AEWM Wealth Report | The Cost of Conflict

Download printable version here

The Cost of Conflict

How the ongoing clash between Russia and Ukraine is impacting the U.S.

The conflict between Russia and Ukraine has had significant repercussions for the U.S. economy. Investors should be prepared for ongoing challenges as the war drags on.

Overview

When Russia invaded Ukraine on Feb. 24, hopes were high that the conflict would be short-lived and that other countries could remain neutral. However, Russia’s persistent and insistent attacks against the Ukrainian government and its citizens have created a ripple effect in the global community, driving global powers to take sides — including the United States.

As of June 17, the U.S. had committed $5.6 billion to helping Ukraine defend against its attackers.1 In early July, the Biden administration authorized an additional $400 million in military assistance for the beleaguered country.2

And those are just the tangible, known costs. The conflict in Ukraine has worsened already-snarled supply chains, particularly those related to energy and food supplies. On July 7, the U.S. State Department tweeted: “FACT: Russian forces are plundering and destroying Ukrainian agricultural infrastructure, including silos, farming machinery and fields. This keeps Ukrainian farmers from sowing and planting, harming future harvests, and worsening the global food crisis.”3

In the U.S., the ongoing Russia-Ukraine situation has served as one catalyst for high inflation rates, rising gas prices and increasing cost of goods. Why does a conflict halfway around the world have such a significant impact on the U.S. economy? It all has to do with geopolitical risk.

Measuring Geopolitical Risk

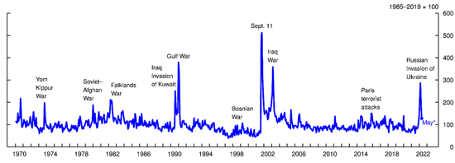

According to research published in the Harvard Business Review, “Geopolitical risk — that is, the wide array of risks associated with any sort of conflict or tension between states — has a clear impact on global trade, security and political relations.”4 This is often measured through the Caldara-Iacoviello geopolitical risk (GPR) index. Since 1900, the index has tracked the amount of risk related to international conflict. The index has spiked since 1990, during the Iraq invasion of Kuwait, the Gulf War, the Sept. 11 attacks and the Iraq War. The index reached one of its highest values in March 2022, following Russia’s invasion of Ukraine.5

Note: The figure plots the Caldara-Iacoviello geopolitical risk (GPR) index from January 1970 through May 2022. The index is constructed merging the historical GPR index from 1970 through 1984, with the recent GPR index from 1985. The index is normalized to average 100 throughout the 1985-2019 period. Spikes are labeled with significant geopolitical events. *Preliminary Reading.

Source: Federal Reserve Board staff calculations based on Dario Caldara and Matteo Iacoviello (2022), “Measuring Geopolitical Risk,” American Economic Review. https://www.federalreserve.gov/econres/notes/feds-notes/the-effect-of-the-war-in-ukraine-on-global-activity-and-inflation-20220527.htm. Accessed July 12, 2022.

High GPR levels are associated with negative effects on global economies through destruction of resources, disruption of international trade and interruption of supply chains. A rise in GPR often correlates with a decrease in global and national gross domestic product (GDP) and elevated inflation. The U.S. has experienced both of these things in the months since Russia’s invasion of Ukraine, with first-quarter GDP contracting by -1.6%6 and the latest inflation numbers coming in at 9.1%.7 While other factors contributed to these readings, the Russia-Ukraine conflict has certainly played a part.

The Trickle-Down Effect of Higher GPR

Heightened geopolitical risk impacts U.S.-based industries and companies, many of which are unable to procure the goods and materials they need as supply chains become bottlenecked or stopped altogether. The rising cost of goods and shipping also drags down their bottom line, while heightened inflation leads to less consumer spending and cuts into company earnings.

High inflation, reduced company earnings and contracting GDP form the perfect storm for markets, leading to increased volatility and decreased overall returns for investors. Since the Russian invasion, the Dow Jones Industrial Average has dropped about 2,600 points8 as of July 14, while the S&P 500 is down more than 500 points.9

Final Thoughts

As the Russia-Ukraine conflict drags on, U.S. markets will likely continue to experience higher volatility, leading to diminished returns within investor portfolios. Unfortunately, right now there’s not much you can do except wait out the storm. It will pass, although when it will pass currently remains unclear.

In the meantime, we recommend contacting your financial professional to reevaluate your risk tolerance and rebalance if it’s necessary. Markets will likely continue to struggle to find their footing until inflation begins to come down and volatility eases. Stay the course and rely on your financial advisor to provide guidance if it feels as though you’re losing your way.

SOURCES

1 U.S. Department of Defense. June 17, 2022. “Fact Sheet on U.S. Security Assistance to Ukraine.” https://www.defense.gov/News/Releases/Release/Article/3066864/fact-sheet-on-us-security-assistance-to-ukraine/. Accessed July 14, 2022.

2 U.S. Department of State. July 9, 2022. “$400 Million in New U.S. Military Assistance for Ukraine.” https://www.state.gov/400-million-in-new-u-s-military-assistance-for-ukraine/. Accessed July 12, 2022.

3 Twitter. @StateDept. July 7, 2022. https://twitter.com/StateDept/status/1545229940924112896?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1545229940924112896%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.state.gov%2Flatest-ukraine-updates%2F. Accessed July 14, 2022.

4 Vivek Astvansh, Wesley Deng and Adnan Habib. Harvard Business Review. March 3, 2022. “Research: When Geopolitical Risk Rises, Innovation Stalls.” https://hbr.org/2022/03/research-when-geopolitical-risk-rises-innovation-stalls. Accessed July 14, 2022.

5 Dario Caldara, Sarah Conlisk, Matteo Iacoviello and Maddie Penn. Federal Reserve. May 27, 2022. “The Effect of the War in Ukraine on Global Activity and Inflation.” https://www.federalreserve.gov/econres/notes/feds-notes/the-effect-of-the-war-in-ukraine-on-global-activity-and-inflation-20220527.htm. Accessed July 14, 2022.

6 Bureau of Economic Analysis. June 29, 2022. “Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), First Quarter 2022.” https://www.bea.gov/news/2022/gross-domestic-product-third-estimate-gdp-industry-and-corporate-profits-revised-first#:~:text=Real%20gross%20domestic%20product%20(GDP,real%20GDP%20increased%206.9%20percent. Accessed July 14, 2022.

7 Bureau of Labor Statistics. July 13, 2022. “Consumer Price Index – June 2022.” https://www.bls.gov/news.release/pdf/cpi.pdf. Accessed July 13, 2022.

8 MarketWatch. July 14, 2022. “Dow Jones Industrial Average.” https://www.marketwatch.com/investing/index/djia. Accessed July 14, 2022.

9 MarketWatch. July 14, 2022. “S&P 500 Index.” https://www.marketwatch.com/investing/index/spx?mod=search_symbol. Accessed July 14, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

7/22-2293324