AE Wealth Management: Weekly Market Insights | 2/6-2/12/22

No end in sight yet

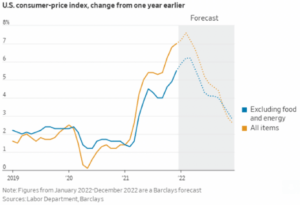

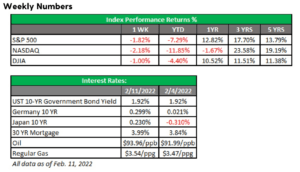

The market continued to crawl back in the early part of last week before going into a tailspin following the January CPI reading, comments from the Federal Reserve’s James Bullard and heightened Russia-Ukraine tensions. The much-watched Consumer Price Index (CPI) came in at a year-over-year rate of 7.5%, higher than the 7.2% estimate, while December’s reading was revised upward. CPI measures how much the cost of consumer goods has increased over a particular period of time. A CPI reading of 7.5% is extraordinarily high, and Americans are feeling the effects firsthand at the gas pump, grocery store and everywhere else. If the CPI remains high, it will negatively affect the economy as individuals and companies cut back on discretionary spending to cover daily expenses.

Then St. Louis Federal Reserve President Jim Bullard that he would like to see the Fed move short-term interest rates from the current 0% to 1% by July 1. Doing the math, we see that the Fed will have three meetings (March, May and June) before then; therefore, at least one of those meetings may feature a hike of 50 bps (.50%). Markets didn’t like the comment, but that’s what happens when you say rates will be raised at the March meeting and give zero guidance as to future rate hikes. Bullard has been and continues to be a rate hawk — meaning he favors raising rates — but he is now a voting member of the Fed, so markets took extra notice of his comment. The Fed Funds futures are predicting a 50% chance that rates will rise between 25-50 bps (.25%-.50%) and a 50% chance that they will increase 50-75 bps (.50%-.75%) at the March meeting. Like CPI, rising interest rates can also set economic growth back; higher interest rates make borrowing more expensive, so fewer people and companies take out loans. Plus, higher interest rates generally mean more interest income, which makes saving money much more attractive than spending it.

The market has been engaged in the fantasy that if it can hang in there with strong earnings, the inflation rate will begin to slow and decline, and the Fed will just stay out of it. After the sell-off in January, the market started to come back, and the plan played out for a while. Apple, Alphabet (Google), Amazon and Disney all posted strong earnings, and while we had a hiccup with Facebook, the plan was holding.

However, volatility continued to circle the ever-dwindling earnings campfire. The yield on the U.S. Treasury 10-year crossing over 2% for the first time since August 2019, the Russia-Ukraine mess, $90 per barrel oil (more below), supply chain issues and inflation at 40-year highs stoked the volatility flames. Is it any wonder, then, that the markets got spooked when Bullard spoke?

We’ve talked for a while now about the yield on the 10-year surpassing 2%. Why is this important? Bond yields are an indicator of the overall health of the economy: If bond yields are rising, that means investors are expecting interest rates to rise — and they’re selling bonds ahead of the increase. In 2021, the 10-year bond yield remained low, and the overall economic outlook was strong. Now it’s on the rise, a sign that investors may not feel so optimistic about the short-term health of the economy.

Well, we’re here — and it happened without any direct action on the part of the Fed.

Now people can either stick with the stock market and its current volatility or potentially get a better yield than the S&P 500 and the safety of a U.S. Treasury. Two attitudes drove this market: fear of missing out (FOMO) and there is no alternative (TINA). Now we have a viable alternative for some folks, and people are more afraid of getting stuck holding the bag if the stock market continues to decline than missing out on new market highs.

On the inflation front, we’ve gone from “it was to be expected and it’s transitory” to “people are working and have money, so a little inflation isn’t bad” to acceptance that inflation is here to stay and it’s harming Americans and the economy. Experts tell us relief is in sight, but they often make predictions and are seldom correct. The same people who can’t tell us what to expect from the Fed next month are predicting the inflation rate to drop below 3% by year-end?

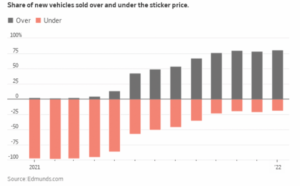

One last note on inflation. Remember the commercials with the overly dramatic voice that would say, “Are you looking for a car or truck …” and remember how the dealers would fall all over themselves to tell you what kind of a great deal you can get if you bought from them? Good luck trying to find a vehicle under the manufacturer’s suggested retail price (MSRP) today. The other item of note is the continued slide of the consumer. Last Friday, we had a dismal reading for consumer sentiment; expectations were for 67, and the actual reading was 61.7. The consumer has an outsized impact on our economy, and right now the consumer is in a gloomy mood.

Ukraine in the crosshairs

Russia has ratcheted up tension and speculation on what happens next in Ukraine. The White House told U.S. citizens to leave Ukraine within 48 hours — and then oil spiked to nearly $95 per barrel. The situation has devolved from a conversation on whether Russia “may” invade to “when” it will invade and how much territory it will take. Russia invaded and started its annexation of Crimea in 2014 while hosting the Sochi Winter Olympics. It worked for them then — so maybe they will do the same this time around. Needless to say, this development, on top of all the items we’ve discussed above, will not be welcomed by the markets and will likely contribute to already higher levels of volatility.

Free at last?

After a large chunk of the population has contracted some form of the coronavirus over the two years of the pandemic, states now feel emboldened to begin rolling back and revoking mandates and restrictions that have been in place during that time. How does this impact the markets and the economy? We can finally return to being fully open and take steps to mend the economy. One concern is that we may have structural changes that it could take a long time to undo after two years. People got used to the government spending and sending them lots of money, we’re paying higher prices than before, attitudes toward work have changed, children have fallen behind socially and academically, and the division in our country has deepened. These scars will need to heal for the economy to be truly healthy again, but getting rid of mandates and restrictions is a start down the path of sunlight from a pretty dark and gloomy place.

Coming This Week

- Data this week should shed more light on the inflation picture, starting with the Producer Price Index (PPI) on Tuesday. After last week’s CPI number, which did not show signs of a slowdown, this reading may offer some signs of relief.

- The White House said that Russia could invade Ukraine as early as this week. If they do, all bets are off as to how markets react.

- The Fed will release its most recent meeting minutes on Wednesday. The minutes will be picked apart by Wall Street to try to decipher what direction the Fed will take.

- Mortgage applications, retail sales, business inventories and industrial production will cap off a busy Wednesday.

- The end of the week will feature several Fed speakers, including Bullard, who moved markets last Thursday with his aggressive stance on where he thinks rates need to go.

- Housing starts and leading indicators on Thursday and Friday will indicate the trajectory of the economy going forward in the near term. Weakness in this area could signal that our economy is slowing.

Have a great week!

Tom Siomades, CFA®

Chief Investment Officer

AE Wealth Management

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The personal opinions expressed by Tom are his alone and may not be those of AE Wealth Management or the firm providing this report to you. The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

02/22 – 2026797