AE Wealth Management: The Zero-Net Economy | Blog

WORKING TOWARD THE NET-ZERO ECONOMY

Download PDF Version Here

The future net-zero emissions economy is one many businesses and industries are looking toward, and this shift may have implications for portfolios.

Overview

Scientists attribute extreme weather events all over the world to a global warming trend. Since the late 19th century, the average global temperature has increased by 2 degrees Fahrenheit (1.1 degrees Celsius).1 To reverse this phenomenon, scientists say we must reduce and maintain the average global temperature increase to 2.7 degrees Fahrenheit (1.5 degrees Celsius) above pre-industrial levels.2

To facilitate this worldwide effort, 200 countries have signed the Paris Agreement, an accord designed to reduce global warming. To ward off the most destructive effects of climate change, scientists say, carbon dioxide emissions worldwide need to be cut in half by 2030 and, by 2050, reduced to net-zero.3

What does net-zero emissions mean? It is a balance between the amount of greenhouse gases produced and the amount removed from the atmosphere. Achieving this will require a remarkable transformation of today’s global economy: Scientists say we must replace fossil fuels as our primary source of energy with more environmentally friendly options such as wind and solar power. It also will require removing what emissions remain via solutions such as restoring forests and generating carbon capture and storage capabilities.4

How To Measure Net-Zero Benchmarks

The effort to reverse global warming is measured via “temperature alignment.” This is a forward-looking benchmark that compares the level of emissions today against the potential for reducing them by a certain date in the future. The measurement is applied to both macro and micro entities, such as governments, individual companies and even investment portfolios.

One approach to measuring temperature alignment is to weigh the role a single company plays in the economy today and evaluate its emissions trajectory plan by 2050. That data is then extrapolated to provide a picture of the overall global economy transforming at that same speed. The more aggressive the efforts to reduce emissions, the more favorable the global economic outcome.5

Investment Opportunities

While the looming threat of extreme weather remains ominous, the transition to net-zero offers significant investment opportunities. It signals a move to long-term planning, which is a departure from the past two decades when reaching quarterly performance goals was a key factor among public companies. Moving forward, businesses will be held to a higher standard, which includes transition plans for net-zero carbon emissions pertaining to all aspects of their operations — including the acquisition of raw materials and shipping/transportation capabilities.

Each industry and market sector is expected to be affected by this transition. It is not just a matter of investing in green energy sources; every company will need to adopt long-term net-zero sustainable solutions to meet these benchmarks, from retail and manufacturing to technology and health care. According to U.S.-based asset manager BlackRock, today’s markets have not fully priced the future impact of climate effects into the value of securities.6 Therefore, companies with optimum transition plans will be better positioned for long-term returns.

Unfortunately, the reverse may be true as well. Even long-established blue-chip companies could suffer if they do not adapt to the changing global economy. The demand for compliance will come from consumers, workers, shareholders, legislators, voters and institutional investors who increasingly experience the financially devastating impacts of climate change.

“In the past few years, companies with higher ESG [environmental, social and corporate governance] ratings exhibited higher average return on invested capital, compared to companies with lower ratings, according to data provider MSCI. This is in part because ESG pushes companies to look beyond the three- to five-year business cycle in evaluating risk.”7

Investment Risks

When it comes to investing, we generally talk about the risk of losing money due to market volatility, inflation, liquidity, concentration or default. Going forward, many asset managers believe the greater risk will be caused by climate change itself. In short, how much will it cost to continue restoring and rebuilding communities affected by extreme weather without implementing mitigation strategies to prevent these disasters?

Investors share the same risks as the securities they invest in. For example, companies bear the physical risk to assets and their ability to stay in business in the wake of changing weather patterns and natural catastrophes. Analysts also have identified a transition risk, which is the potential for short-term revenue losses and long-term profitability due to a company’s transition to a low-carbon model of business (e.g., energy companies with large fossil fuel reserves).

The greatest risk of loss may come from companies that continue to depend on producing or consuming fossil fuels longer than is feasible in the net-zero economy.8

Asset Managers

In 2020, BlackRock conducted a survey of corporate and public pension plans, sovereign wealth funds, insurers, asset managers, endowments, foundations and global wealth managers. Among them, more than half (54%) considered sustainable investing to be a foundational consideration for analysis and decisions moving forward. However, an interesting caveat was how much opinions varied by region. Not so much in theory, but rather in how quickly they are integrating this investment strategy.9

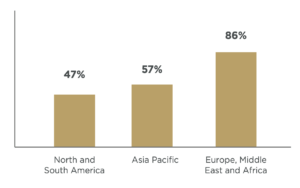

For example, 86% of survey respondents from the region of Europe, the Middle East and Africa (EMEA) were actively analyzing sustainability data, while those in Asia-Pacific (APAC) and the Americas (AMRS) were in the early stages of this process.10

Long-term Strategy for Sustainable Investing by Global Region11

Percentage of respondents in each region who expressed that a commitment to sustainability is already, or will become, central to investment strategy.

BlackRock Global Client Sustainable Investing Survey. July-September. 2020.

Portfolio Strategies

Many of the portfolio strategies that institutional asset managers use to evaluate and select investment holdings also can be deployed by individual investors. Consider the following guidelines to align your investment allocation with the objectives for a net-zero economy:12

- Scrutinize issuers that present significant climate-related risk, such as high carbon use or production, poor long-term planning or low ESG stewardship.

- Reduce exposure to high-carbon emitters and companies not making forward-looking commitments to transform to the net-zero economy.

- Incorporate sustainable sectors (e.g., clean energy, green bonds) as part of your asset allocation strategy; diversify investments among holdings.

- Ensure your issuers and investments are meeting temperature alignment benchmarks by monitoring available data and published transition plans. Review this benchmark with the same rigor as traditional financial data.

- Use the power of citizen and shareholder vote to support legislators, board members and asset managers committed to investing in and supporting the transition to a net-zero economy.

- Use the power of consumer spending to support companies actively transitioning to a net-zero economy.

Final Thoughts

The trend of incorporating environmental, social and governance considerations into investment research and decision-making has been emerging for quite some time. Now it is poised to take the spotlight as a leading measure by which companies are evaluated for investment prospects. This creates an interesting opportunity for both investors and consumers to put their money behind their beliefs.

As extreme weather events continue to wreak havoc on homes, businesses, major corporations and governments around the world, the individual levers of voting and spending habits could have a greater impact than ever before on household financial security and the future of the environment.

If you are interested in learning more about sustainability-integrated portfolios and their potential for risk-adjusted returns, contact your financial professional.

1 Rebecca Lindsey and LuAnn Dahlman. Climate.gov. March 15, 2021. “Climate Change: Global Temperature.” https://www.climate.gov/news-features/understanding-climate/climate-change-global-temperature. Accessed Sept. 7, 2021.

2 Seth Borenstein. Associated Press. Aug. 10, 2021. “‘Code red’: UN scientists warn of worsening global warming.” https://apnews.com/article/asia-pacific-latin-america-middle-east-africa-europe-1d89d5183583718ad4ad311fa2ee7d83. Accessed Aug. 30, 2021.

3 Abnett and Valerie Volcovici. Reuters. Aug. 5, 2021. “Flurry of emissions pledges still not enough to meet global climate goals.” https://www.reuters.com/business/sustainable-business/flurry-emissions-pledges-still-not-enough-meet-global-climate-goals-2021-08-05/. Accessed Aug. 30, 2021.

4 BlackRock. March 2021. “Getting to Net Zero.” https://www.blackrock.com/us/individual/literature/investor-guide/blackrock-investor-guide-to-net-zero-en-corp-rc-investor-guide.pdf. Accessed Aug. 30, 2021.

5 Ibid.

6 Ibid.

7 Raymond James. 2021. “Why Choose Sustainable Investing?” https://www.raymondjames.com/commentary-and-insights/markets-investing/2021/06/15/why-choose-sustainable-investing. Accessed Aug. 30, 2021.

8 BlackRock. 2021. “Getting to Net Zero.” https://www.blackrock.com/us/individual/literature/investor-guide/blackrock-investor-guide-to-net-zero-en-corp-rc-investor-guide.pdf. Accessed Aug. 30, 2021.

9 BlackRock. 2020. “Sustainability Goes Mainstream.” https://www.blackrock.com/us/individual/literature/publication/blackrock-sustainability-survey.pdf. Accessed Aug. 30, 2021.

10 Ibid.

11 Ibid.

12 BlackRock. 2021. “Getting to Net Zero.” https://www.blackrock.com/us/individual/literature/investor-guide/blackrock-investor-guide-to-net-zero-en-corp-rc-investor-guide.pdf. Accessed Aug. 30, 2021.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM, nor the firm providing you with this report, are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at https://brokercheck.finra.org/. AEWM and BlackRock are independent entities. Neither is an agent of the other. 9/21-1822066