AE Wealth Management: Weekly Market Insights | 4/7/24 – 4/13/24

Weekly Market Commentary

THE WEEK IN REVIEW: April 7-13, 2024

Inflation accelerates, jobs stay strong and rate cut expectations implode

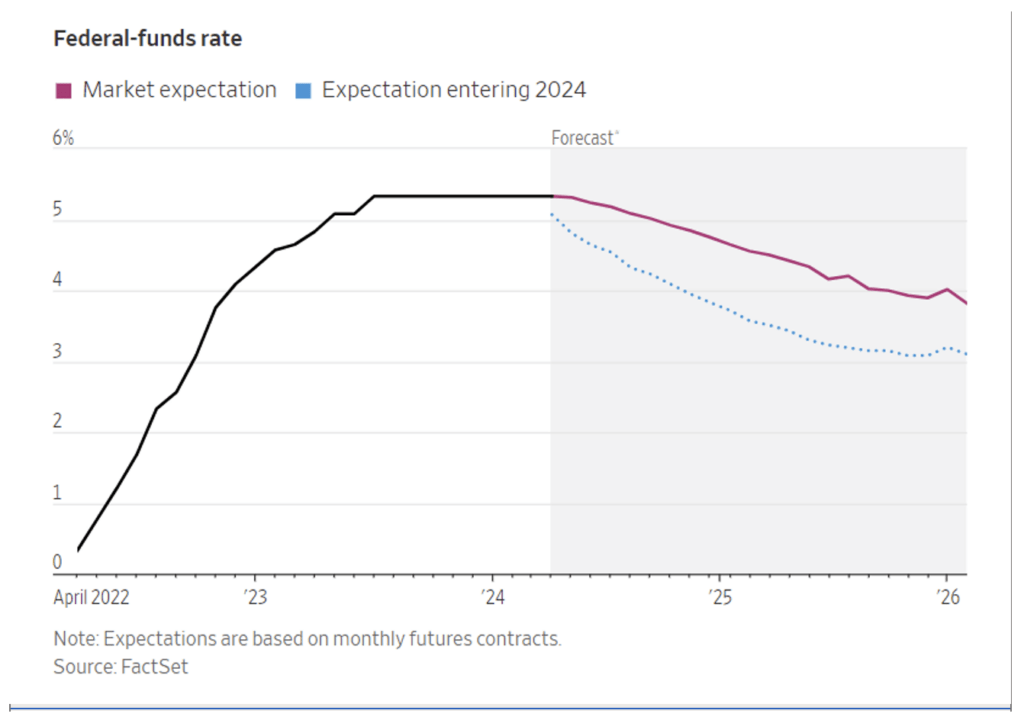

Markets had a rough week as the Consumer Price Index (CPI) and Producer Price Index (PPI) readings didn’t show signs of slowing inflation. Instead, inflation has crept slowly back up after dropping to 3.0% in June 2023. We’ve previously covered the market’s expectations about rate cuts, including how many cuts we might expect this year and the Federal Reserve’s narrow window to make them without looking political. Over the past three months, we’ve gone from expecting six or seven cuts to accepting three — and now markets are praying for one or two by the end of the year.

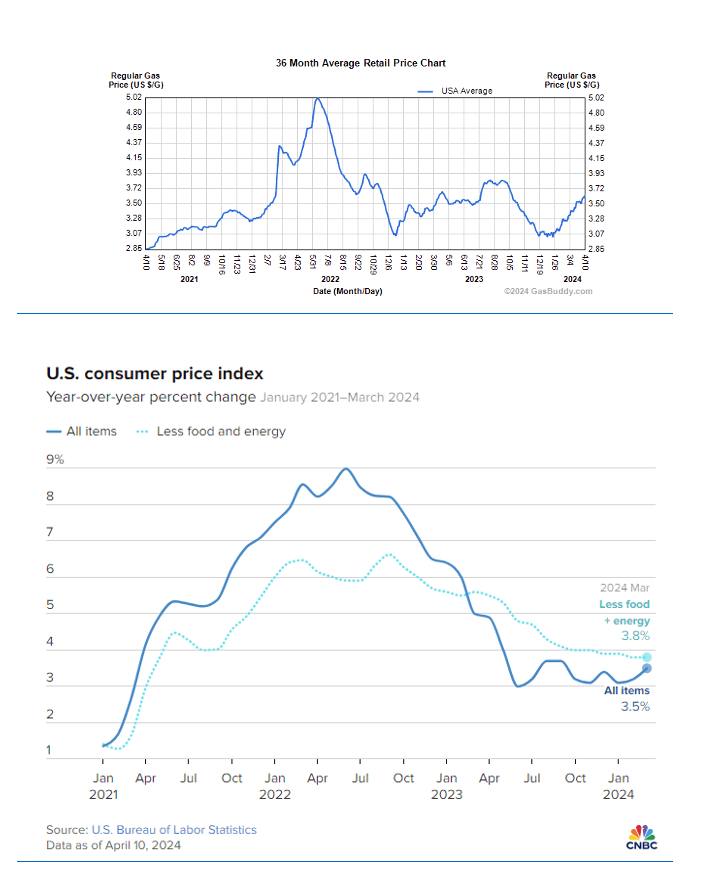

In March, it seemed the Fed would make the first cut at its June meeting. However, the chances of that happening have dropped significantly. The reason? Inflation has stalled between 3%-4% and remained stubbornly elevated for almost a year. And what else has remained stubbornly inflated? The cost of oil. Regular gas nationally was around $3.70 per gallon last week, and oil is now hovering around $86 per barrel.

Measures of inflation omit “volatile food and energy prices.” But the problem is that once those volatile prices move upward for a prolonged period, they begin to impact other things. Specifically, when the price of gas goes up, people spend more on gas and less on other things. One could argue higher prices limit producers’ ability to keep raising prices on their products because people are buying less, which slows economic activity and inflation. In the meantime, how long does that take to manifest itself if people don’t have money they can spend or borrow or both?

As we know, energy is in everything. For producers, when input costs (in this case, gas) go up, prices also go up to make up for additional costs. If people are willing to pay, then prices will remain high. This can only go on for so long before people run out of money and the cycle reverts because businesses cannot sell the same things for the same prices. As a result, they make less and employ less before they cut prices. Then less energy is needed because they are producing less and, theoretically, demand for energy goes down. If we don’t have a policy to stabilize volatility, it will be reflected in prices. Right now, it is contributing a great deal to inflation — whether or not it’s “officially” measured.

Add to all this the upcoming travel season and the brewing anticipation of how Iran may continue to retaliate against Israel for its recent attack on the Iranian embassy in Syria. That will put even more pressure on oil prices and drive gas prices higher, thus impacting inflation. That gives the Fed two choices: a) leave rates where they are and wait for the economy to slow down while hoping for a long and soft landing, or b) raise rates again to stem inflation and potentially drive the economy into recession. Neither scenario sounds like fun, and neither looks like it will feature rate cuts any time soon.

What else is worrying markets?

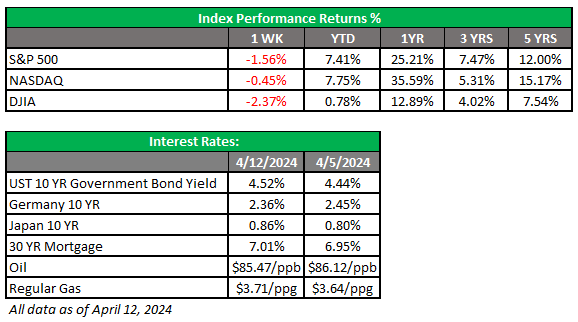

First-quarter earnings reporting started last week, providing fresh worries for markets. Delta Airlines had record earnings, but that didn’t save markets from selling off on Wednesday following the CPI report. After a brief bounce, the next day JP Morgan issued weak guidance that sealed a rough week. We got crushed as rates continued to rise, with the 10-year Treasury yield settling at 4.5%, its highest level since November. Another sour note was an action of 10-year Treasury notes on Wednesday, which was met by soft demand and weak participation from investors. It seems people aren’t confident about the future and want higher rates to tie up their money longer.

Finally, as we touched on earlier, Fed funds futures are implying just one or two quarter-point cuts this year. That’s a long way from the six or seven cuts people expected in January. And thanks to elevated inflation, we may not see any cuts at all this year.

Coming this week

- Fed officials are making the speaking rounds this week and will most likely react to fresh inflation data and what it means for interest rates.

- Earnings will be the other big news this week. Some of the better-known names scheduled to report include Goldman Sachs, Bank of America, Morgan Stanley, UnitedHealth Group and more.

- Other data this week includes retail sales, builder confidence and inventories on Monday; housing starts and building permits on Tuesday; MBA mortgage applications on Wednesday; and existing home sales and leading indicators on Thursday.

Sources:

https://www.morningstar.com

https://www.cnbc.com

https://www.marketwatch.com

https://markets.businessinsider.com

https://ycharts.com

Accessed 04/12/2024

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

4/24-3481697-3