AE Wealth Management: Using Your HSA for Retirement | Blog

USING THE HSA FOR RETIREMENT, NOT JUST HEALTH CARE

Download PDF Version Here

Learn about the lesser-known benefits of owning a Health Savings Account (HSA) to help fund your retirement.

Overview

Whether your health insurance is purchased from the individual market, including government exchanges, or sponsored by your employer, chances are good that one of your options is an HSA- eligible plan. A health savings account, often referred to as an HSA, is a savings vehicle that can be paired with a high deductible health insurance plan (HDHP). It is designed to help you pay for out-of- pocket medical-related expenses with tax-free income.

At first glance, paying for a high-deductible health insurance plan may not seem as advantageous as other health insurance options. Nor may it seem like as strong a benefit compared to a 401(k) plan or employer stock options. However, the hidden value of an HSA can come later in life if you have the discipline to make maximum annual contributions, invest them for growth and not withdraw from the account until you retire.

How It Works

Compared to other health plans, you generally pay a lower premium for an HDHP. In fact, the higher the deductible, the lower the monthly premium. The trade-off, of course, is that you pay out-of-pocket for much of your medical care (except standard preventive care, such as annual checkups) until you’ve met the higher deductible each year. That is why many HDHPs permit the plan member to open and contribute to a health savings account. The money saved can be used to pay these out-of-pocket expenses, as needed.

In 2021, the annual HSA contribution limit is $3,600 for individuals and $7,200 for family coverage, and an additional $1,000 “catch-up” contribution is permitted for account owners age 55 and older.1 For those whose HSA is associated with a work-sponsored HDHP, both the employee and the employer may contribute to the HSA. Note that their combined contributions may not exceed the annual limit, which is periodically adjusted for inflation.

One of the perks of an HSA is that all the money contributed belongs to the account owner. Unlike an employer-sponsored flexible savings account (FSA), the employee doesn’t have to “use it or lose it” by the end of the year. Moreover, the account belongs to the employee even when he or she leaves the company. He or she cannot continue contributing to the HSA unless or until enrolled in another HDHP, but the balance can continue growing and he or she may use the funds to pay for eligible expenses.

“People who invest their HSA savings have balances that are four times higher than those who do not invest, at every step of the way.”2

— William Applegate, Fidelity Health Solutions

Investment Options

The HSA is not administered by the HDHP insurer. It must be opened separately at a financial institution, such as a bank. The custodians that offer health savings accounts typically also enable the account owner to invest a portion of the balance once it reaches a certain threshold. Typically, the account owner must retain a minimum balance in the HSA (usually $1,000 to $2,500) before transferring assets to an investment account. The owner can transfer money between the savings and investment account as needed.

The invested portion of an HSA is administered by a brokerage firm. As such, there is generally a wide range of investment options such as mutual funds and individual securities. In recent years, many HSA providers have reduced plan fees, expanded investment options and lowered investment thresholds. Of HSA investment funds researched by Morningstar analysts, at least 80% earned gold, silver or bronze analyst ratings from Morningstar. While the least expensive passively managed portfolios range from 0.02% to 0.68% a year, be aware that some account and investment management fees remain higher.3 Therefore, just as you would with other types of investments, assess the impact of fees before you decide where to place your money.

Wealth Accumulation

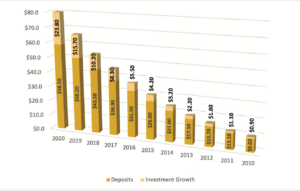

When an account owner maximizes contributions and transfers them to the investment account, the HSA is structured to grow a substantial nest egg over a long period of time. The accompanying graph illustrates how much these accounts have grown in the U.S. over the past 10 years.

Total HSA Assets (in billions) 4

Source: Devenir Research

Be aware that principal and performance returns in the invested component of a health savings account will fluctuate and, when redeemed, may be worth more or less than their original cost. The invested assets are not FDIC-insured or guaranteed by the bank that administers the health savings account. As with other types of investments, it is important to review the associated costs, such as investment expenses and account fees, which can reduce returns over time.

Tax Benefits

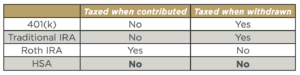

Financial professionals have long touted the advantages of investing for tax-deferred growth for retirement. The HSA actually enjoys more tax benefits than that of an employer-sponsored retirement plan, traditional IRA or Roth IRA.

Note that all contributions made to a health savings account are tax-free. They are either made via payroll deductions at work, which also avoid FICA taxes, or can be claimed as a tax deduction if the HDHP is purchased independently. Also, the interest earned on invested HSA funds grows tax-free, and withdrawals used to pay for qualified medical expenses are not taxed. If the money is used for nonmedical expenses, the account owner must pay income taxes on those specific amounts and may be subject to an early withdrawal penalty. However, the penalty fee goes away once the account owner reaches age 65.

If you were to instead invest those funds in a 401(k) plan or traditional IRA, you would have to pay income taxes on both the contributions and earnings when withdrawn, even the money used for health care expenses. If you put that money in a Roth IRA, your earnings would be tax-free, but your contributions wouldn’t be tax deductible. The HSA is the only investment vehicle that avoids taxes altogether when used to pay for eligible health care expenses.5

Retirement Income Tax Diversification

An HSA offers yet another opportunity to diversify your tax liability during retirement. While pension, traditional IRA and 401(k) benefits will be taxed when distributed during retirement, money drawn from an HSA and a Roth IRA will not. The latter two also do not mandate required minimum distributions as you age, so interest can continue compounding tax-free.6

In other words, diversifying your retirement assets across a variety of tax-advantaged accounts can help lower your tax bill during retirement.

Emergency Savings Fund

With so many demands on our money, it’s difficult to prioritize savings efforts. One of the most important recommendations is to have a liquid emergency savings account funded with at least three to six months worth of income. This is where an HSA can work double duty. It’s possible to access the same tax-advantaged funds you invest for health care in retirement to pay for emergency expenses.

The way to do this is to pay for out-of-pocket medical expenses with current income and leave the money you’ve saved and invested in a health savings account to continue growing. However, save the receipts you receive for all of those eligible purchases. You are permitted to “reimburse” yourself for paying those expenses via your tax-advantaged HSA funds. There are no time limits for when money in an HSA must be used or distributed for reimbursement.7 This means you can withdraw money as needed from that account to pay emergency expenses by pairing the amounts withdrawn with receipts already paid for. Not only will those distributions be both tax- and penalty-free, but the additional bonus is any unused money in your HSA nest egg can continue growing tax-free as well.

The recently passed Coronavirus Aid, Relief, and Economic Security Act (CARES Act) makes this strategy even easier. The legislation expanded the list of eligible expenses for HSA funds to include over- the-counter medicines and other health-related products, including:8

• Facial cleansers, toners and moisturizers

• Over-the-counter acne treatments

• Sunscreen, sunburn creams and ointments

• Lip balms for sun protection and chapped lips

• Sleep aids and CPAP machines

• Nighttime mouthguards

• Sports mouthguards

• Hot pads, cremes and patches

• Feminine care products

• Pregnancy kits

Many of these items are things we buy every day without thinking about using HSA funds to pay for them. You need only track those qualifying expenses and keep the receipts to enable your HSA to work as a tax-free emergency savings account.

Health Care Savings for Retirement

Because a health savings account is “portable,” you can keep it as long as you want – that money does not stay with any employer. If you continue health coverage under an HDHP, you may continue contributing to the account. However, even when you may no longer contribute, the invested balance is yours and continues growing tax deferred.

Once you’ve retired, you have many options for using this money. After age 64, HSA distributions can be made for any reason, although funds not used to pay for qualifying medical expenses will be taxed at the owner’s ordinary income tax rate, which is often lower in retirement. Obviously, the most effective use is to pay for health-related expenses, and you’re likely to have more of these during retirement. Eligible expenses include dental and vision care, Medicare premiums, long- term care insurance premiums and nursing home costs.9

Fidelity projects that the average 65-year-old couple who retired last year will need about $300,000 for premiums and out-of-pocket medical expenses during retirement, excluding long-term care.10 If you delay using your health savings account until retirement, you’ll have ready money to tap for those out-of-pocket expenses on an as- needed basis. Furthermore, you won’t have to pay income taxes on withdrawals, and the funds that remain invested in the account may continue to grow tax deferred. With saved receipts, you’ll still be able to tap the HSA for tax-free emergency funds.

Final Thoughts

It may defy reason, but the HSA could be more valuable as a retirement savings vehicle than a medical expense account. By maximizing annual contributions, investing those assets for growth, and not making any withdrawals until retirement, the HSA can create a tax-free means of paying for health care expenses. At the same time, it can be an effective emergency savings safety net. As with any investment vehicle, it’s important to keep in mind that HSAs are exposed to market fluctuations and are not guaranteed to grow.

While most financial professionals do not directly offer health savings accounts, they can advise you on how to invest funds saved there, particularly within the context of your overall asset allocation strategy. As open enrollment season approaches this fall, you may want to give serious consideration to selecting an HSA-eligible, high-deductible health care plan in order to add this flexible and tax-advantaged account to your investment portfolio.

1 Fidelity. May 6, 2021. “5 ways HSAs can fortify your retirement.” https://www.fidelity.com/viewpoints/wealth-management/hsas-and-your-retirement. July 8, 2021.

2 Lee Barney. PlanSponsor. Oct. 28, 2020. “The Critical Role of HSAs in Helping People Prepare for Retirement.” https://www.plansponsor.com/critical-role-hsas-helping-people-prepare-retirement/. July 8, 2021.

3 Morningstar. Oct. 14, 2020. “Morningstar’s Fourth Annual Study of Health Savings Accounts Shows Fidelity’s HSA Remains Top Choice for Both HSA Spenders and Investors.” https://newsroom.morningstar.com/newsroom/news-archive/press-release-details/2020/Morningstars-Fourth-Annual-Study-of-Health-Savings-Accounts-Shows-Fidelitys-HSA-Remains-Top-Choice-For-Both-HSA-Spenders-and-Investors/default.aspx. July 8, 2021.

4 Devenir. March 3, 2021. “HSA Investment Assets Soar to $23.8 billion, Up 52% In 2020. https://www.devenir.com/hsa-investment-assets-soar-to-23-8-billion-up-52-in-2020/. July 8, 2021.

5 Fidelity. May 6, 2021. “5 ways HSAs can fortify your retirement.” https://www.fidelity.com/viewpoints/wealth-management/hsas-and-your-retirement. July 8, 2021.

6 Ibid.

7 Defined Contribution Institutional Investment Association. October 2020. “The HSA: The “S” is for Savings (not Spending!)” https://cdn.ymaws.com/dciia.org/resource/collection/86B222DC-DAAD-41B9-9A31-B63EA74AF98F/DCIIA_HSA-2_100120.pdf. July 8, 2021.

8 Cigna. 2021. “Which Expenses are Eligible for HSA, FSA and HRA Reimbursement?” https://www.cigna.com/individuals-families/member-resources/hsa-fsa-hra-payments/eligible-expenses. July 8, 2021.

9 Ibid.

10 Fidelity. May 6, 2021. “5 ways HSAs can fortify your retirement.” https://www.fidelity.com/viewpoints/wealth-management/hsas-and-your-retirement. July 8, 2021.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM, nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. When incorporating other services into your practice, whether tax, legal or other, clients must fully understand who provides which service and that producers cannot hold themselves out as being able to provide services they are not qualified to perform. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/. 7/21-1730143