Posts by webteam

AEWM Wealth Report: A Recessionary Tale

Download PDF Version Is the U.S. headed for — or already in — a recession? Some of the signs point to yes, but we may not know until it’s already over. Overview After President Trump announced new tariffs against a wide range of countries early in his second term, talk of a potential recession in…

Read MoreAE Wealth Management: Weekly Market Insights | 5/18/25 – 5/24/25

Weekly Market Commentary THE WEEK IN REVIEW: May 18-24, 2025 Market focuses on reconciliation bill For the first time in some time, markets weren’t focused on tariffs last week — at least until Friday. Most of the week was consumed with discussions of the tax package, which made its way through the House and is…

Read MoreAE Wealth Management: Weekly Market Insights | 5/11/25 – 5/17/25

Weekly Market Commentary THE WEEK IN REVIEW: May 11-17, 2025 Market wipes out 2025 losses And just like that, the market is right back to where it was at the start of the year. All it took was the news of a tariff suspension for China for 90 days and that a broader deal will…

Read MoreAE Wealth Management: Weekly Market Insights | 4/27/25 – 5/3/25

Weekly Market Commentary THE WEEK IN REVIEW: April 27 – May 3, 2025 Halfway to recession? After a lot of handwringing and hypothesizing, we finally got the advance reading of first-quarter gross domestic product (GDP).1 At one point a few weeks ago, the Atlanta Fed was predicting a -2.5% reading — a stunning reversal from…

Read MoreAE Wealth Management: Weekly Market Insights | 4/20/25 – 4/26/25

Weekly Market Commentary THE WEEK IN REVIEW: April 20-26, 2025 You’re fired. (Not!) Volatility continues to reign in the markets. As last week started, President Trump renewed his very public criticism of Federal Reserve Chair Jerome Powell. Predictably, the markets panicked, and we had a fresh round of selling. At one point last Monday, the…

Read MoreAE Wealth Management: Weekly Market Insights | 4/13/25 – 4/19/25

Weekly Market Commentary THE WEEK IN REVIEW: April 13-19, 2025 Powell stirs the pot Last week was a short one for traders as markets were closed for Good Friday. Markets seemed to have settled into a range as we awaited more news on tariffs, but the week didn’t bring any more “world series of tariffs”…

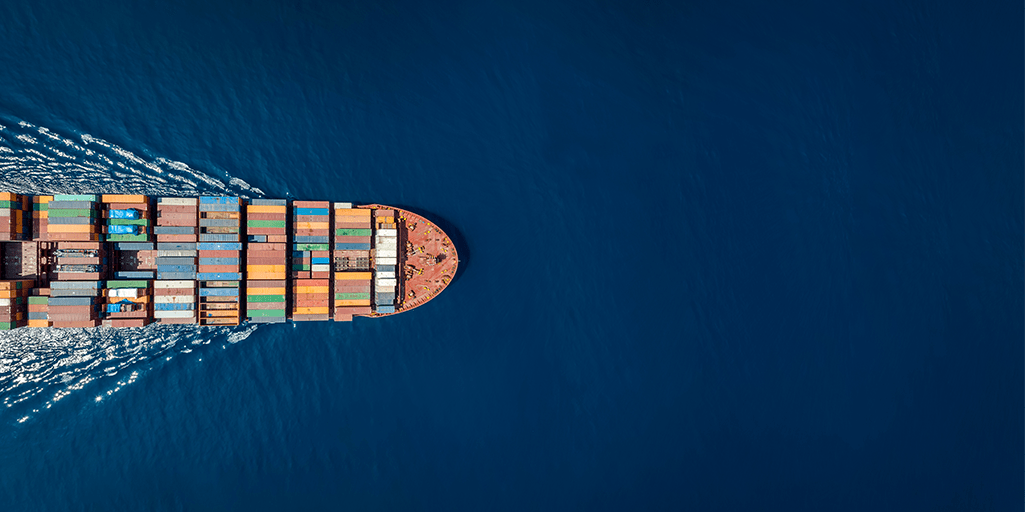

Read MoreAE Wealth Management: Weekly Market Insights | 4/6/25 – 4/12/25

Weekly Market Commentary THE WEEK IN REVIEW: April 6-12, 2025 Tariff battle evolves The market volatility continued last week but began to take shape as a showdown between the U.S. and China instead of the U.S. against the entire world.1 There was a false report on Monday that the administration was considering a 90-day pause…

Read MoreAE Wealth Management: Weekly Market Insights | 3/30/25 – 4/5/25

Weekly Market Commentary THE WEEK IN REVIEW: March 30 – April 5, 2025 Liberation liquidation President Trump issued his tariff plan last Wednesday, which he proclaimed as U.S. “Liberation Day” and painted as a glorious day in American history.1 Hyperbole aside, the markets didn’t like the news and sold off hard on Thursday on fears…

Read MoreAE Wealth Management: Market Minute — More Market Madness

More market madness After President Trump declared Wednesday as the U.S.’s “Liberation Day,” markets sold off hard on Thursday from fear the announcement would trigger a trade war. Those fears materialized somewhat, as China responded with 34% tariffs on U.S. imports and markets plunged once again to end the week.1 Are we done? It could…

Read MoreAE Wealth Management: Market Minute — Tariff turbulence increases

Tariff turbulence increases Markets reacted strongly on Thursday, April 3 to new tariff announcements. The S&P 500 went back into correction territory while the Dow tumbled more than 1,400 points and the Nasdaq fell 5% for the day. Thursday’s decline, coupled with losses over the past two months, puts markets back at the levels they…

Read More