AE Wealth Management: ESG Rating’s Purpose and Power | Blog

The Purpose and Power of ESG Ratings

The Wealth Report by AE Wealth Management

Download PDF Version Here

Long-term sustainability has quickly become a mainstay criterion in global investing, as measured by environmental, social and governance (ESG) ratings.

Overview

In the past, socially responsible investing was largely viewed as a form of moral or political correctness. Today, however, companies are making these investments for their own sustainability, and investors are poised to benefit.

Along with analyst forecasts, recommendations and credit ratings, investment managers with trillions in assets under management are using ESG ratings to influence their portfolio construction and trading decisions. According to BlackRock, many wealth managers are seeking to create sustainability-integrated portfolios with the potential for better risk-adjusted returns.

Why is the ESG ratings trend rising quickly now? It’s largely due to the convergence of crises over the past few years. For example, in 2020 alone, natural disasters caused $210 billion in damage in the United States. That is the highest amount ever recorded, and each year seems to bring more and more extreme weather events to nearly every region in the country.1

Furthermore, the pandemic has raised a plethora of complexities with regard to employment policies, safety measures, decisions regarding the viability of office real estate amid the highly popular work-from-home (WFH) trend, wage pressures driven by a competitive labor market and the demand for enhanced diversity, equity and inclusion (DEI) policies.

In other words, there has been a marked increase in the number of people who are deciding where to work, live and invest their money based on alignment with their personal values. The call for companies to accommodate these demands is coming from all directions — workers, consumers, investors, investment managers and government agencies.

ESG Ratings

You likely are familiar with credit ratings issued by Fitch, Moody’s and Standard & Poor’s. There also are agencies that research specific industries and sectors, screen stocks and conduct due-diligence reviews in order to rate security issuers with an ESG score.

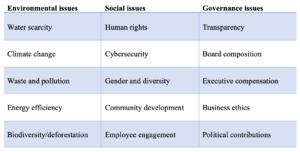

These factors include financial strength and stability, investment risk, policies and regulations pertaining to social responsibility, and environmental sustainability. Investors and investment managers use ESG scores to identify companies with strong ESG performance relative to their peers. ESG factors that are scrutinized include:

- Extractive industries or energy production

- Materials management

- Product responsibility

- Hazardous substances and waste management

- Supply chain policies

- Labor practices, hiring and firing policies

- Human rights

- Working conditions

- Diversity, equity and inclusion (DEI) policies

- Community relations

- Indigenous peoples’ rights

- Customer relations and consumer rights

- Open communication and transparency in corporate governance

Individual companies often hire an ESG ratings agency to conduct an in-house analysis of policies and to help them develop effective solutions. However, there are presently hundreds of ESG ratings agencies that are not regulated to meet specific standards. In fact, some simply use corporations’ own statements to generate their ESG ratings. Congress is currently working to pass a bill that would require companies to regularly disclose their ESG policies based on standardized guidelines so they can be compared on an apples-to-apples basis.

For now, the most highly regarded ESG ratings agencies include MSCI ESG Research, Bloomberg ESG Disclosure Scores, FTSE Russell’s ESG Ratings, Institutional Shareholder Services, Standard & Poor’s Global ESG Scores, Moody’s ESG Solutions Group and CDP.2

ESG Issues

Environmental

The world’s major oil producers report that oil production peaked in 2019. Now the race is on to find sustainable and affordable ways to generate electricity. Fortunately, many forward-thinking companies — including auto manufacturers and power utilities — have been investing for years in alternate lines of business. Those investments may soon pay off as the world transitions to renewable sources of energy, which are projected to surpass coal in less than three years.

In 2021, the U.S. rejoined the Paris Agreement. More than 125 countries, including the European Union, China and Japan, have committed or are considering how to commit to building economies that emit no more greenhouse gas than they remove (referred to as a “net-zero economy”).3

Social

The social component of ESG has not enjoyed the same level of attention and capital allocation as environmental concerns. That’s because social is composed of human capital, which can be a more complex matter. One of the reasons is due to a lack of transparency in pay, promotion criteria and underlying attitudes that shape a corporate culture. Companies may develop and publish policies that address diversity, equal opportunity, health and safety, and labor relations, but it is more difficult to quantify the success of these policies within a ratings system. It is even more difficult for corporate investor relations officers to make reports to investors regarding human capital policies — or tie them to bottom-line profits and sustained performance.

Governance

Governance refers to the role and composition of a company’s board of directors, including their compensation and oversight of C-suite executives. The criteria for quality governance go beyond the optics of gender and diversity parity. Lack of oversight and accountability can lead to poor business decisions, missing out on market opportunities and posing higher risks to investors. Governance performance is generally assessed in terms of structure, values, transparent reporting and cybersecurity.4

Investment Opportunities

The speed at which climate risk has moved from personal insurance claims, to local and federal government budgetary strain, to corporate initiatives has been remarkable. The risks associated with shutdowns, power grid interference, travel and ground transportation (supply chain) disruption, widespread insurance payouts and new pricing models have created a minefield of volatility for companies and investors alike.Fortunately, the United States is not alone in this endeavor. There are international companies across the world actively working toward a net-zero economy. Ultimately, clean energy solutions should not only reduce our carbon footprint, but these innovations are expected to reduce overall costs for both companies and consumers. Moreover, the new generation of younger and ever environmentally conscious investors seems to be wholly in favor of sustainable strategies.

To keep up with the (literal) changing tides, companies have made great strides in their efforts to adapt to new environmentally friendly standards, largely due to competitor commitments. For example, last year General Motors announced plans to stop producing gas-powered vehicles by 2035, while Volvo published its intention to be fully electric by 2030. BP Oil is actively working toward its commitment to reduce its greenhouse gas emissions to net zero before 2050, in response to similar pledges by Royal Dutch Shell, Total and others.5

However, today’s new sustainable technologies and industries are not limited to clean energy. They are supported by an entire ecosystem to deploy these initiatives. This includes lithium-ion batteries used to power vehicles and store electricity produced via renewable sources, as well as new infrastructure for charging stations, distribution and transmission cables and an enhanced recycling market.6

ESG ratings help investors differentiate earnings growth potential within established industries. For instance, one ratings agency tracks clean energy patents to project potential future earnings growth. Studies have found that among carbon emission-intensive industries, such as utilities, materials and energy, companies with the highest number of green energy patents tend to have the highest earnings growth.7

“Emerging research suggests that companies that are well adapted to a low-carbon economy are better positioned than peers to grow earnings, and that greenhouse gas efficiency has links to financial performance.”8

Municipal Bonds

Equities are not the only beneficiaries of ESG exposure. Within the municipal bond sector,

green bond projects are emerging in support of sustainable building construction, energy efficiency, pollution prevention and control, clean water and wastewater management (including flood/stormwater reduction), early warning systems and climate change adaptation. Social bond projects address cybersecurity, homelessness, homeownership, and access to quality health care and education.

In fact, Bloomberg reports that U.S. municipal green bond issuance increased by more than 200% from 2018 to 2020, up from $4.4 billion to $14.5 billion. One of the drawbacks continues to be a lack of uniform ESG reporting standards to assist investors in evaluating the potential credit risk versus social impact of these types of investments. Thus, the growing market of green investors are clamoring for enhanced ESG disclosure from government bond issuers.9

Final Thoughts

One of the silver linings of the pandemic is that both employers and employees have learned what they do and do not need to be effective on the job. This recognition has led many companies to reduce their cost of doing business, particularly with regard to company-paid travel and commercial buildings. In addition to lower overhead, continuing these pandemic-induced work models also helps reduce energy costs and increase company profits. As the world continues to struggle against the impact of COVID-19, it is unlikely we will see large corporations return to their former expensive ways of doing business.

Perhaps inadvertently, this shift in capital spending has put a greater emphasis on the viability and sustainability of environmental, social and governance initiatives. Ultimately, everyone from consumers, job seekers, investors and corporate leaders may consider how technologies, products, commodities and company policies may help or hinder our carbon footprint and long-term sustainability. The main problem that continues to exist is how to accurately conduct this assessment, which is where the purpose and power of ESG ratings take center stage.

We would encourage investors interested in sustainable investing to work with their financial professional to vet ESG policies as they apply to long-term risk and growth opportunities. Remember, as investors, we each hold the power to decide where to place our capital, and we have the right to expect those organizations to provide a responsible and rewarding return on our investment.

1 BlackRock. 2021. “A sea change in global investing.” https://www.blackrock.com/us/individual/literature/whitepaper/a-sea-change-in-global-investing-climate-paper-en-us.pdf. Accessed April 11, 2022.

2 The Impact Investor. March 24, 2022. “8 Best ESG Rating Agencies – Who Gets to Grade?” https://theimpactinvestor.com/esg-rating-agencies/. Accessed April 11, 2022.

3 BlackRock. 2021. “A sea change in global investing.” https://www.blackrock.com/us/individual/literature/whitepaper/a-sea-change-in-global-investing-climate-paper-en-us.pdf. Accessed April 11, 2022.

4 S&P Global. Feb. 24, 2020. “What is the ‘G’ in ESG?”

https://www.spglobal.com/en/research-insights/articles/what-is-the-g-in-esg#:~:text=The%20%E2%80%9CG%E2%80%9D%20in%20ESG%20refers,managers%2C%20shareholders%2C%20and%20stakeholders. Accessed April 11, 2022.

5 BlackRock. 2021. “A sea change in global investing.” https://www.blackrock.com/us/individual/literature/whitepaper/a-sea-change-in-global-investing-climate-paper-en-us.pdf. Accessed April 11, 2022.

6 Carmen Reichman. FT Advisor. April 12, 2022. “’The market has turned decisively in favour of ESG.’” https://www.ftadviser.com/ftadviser-focus/2022/04/12/the-market-has-turned-decisively-in-favour-of-esg/?page=1. Accessed April 12, 2022.

7,8 BlackRock. 2021. “A sea change in global investing.” https://www.blackrock.com/us/individual/literature/whitepaper/a-sea-change-in-global-investing-climate-paper-en-us.pdf. Accessed April 11, 2022.

9 Raymond James. 2022. “ESG gains momentum in the municipal space as the calls for disclosure grow.” https://www.raymondjames.com/corporations-and-institutions/public-finance/industry-insights/public-finance-market-watch/esg-investing. Accessed April 11, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/.

4/22-2127967