AE Wealth Management: Weekly Market Insights 8/14/22 – 8/20/22

Weekly Market Commentary

THE WEEK IN REVIEW: August 14 – August 20

Keeping us in the game

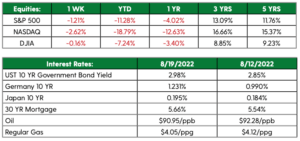

Markets were slowed quite a bit last week following the Federal Reserve’s release of minutes from its last meeting. There wasn’t anything super discouraging in them — but there also wasn’t anything overly encouraging either. This is where we are: We have made back about half of our losses from the market’s bottom in mid-June, mostly on the back of the market’s belief the Fed will ease up or curtail its rate-raising plans if the economy slows down. So far, the only bright spots in this slowing economy have been job growth and retail spending. Inflation talk has now shifted from last year’s “transitory” to this summer’s mot du jour “peak inflation,” meaning we’re at a point where we’re not going to see higher levels of inflation. That may be, but inflation is still at 8.5%, remaining unchanged in July as lower gas prices offset food and housing cost increases. (Gas prices have stopped dropping by the way, with the national average hovering around $4.)

If dropping gas prices are the catalyst that got us from 9.1% to 8.5% inflation, where will the rest of the inflation reduction come from? The government just passed another spending bill, which will not help lower inflation. Consumers are still spending but are depleting their savings and running up credit cards. There appears to be a ticking time bomb, and we cannot sustain this economy at “peak inflation” of 8.5%.

Sure, the Fed could simply say our new inflation target is 4% and make its job easier by letting the economy continue to slow. But all that would do is cement permanently a stagflationary environment, where a low- to negative-growth economy is dominated by elevated inflation. More likely, the Fed will be forced to continue raising rates through the rest of the year and maybe into next year to lower the inflation rate.

Remember when the benchmark 10-year Treasury rose to about 3.5% when we hit June lows? Currently the 10-year is around 3%. Since we’re at full employment, the Fed feels emboldened to allow unemployment to rise in an effort to lower demand. The problem with that approach is it takes a while for the momentum to build and also time for it to revert. You simply cannot dial up 5% unemployment from 3.5% and stop. If the job market falters, consumers will buy less and those with excessive credit card balances will be hurt by higher rates.

There you have it: lower inflation via demand destruction. With much of the U.S. economy driven by consumer spending, it’s hard to see how that doesn’t impact equity markets in a negative manner. Perhaps the market is starting to see some alternatives to the rosy picture it’s been painting for itself the past two months.

Another golden opportunity

The recent rally has once again given people a golden opportunity to reassess their allocations. If you’ve been upset and stressed by the markets’ behavior this year, this may be your chance. Investors were happy to receive excess returns while exposed to higher-risk assets; that worm turned in 2022 and now people are upset with declines in those same risk assets they celebrated a mere six months ago.

We have made up a significant portion of the losses year-to-date. Could we go higher? Sure. Could we go lower? That can happen, too. If you’re good with going higher given your allocation, then you probably should be fine with a downturn as well. That’s the nature of the market; volatility is the price we pay for returns. The higher the risk, the higher the reward.

If you’re not comfortable with that, talk with your advisor about reallocating to positions that help provide less volatility and less stress. Keep in mind you could miss out on higher returns — but you could also experience smaller losses. Whether you see the glass as half-full or half-empty, this market has once again provided a golden opportunity to get your risk tolerance and allocation aligned. Make the most of it.

Coming this week

- This week will be a fairly quiet one as the summer doldrums set in.

- The housing market isn’t looking too good right now. New home sales (Tuesday), mortgage applications and pending home sales (Wednesday) will offer some insights on how things are going in the housing space.

- Fed member Neel Kashkari is a very dovish Fed member turned inflation hawk. He’ll be giving a speech this Tuesday.

- On Wednesday, we’ll get the second reading of second-quarter gross domestic product (GDP). The first reading was -0.9%.

- Finally, on Friday we’ll get retail and wholesale inventories. A backup in those readings will signal further slowing in economic activity. Consumer spending (which has been strong) and sentiment (which has not been strong) will close out the week.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR), who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

8/22-2330610-4