AE Wealth Management: Weekly Market Insights | 9/22/24 – 9/28/24

Weekly Market Commentary

THE WEEK IN REVIEW: Sept. 22-28, 2024

Market defies September tradition

The Federal Reserve delivered its long-awaited rate cut on Wednesday, Sept. 18. Markets paused initially and then surged in the two days following the announcement, then posted new highs in the first half of last week. We took a step back on Wednesday, then bounced up and down to close the week — but not before we gained more than 100 points on the S&P 500 since the Fed meeting.

The final reading of second-quarter gross domestic product (GDP) was confirmed to be 3% year-over-year, and stimulus in China got markets going (more below). Plus, preferred consumption expenditures — or PCE, one of the Fed’s preferred inflation measures — showed some improvement.

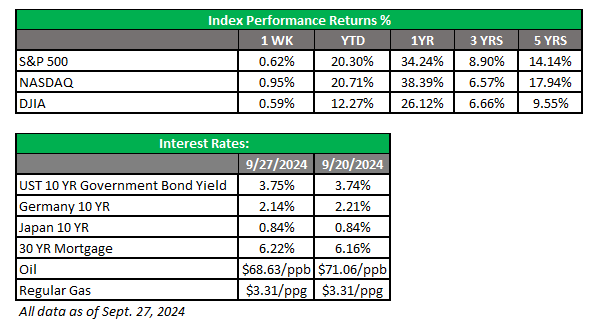

This good news, plus a lack of decidedly bad news, fueled the market’s rally as we closed out September. The rally continues defying expectations that markets historically perform poorly in September. Year-to-date, the S&P 500 is up over 20% and more than 90% over five years! The Nasdaq is even better, up over 22% year-to-date and 125% over five years.

Although the Dow is over 42,000, it hasn’t done as well as the S&P 500 or Nasdaq, returning just below 12% year-to-date and 56% over the past five years. We’ve talked about the limitations of the Dow as a representation of the broad markets before, but it still gets coverage and people still follow it. Both the S&P 500 and Dow posted new highs last week, while the Nasdaq still has a way to go to notch a new high above the prior record set on July 10.

We’re relieved that September turned out to be a good month despite its reputation as being a bad one for markets. It appears October will begin decently, although the coming month is far more uncertain at this point. The proximity to the election, geopolitical events, more economic data, rate-cut expectations and no Fed meeting until November gives the markets potential for volatility. September bucked the odds; here’s to October following suit.

China, supply chain and oil pose potential problems for markets

Remember a few years back when U.S. markets swooned every time it looked like China was slowing down? This happened specifically in 2015-16 and again in late 2019 and early 2020, when global stock markets viewed a decline in China’s GDP growth with concern.

Last week, China announced a set of stimulus measures: a cut in its benchmark interest rate, a lowering of bank reserve requirements to encourage lending, an easing of interest rates on existing mortgages, and the equivalent of more than $100 billion in credit offered to brokers to buy weakened stocks or for companies to finance share buybacks. China is at risk of falling into a “deflationary spiral,” as multiple economic problems — including the overleveraged housing market — continue to plague growth. It’s too early to tell what this may mean to us or whether this time we are less entangled with China for its slowdown to have a major impact, but we seem to be on a four-year cycle when it comes to China’s economy.

Another potential problem is the upcoming port strike, which could delay product deliveries just ahead of the holidays and would sour the very important end-of-year shopping season by kicking off another supply chain problem. The sides are far apart on any agreement, and the Biden administration is vowing not to intervene via the Taft-Hartley Act, which would compel workers to keep working while negotiating with management.

Finally, there’s the price of oil. Things are heating up again in the Middle East, this time between Israel and Hezbollah in southern Lebanon. Hezbollah, Hamas and the Houthis are all backed by Iran, which is a major oil exporter despite U.S. sanctions. If Israel decides to strike Iran or Iran decides to take a direct role in a conflict with Israel, we could see the price of oil zip up in time.

Coming This Week

- Data will be scant again this week, but a big highlight will be the September jobs report on Friday. There will be the usual concerns of economic slowdown and recession if the report is weak, and if it’s strong, the market will begin to question whether the Fed will continue to cut. Ideally, we will see 150,000 to 160,000 jobs added in September, and wage growth even with or slightly higher than the current consumer price index (CPI). That seems like a hard needle to thread, so we could see some turbulence if we miss by a significant margin or if revisions are big.

- Other data will include Chicago PMI (Monday), which will have inflation implications. We’ll see the Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. On Wednesday, we’ll get the ADP corporate employment numbers and MBA mortgage applications. Plus, the new Cleveland Fed president Beth Hammack will be speaking, so she could drop some insights.

- On Thursday, we’ll get unemployment claims and factory orders. Minneapolis Fed president Neel Kashkari will moderate a discussion with Atlanta Fed president Raphael Bostic.

- Finally, in addition to September jobs, we’ll see the updated unemployment rate, hourly wages and year-over-year wage growth on Friday.

AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

9/24 – 3827819-5