AEWM Wealth Report – Is the 60/40 Portfolio Still Viable in the Current Market Environment?

Download PDF Version

Is the 60/40 Portfolio Still Viable in the Current Market Environment?

When building portfolios, the traditional model is a split of 60% stocks and 40% bonds. But high inflation and rising interest rates have hit bonds hard and recent volatility has pushed markets down. Should investors add more stocks to their portfolio in anticipation of a market comeback? It depends on your goals.

Overview

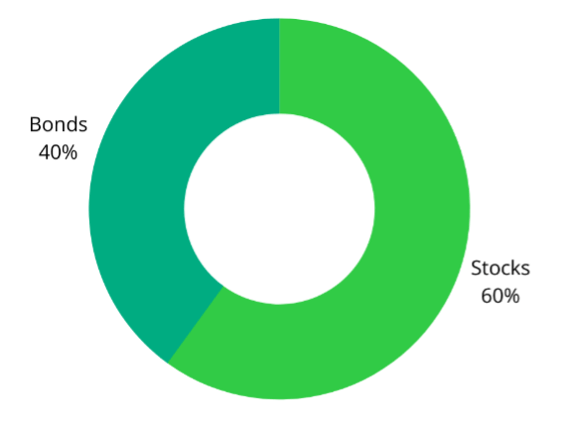

“Is The 60/40 Portfolio Dead?”1 That was just one of the headlines in the media in June and July, as market volatility, high inflation and rising interest rates wreaked havoc on portfolios. Known in the industry as simply the “60/40,” this traditional model generally calls for investors to split their portfolio between 60% equities (stocks) and 40% bonds.

Financial advisors — and their clients — have long relied on the 60/40 split as a starting point for building portfolios. Why? This approach balances the need for growth (stocks) with the potential for income (bonds). It also provides investors with some diversification, since it’s not common for stocks and bonds to have negative returns in the same year.2 The approach has been proven to work; between 1926 and 2021, the annualized return of a classic 60/40 portfolio was 8.8%.3

The Traditional 60/40 Model Portfolio

Unfortunately, the traditional 60/40 hasn’t performed well in 2022. While it’s not common for stocks and bonds to both experience turbulence at the same time, that’s exactly what’s currently happening. Both stocks and bonds have been beaten and bruised lately, impacted by high inflation, rising interest rates and other economic challenges. It’s left investors with nowhere to hide, and the typical 60/40 portfolio is down 17.6% through the first months of the year.4

The Case for a New Split

If the 60/40 split isn’t currently working, what will work in the current environment? Some analysts say it’s time to consider a higher percentage of stocks within a portfolio. Their reasoning is twofold. First, the Federal Reserve is committed to fighting high inflation by increasing interest rates, a move which will likely continue to negatively impact bonds through the end of the year.

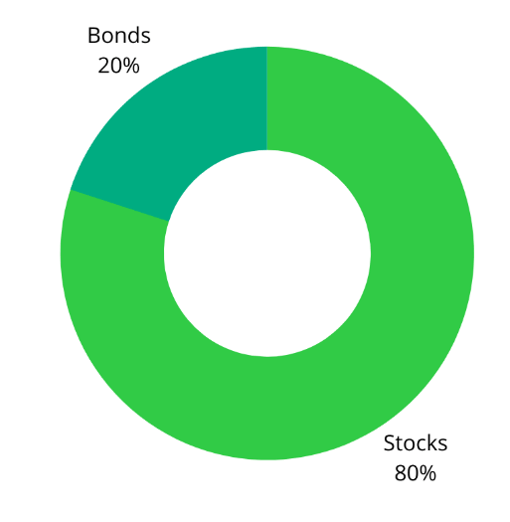

On the flip side, equity markets are currently down 20% from their most recent highs.5 Although that’s not great for portfolios in the short term, markets are bound to come up sooner rather than later. And when they do, it provides investors with greater opportunity for growth. Changing a portfolio’s stock-to-bond ratio to 80/20 or even 90/10 may help investors position themselves for potential maximum growth when markets recover.

More Aggressive 80/20 Model Portfolio

The argument to shift to an 80/20 portfolio makes sense, particularly for investors with a longer horizon before retirement or more aggressive investing profile. If the Fed keeps raising interest rates over the next few months, bond prices could continue to take a beating — likely reducing the benefits of a balanced portfolio.

But what about investors who plan to retire soon or are already living in retirement and need a more moderate investing approach? While increasing the percentage of stocks may not be the right strategy, it’s a good time to consider restructuring the portfolio from a traditional 60/40 split to a 60/20/20, with the portfolio divided into 60% stocks, 20% bonds and 20% bond alternatives.

Replacing a portion of the bonds in a portfolio with alternatives can provide additional opportunities for fixed income. Bond alternatives include real estate investment trusts (REITs), fixed annuities and high-yield savings accounts, among others.

Final Thoughts

While we think the 60/40 model has proven to be a successful strategy and is certainly still viable, the current market environment may call for a revised approach. Some investors may find an 80/20 or even a 90/10 allocation model better meets their current needs. Those with a shorter time horizon may want to look at sticking with 60% stocks but reducing their bond risk with alternative income options.

No matter what your ideal stock-to-bond split, it’s important to remember that time in the market — not timing the market — is what matters. Shifting the investments to take advantage of short-term market events doesn’t result in long-term performance. Getting to your goals means staying disciplined and focused on the long-term picture.

It is possible latest market events have caused your portfolio to become unbalanced and out of alignment with your target allocation. If you haven’t done so lately, we recommend contacting your financial professional to request a portfolio review. They can help you rebalance your portfolio and make sure you’re still on track to meet your investing goals.

SOURCES

1 Barry Gilbert. Financial Advisor Magazine. June 13, 2022. “Is The 60/40 Portfolio Dead?” https://www.fa-mag.com/news/is-the-60-40-portfolio-dead-68297.html. Accessed July 25, 2022.

2,3 Roger Aliaga-Díaz. Vanguard. June 8, 2022. “Like the phoenix, the 60/40 portfolio will rise again.” https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/like-phoenix-6040-portfolio-will-rise-again.html. Accessed July 25, 2022.

4 Greg Iacurci. CNBC. June 24, 2022. “Inflation and rising interest rates have stressed the 60/40 investment portfolio strategy – ‘but it’s not dead,’ says financial advisor.” https://www.cnbc.com/2022/06/24/how-inflation-interest-rate-hikes-affect-the-60/40-portfolio-strategy.html. Accessed July 25, 2022.

5 Tanaya Macheel and Pippa Stevens. CNBC. June 29, 2022. “S&P 500 posts worst first half since 1970, Nasdaq falls more than 1% to end the quarter.” https://www.cnbc.com/2022/06/29/stock-market-futures-open-to-close-news.html. Accessed July 25, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

8/22-2315226