AE Wealth Management Quarterly Market Report for Q3-2021

SLOWING MARKET CLIMB

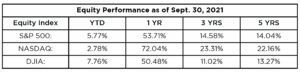

Despite hitting record highs well into August, markets were subdued throughout the third quarter, especially in comparison to the heady optimism experienced in the first half of 2021. Rising coronavirus cases and stalling vaccinations increased concerns about new restrictions and delayed reopening. Inflation began to surge as demand outstripped supply, leading many consumers to tighten up on their spending. Markets began to get nervous — and the anxiety increased after Congress introduced a new $3.5 trillion spending bill.

September is historically a less-than-stellar month for markets, and this September proved to be no exception. After climbing to new highs at the end of August, markets slid slowly downward. They dropped sharply on Sept. 20, following the announcement from Chinese real estate development firm Evergrande regarding a potential default on interest payments and debt. The news sparked the first correction of more than 5% in 2021.1

Source: Morningstar. Index Performance: Return (%). http://news.morningstar.com/index/indexReturn.html.

Accessed Oct. 1, 2021. There is good news: Schools have reopened, coronavirus cases seem to be slowing in the U.S. and gross domestic product (GDP) is up more than 6% year-to-date.2 Still, markets remain sluggish as we enter the final quarter of 2021.

A LOOK AHEAD

With consumer confidence low and inflation high, market performance in the fourth quarter remains uncertain. Investors have more questions than answers, especially regarding the supply chain and whether Congress will pass new spending bills. The Federal Reserve has signaled it will likely begin tapering its bond-buying program as early as November, but how quickly the taper will take place and what it might look like have yet to be determined.3

Questions still linger regarding our future with COVID-19, as well. Workers, companies and states have already brought lawsuits challenging proposed vaccine mandates,4 while some companies have delayed plans to bring workers back to the office well into 2022.5 As a result, reopening has slowed as businesses and governments figure out how to navigate in a post-pandemic world.

As we look ahead, it’s good to look back and celebrate the progress we’ve made. The markets have experienced an overwhelmingly positive run since their dramatic drop in March 2020. Vaccines are being distributed globally, coronavirus cases appear to be slowing and schools have reopened.

We also rocketed back to new records in the markets much more quickly than anticipated. While this growth has been welcomed, many investors seem to be overexposed to equities — and vulnerable to a potential correction.

Now is a crucial time to sit down with your financial professional and rebalance your portfolio to realign with your goals. Remember the old saying: “The time to fix the roof is when it’s not raining.” It’s not raining right now — but it could be soon. Appropriate positioning, solid allocation and staying focused on your goals can help you protect against a potential correction in the coming months.

1 Will Feuer and Lydia Moynihan. New York Post. Sept. 20, 2021. “Dow drops as much as 971 points amid troubles in China’s real estate market.” https://nypost.com/2021/09/20/dow-futures-drop-amid-september-sell-off/. Accessed Sept. 27, 2021.

2 Bureau of Economic Analysis. Aug. 26, 2021. “Gross Domestic Product, 2nd Quarter 2021 (Second Estimate); Corporate Profits, 2nd Quarter 2021 (Preliminary Estimate).” https://www.bea.gov/news/2021/gross-domestic-product-2nd-quarter-2021-second-estimate-corporate-profits-2nd-quarter. Accessed Sept. 27, 2021.

3 Howard Schneider and Jonnelle Marte. Reuters. Sept. 22, 2021. “Fed signals bond-buying taper coming ‘soon,’

rate hike next year.” https://www.reuters.com/business/finance/fed-likely-open-bond-buying-taper-door-hedge-outlook-2021-09-22/. Accessed Sept. 27, 2021.

4 Jeanine Santucci, et al. USA Today. Sept. 10, 2021. “GOP governors vow to fight Biden’s vaccine mandate; FDA weighs in on vaccines for kids: COVID updates.” https://www.usatoday.com/story/news/health/2021/09/10/covid-biden-vaccine-mandate-face-masks-cases/8265425002/. Accessed Sept. 27, 2021.

5 Kellen Browning, et al. The New York Times. Sept. 6, 2021. “Why You Might Not Be Returning to the Office Until Next Year.” https://www.nytimes.com/2021/09/06/business/rto-return-to-office.html. Accessed Sept. 27, 2021.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security product. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/. 10/21 – 1852559