AE Wealth Management: Weekly Market Insights | 2/27-3/5/22

VIEW PDF VERSION

State of the Union comes and goes while Russia-Ukraine conflict continues with no end in sight

The State of the Union address last Tuesday really didn’t provide anything new for the markets to react to (which may be a good thing). President Joe Biden included a rehash of the plan for moving forward with some parts of the Build Back Better agenda, but overall, the speech was swamped by the current major crisis dominating the world’s stage.

Russia continued to maul its neighbor Ukraine last week. Rather than roll over and fold, the Ukrainians continue to resist, and the Russians aren’t moving as quickly as they anticipated. The West has sanctioned Russia and continues to support Ukraine with military and humanitarian aid. But here’s what’s not happening, as of yet: NATO is not enforcing a no-fly zone, while the U.S. and NATO are not engaging with Russian troops. And Ukrainian President Volodymyr Zelensky is not leaving; instead, he’s providing leadership and inspiration to a beleaguered nation.

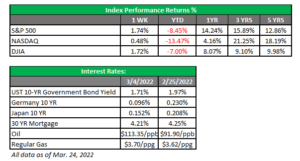

These events plus a constant drumbeat of negative news have caused markets to bounce around at the same levels for the past few weeks. We get some news that seems favorable — such as soft sanctions or less-than-anticipated rate hikes — and the market bounces up. Then we get news of more severe sanctions, spikes in oil prices, news of an attack on a Ukrainian nuclear plant or a really strong jobs report strengthening the argument for higher rate increases, and down the market goes.

We have yet to see the full fallout of the Russia-Ukraine conflict. There will not be a quick resolution, and the announced economic sanctions have yet to be fully felt by both sides. How will the world live without Russian energy, and how will Russia live without pretty much everything except what they get from China?

We are a lot closer to 4,000 on the S&P 500 than we are to the record highs we saw in early January of this year, hovering right around 4,300. So far, we have bounced back quickly once we dipped below 4,300 and the 10% correction level, and we haven’t remained at those levels very long. How much longer will we keep bouncing back up in the face of continuing bad news?

Powell lays it out and shuts down 50 bps talk; the job market is still rocking while oil hits highs not seen since 2008

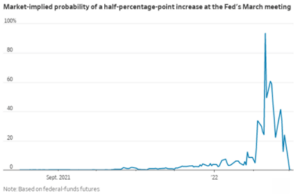

If there was any suspicion that the Federal Reserve might raise rates by half a point at the conclusion of its next meeting on March 16, Fed Chair Jerome Powell laid those fears to rest. He very clearly announced that he would back a quarter-point (.25%) increase at the next meeting. This is highly unusual, but the clarity, transparency and outward dovishness of the comment was enough to boost markets last Wednesday.

Then we got a solid February jobs report on Friday; expectations were for +440,000 and the actual number was +678,000. Yes, it was a strong jobs report, but it did not account for the Ukrainian invasion period. The strength of the top-line number should give the Fed a reason to be more aggressive — but they likely won’t be. Also, the economy is decelerating. It remains to be seen how the Fed will negotiate strong data (which favors tightening) and fighting inflation (ditto) with an economy that is potentially slowing (which would call for looser policy).

Wages remained flat and hours worked ticked up last month, so workers are being asked to work more for the same money. That’s not good in a 7.5% inflationary environment. Consumer sentiment is weak, and mindset is a very important factor in whether our economy continues to grow. If people feel battered (and they do, thanks to two years of COVID and inflation), they will change their behavior and how they spend.

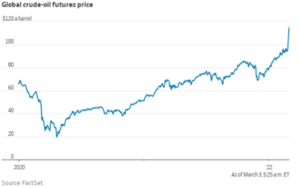

Oil prices have continued their march upward, propelled by worries of supply disruption as a result of the events in Ukraine. Oil had stabilized around $40 per barrel in early 2021, after dropping to $20 per barrel during the economic lockdown in March 2020. The price has steadily climbed over the past year and isn’t showing any signs of moderating.

We’ve discussed a lot of the energy policy changes by the current administration that put us on this path, and the recent tensions have just exacerbated the problems we are already having, from higher gas prices to higher heating oil and natural gas prices to warm and cool our homes. The second derivative of higher energy prices is inflation. Energy costs are a core input into almost all industries, and when industries have to spend more for energy, they usually pass those costs on to consumers. This causes prices to go up, creating inflation.

Coming This Week

- The Job Openings & Labor Turnover Survey (JOLTS) data will be released Wednesday. Last month’s report showed we have been running at approximately , and after the most recent strong job data, it would be welcomed to see that number begin to decline. If we see a decline, it should bode well for the Fed to move more quickly.

- According to the January Consumer Price Index (CPI) numbers, released in February, we are running at a 5% rate with no indication that we are moderating. Expectations for Thursday’s report have been calling for a spike in oil, chances are that it may go higher. If the next inflation reading is higher than anticipated, that may also spur the Fed to move more quickly.

- Finally, on Friday, the consumer will get a chance to be heard via the consumer sentiment number. The consumer is getting wary, and the constant negative news from Ukraine and higher gas prices will likely weigh on the consumer even more.

Have a great week!

Tom Siomades, CFA®

Chief Investment Officer

AE Wealth Management

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The personal opinions expressed by Tom are his alone and may not be those of AE Wealth Management or the firm providing this report to you. The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

03/22 – 2066555-1