AE Wealth Management: Weekly Market Insights | 9/10/23 – 9/16/23

Weekly Market Commentary

THE WEEK IN REVIEW: Sept. 10 – 16, 2023

Inflation is sticking around

The latest consumer price index (CPI) and producer price index (PPI) numbers came in higher than expected last week, signifying that inflation continues to persist. Despite the speed at which the Federal Reserve raised rates over the past year, driving inflation down further will require more work for the Fed and come with potentially real pain.

The inflation reading in August ticked up to 3.7%, which rattled the market’s preferred narrative. Gas prices and energy — the primary drivers of current inflation — were once again the main culprits. The record-high inflation we saw from shutdowns and supply chain issues has mostly been squeezed out, but driving down inflation from 3%-4% levels is going to be difficult.

Concerns began to mount that the Fed will have to keep rates where they are and perhaps hike even further. The problem with that is higher rates will not have an effect on energy prices, which will need a policy shift by the current administration. So long as energy prices remain volatile and elevated, those costs will continue to be passed on to consumers via higher prices.

Wage growth also continues to be a component of inflation as employers must pay more to hire and keep workers due to the low unemployment rate. People have more money to spend, and they are paying higher prices. Stimulus money and savings are largely gone, and those that are not getting paid more are running up their credit. The consumer is spending and keeping the economy going, but as August rolled into September, signs of weakness began to appear and the markets began to fret.

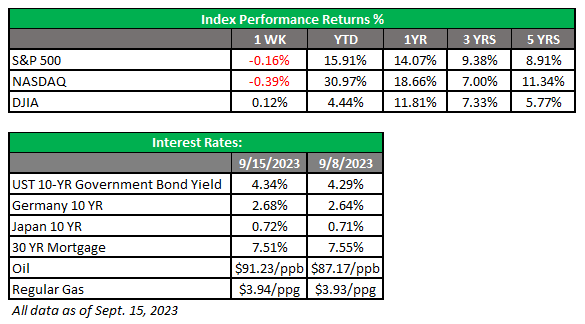

August and September have been weak months for the market, largely thanks to higher interest rates. In addition, the 10-year U.S. Treasury note remains elevated; its yield has been consistently over 4% since early August, and last week it clocked in over 4.3%. As a result, concerns that the Fed would have to do more to tame inflation crept into the daily dialogue, although those concerns aren’t fully priced in right now.

Here’s the problem with expectations that the Fed will need to do more: Moving inflation from 4% to the Fed’s desired 2% level would induce a recession. Recessionary fears are dominating again, and markets have floundered from one data point to another trying to find a path forward. Now we have a looming government shutdown, an strike and worries about the Fed possibly doing too much. That’s a lot of headline risk.

Hopefully, this week’s Fed meeting will answer some questions and allow the market to regain its balance. Expectations right now are no change in rates at this meeting, and markets are expecting one more hike at one of the last two meetings in 2023. The narrative that we are near the end of rate hikes and could see cuts early next week lingers, although it may not be realistic given the stubbornness of inflation. It will be hard for the Fed to reach its target unless energy prices are stabilized, and until that happens, the threat of higher rates for longer will remain in play.

A quick word on the auto strike

The United Auto Workers (UAW) decided to strike last week after contract negotiations stalled. After the deal that UPS workers struck last month, autoworkers decided it was their time. The strike isn’t industry-wide, but this is the first strike where all three automakers are being targeted simultaneously.

Whatever side of the debate you land on, the end result will likely be the same: Prices for cars will go up. Autoworkers will get a significant bump in pay (although maybe not the 40% over the next few years the union is looking for.) Suppliers will probably increase their prices. Gas prices will remain elevated. Given everything that has happened to the auto industry in the past few years — from the pandemic to the electric vehicle push and the overall state of the economy — the strike will be problematic no matter how this turns out. Let’s hope the disruption is minimal and short-lived.

Coming this week

- This week’s big news will be the Fed meeting on Tuesday and Wednesday. A decision on the Fed Funds rate will be announced on Wednesday afternoon; current expectations are for rates to remain at the current 5.25%-5.50% level, with no rate hike.

- Otherwise, it’s a fairly light week for data. We’ll see housing starts on Tuesday and mortgage applications on Wednesday. Then, the Philly Fed manufacturing index, leading indicators and the Fed balance sheet will be released on Thursday.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

9/23-3095098-3