AE Wealth Management: Weekly Market Insights | 9/29/24 – 10/5/24

Weekly Market Commentary

THE WEEK IN REVIEW: Sept. 29-Oct. 5, 2024

Jobs data points to fewer cuts by end of year

After the Federal Reserve delivered its first rate cut in over two years, all eyes are now on how many more cuts we will see, how soon we can expect them and whether the data will support the narrative. We need to see jobs soften as inflation comes down, and last week did not help.

The Job Openings and Labor Turnover Summary (JOLTS) report for August showed openings have actually gone up instead of coming down, suggesting the jobs market isn’t slowing as quickly as the Fed wants. Then there was the ADP employment report for September; consensus was calling for the addition of 121,500 jobs and the actual number was 143,000. However, wage growth was muted, so that may keep the Fed on track for more cuts. And weekly jobless claims came in right at consensus on Thursday at 225,000.

This was the backdrop on Friday when we received the Bureau of Labor Statistics (BLS) employment situation (aka non-farms payroll) for September. The consensus was calling for 132,5000 new jobs, but what we got was a whopping +254,000 and a drop in the unemployment rate from 4.3% to 4.1%.

Of the jobs added in September, well over half were in government, health care and social assistance. (The latter two categories are largely dependent on government spending.) The next-highest sources of new jobs were mining and logging (well-paying jobs) and leisure and hospitality (not-so-well-paying jobs). Paradoxically, the report mentioned an increase of 69,000 jobs in “food services and drinking places.” Since that specific line item isn’t included in the report, the figure must be embedded in the leisure and hospitality number. It still appears most of the job growth is coming from government-induced spending and low-paying jobs in the service sector. Plus, it looks like dining and drinking are doing better than the other service sectors (hotels, theme parks, etc.). Employment numbers for July and August were also revised upward by 72,000.

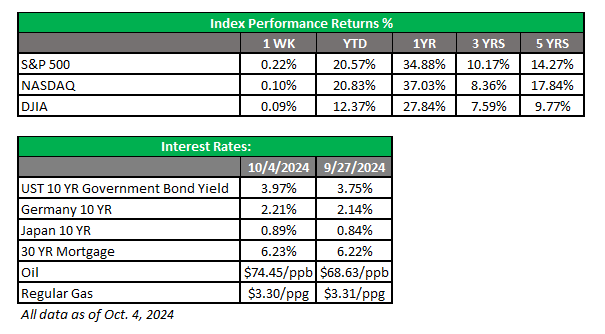

Markets rallied initially on the BLS number in a “good news is actually good news” vibe because the job market indicated we aren’t falling off a cliff into a recession. But as the day wore on, the talk of potentially curtailed rate cuts due to the job market’s strength and angst over what may happen in the Middle East over the weekend dampened some of the enthusiasm. Despite all the froth, we managed to end the week fairly flat and still near all-time highs for the S&P 500.

October surprises

As if the election wasn’t enough to dominate the conversation, it looks like things are beginning to ratchet up as we start a new quarter. We are often told to expect an “October surprise” in the weeks prior to election day. This time, any surprise we see might be crowded out by unfolding current events.

First, there’s the issue of escalating tensions and a possible expansion of the conflict in the Middle East as Israel prepares to strike Iran after Iran launched missiles in response to Israel’s assassination of Hezbollah frontman Hassan Nasrallah and his cronies. Israel was responding to Hezbollah’s attack on them after they attacked Hamas — which originally attacked Israel. (Whew! Got all that?)

The issue for markets is that Iran still produces about 3% of the world’s oil supply. A disruption (via destruction) of Iran’s oil-producing facilities will have a major impact on the price of oil and economies worldwide.

Second, there was the port strike, which was suspended on Thursday night until Jan. 15. The parties reached a tentative agreement for higher wages after three days and decided to continue negotiating on other sticking points. For now, the ports are open, and goods are moving through them. This may still come back to haunt us, but if the ports remained closed even for a week or two, it would result in a significant disruption to the supply chain and economy. Some reports indicate a strike lasting three weeks would create a backlog that couldn’t be cleared until January. It appears the disruption was minimal and shouldn’t affect consumers (or businesses) as we enter the critical holiday shopping season. In this case, a crisis delayed is a crisis averted, at least in the short term.

Finally, southern states are still grappling with the aftermath of Hurricane Helene, which caused severe damage from Florida to North Carolina to Georgia to Tennessee. People are struggling, and there is a lot to be done. It’s hard to assess the response so far, but it is safe to say that when it comes to natural disasters there is a lot of downside risk for the people in charge. Comments from the administration that the Federal Emergency Management Agency (FEMA) may not have enough money to make it through hurricane season did not go over well.

Any of these events would cause concern individually, but all three at once in the month of October before a presidential election is astounding. There is also the potential for any or all of these events to spiral into something worse, which is even more troubling. Here’s hoping we avoid another “October surprise” as we navigate the rest of the month.

Coming This Week

- Last week was all about the employment picture and whether job growth has slowed enough to keep the Fed on track with rate cuts. The jobs data and the BLS report were a lot stronger than expected. Prior to the jobs report, the markets were predicting a 100% chance of a cut after the election in November (65.5% for 25 basis points, 34.5% for 50 basis points). There also was about a 50% chance that the fed funds rate would be at 4% after the December meeting, down 75 basis points from where we are now. After last week’s stronger-than-expected jobs report and Fed Chair Jerome Powell’s tamping down expectations earlier in the week, the odds have been lowered to about 50 instead of 75 basis points worth of cuts by year-end. For now, the market is buying it. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- There will be no shortage of Fed speakers this week, featuring a total of 11 speakers and 16 speeches. There will be a lot of talk, but the jobs are what they are, inflation is what it is and, if we continue to see inflation remain elevated or more strength on the jobs front, it will make continuing to cut rates problematic. The market will sniff out the stone-cold facts from the hyperbole.

- Monday will be quiet, with only consumer credit being reported. Tuesday will feature the trade deficit; then we’ll get MBA mortgage applications and wholesale inventories (with the initial impact from the limited port strike) on Wednesday. Plus, the minutes from the last Fed meeting will be released, which will be interesting because the amount of the cut was not unanimous.

- The main event will be on Thursday and Friday when we get the latest consumer price index (CPI) and producer price index (PPI) numbers. We need to see improvement here; a stall in the decline of inflation may cause the Fed to slow down rate cuts and potentially lead to turmoil in the markets.

AE Wealth Management, LLC (AEWM) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/24 – 3916698-1