing of this announcement was somewhat surprising, given the recent strength in U.S. economic data and the debt limit suspension, the action itself wasn’t entirely unexpected. Fitch’s rationale for the downgrade was likely based on the growing government debt burden, specifically the “erosion” of governance. They stated that “the repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

Fitch Ratings also highlighted the growing general government deficit, which they expect to rise significantly from 3.7% of gross domestic product (GDP) in 2022 to 6.3% of GDP in 2023. This downgrade leaves Moody’s as the only rating agency with a AAA rating for U.S. debt since the S&P rating has remained at AA+ since 2011.

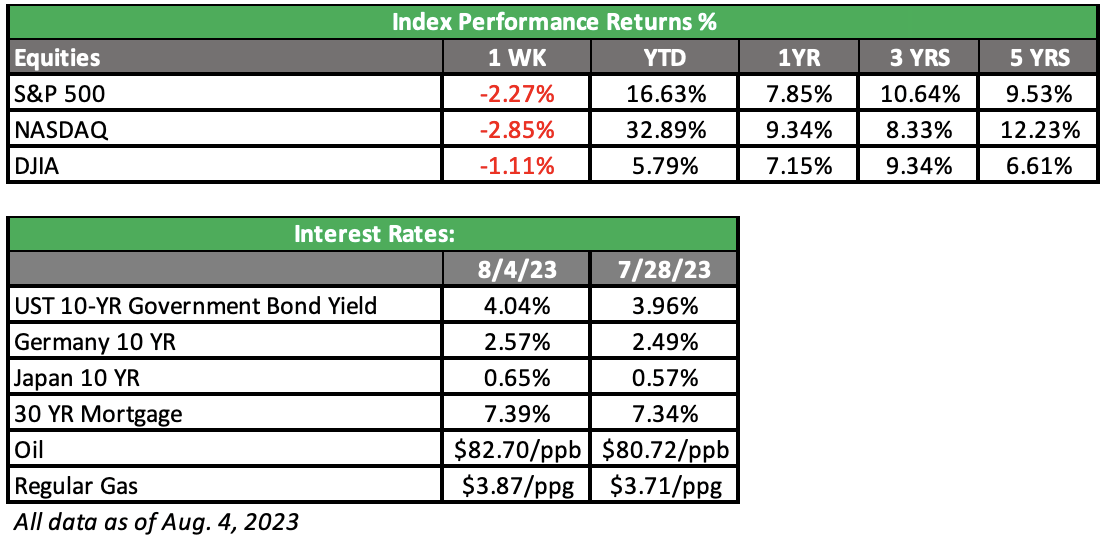

In our view, the downgrade is a consequence of the government’s constant bickering and brinkmanship. But after experiencing a couple of rocky days following the announcement, the markets shrugged off the downgrade on Friday as July job growth came in slightly below expectations and rekindled the “Fed pause” narrative (more below).

What will the Fed do next?

Markets are anticipating the Federal Reserve to stop raising rates after last month’s 25-basis-point (.25%) hike — but they’ve been anticipating a pause since the beginning of the year. Earnings have seemed to fare better than expected, and talk of a soft landing is in the air, so the markets have rallied since March. The ADP July employment report came in warm at +324,000 (vs. expectations of +185,000), but the increase was significantly lower than June’s revised increase of 455,000.

The ADP report, coupled with the Fitch downgrade, sent the markets into a tailspin on Wednesday. However, the Job Openings and Labor Turnover Survey (JOLTS) data showed a downward revision reading for the prior reading, with job openings coming in at 9.62 million instead of the initial 9.82 million in June. So, job openings are decreasing, and as JOLTS has a one-month lag, it appears we’re on the right path as far as the Fed is concerned.

The Bureau of Labor Statistics (BLS) also released July nonfarm payrolls last week. We added 187,000 jobs in July, under expectations for 200,000, and also a good sign we’re headed in the right direction. Meanwhile, unemployment ticked down from 3.6% to 3.5%.

It’s a lot of data — but most of the numbers are lower than expectations or were revised downward, which is good. This will give the Fed ample opportunity to do nothing in the upcoming months, which will benefit equities.

Coming This Week

- Data will be scant this week, with the exception of the latest consumer price index (CPI) numbers on Thursday and the producer price index (PPI) report on Friday. Both CPI and PPI need to continue trending downward to keep the Fed on the sidelines. Given the continued robustness of the economy (as measured by second-quarter GDP) and the continued strength in the labor market, it will be hard to make the case for theFed to stop raising rates if inflation ticks back up.

- Mortgage applications (Wednesday), unemployment claims (Thursday) and consumer sentiment (Friday) are always good checks on the economy’s current temperature.

- After the Fitch downgrade of U.S. debt last week, the 30-year bond auction on Thursday may prove interesting

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

8/23-3022085-2